The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

This matches broader trends in the mortgage insurance business previously reported by the

"We are observing an increased penetration of MI into the refi market and we trace it largely to the 2018 book year," NMIH Chief Financial Officer Adam Pollitzer said on the company's conference call. "What's unique this go-around is that we've had rates fall so quickly and by so much without a corresponding macro-credit event.

"And so that means that those borrowers who took out loans really in the back end of 2018 in a much higher note rate environment are now coming into the market and can benefit from a refinancing opportunity, but they haven't yet benefited from near as much home price appreciation or also as much time to amortize down their principle balance through monthly payments," Pollitzer said.

National MI wrote $14.1 billion in new insurance written for the third quarter, up from $12.2 billion in the second quarter and $7.9 billion for

"Given the strong origination figures posted by NMIH's private mortgage insurance peers thus far in the third quarter against a favorable backdrop of lower interest rates and a low unemployment rate, it was not surprising that the company also posted very solid results during the quarter, " said BTIG analyst Mark Palmer said in a note. "Yet the third-quarter report that NMIH released nevertheless exceeded that raised bar in several respects."

That included beating analyst estimates on net premiums earned and revenue.

The record NIW beat B. Riley FBR analyst Randy Binner's expectations of just $7.7 billion for the quarter.

NMIH had net income of $49.8 million for the quarter, up from $39.1 million in the second quarter and $24.8 million for the third quarter last year.

Essent Group reported its mortgage insurance unit did $18.7 billion in NIW for the third quarter, up from $18 billion in the second quarter and $13.9 billion one year prior.

Essent had third quarter net income of $144.6 million, compared with $116 million one year prior.

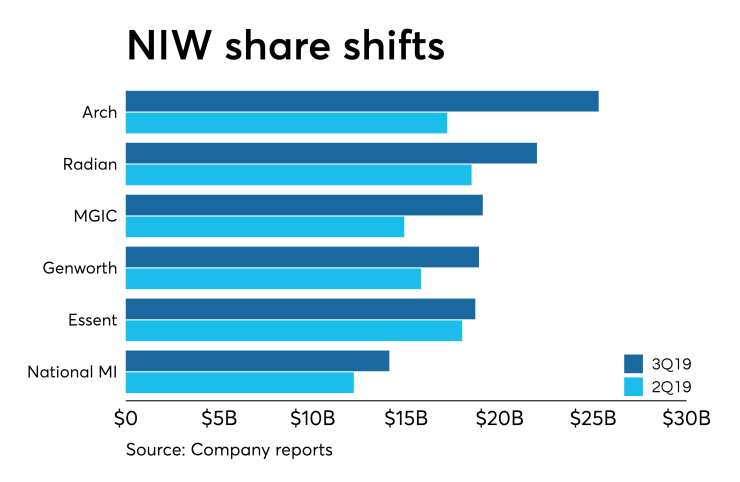

The market share among the six companies shook up compared with

The status quo on GSE reform benefits the mortgage insurers going forward, Binner said in his NMIH earnings note.

"We view recent changes to the GSE cash flow sweeps as highlighting the ongoing need for the Preferred Stock Purchase Agreement to remain in place. This structure may be an impediment to recapitalization. Further, the replacement of the PSPA by an explicit government guarantee (potentially administered by Ginnie Mae), likely requires congressional action. We view this as unlikely ahead of the November 2020 election," Binner wrote.

The Consumer Financial Protection Bureau had a public comment period regarding potentially

Those comments, said Binner, "highlighted significant support of compensating factors that influence credit quality, compared to the current debt-to-income approach. We believe NMIH and the industry are well positioned for whatever the QM-patch replacement is, as they already are actively underwriting to these compensating factors (such as loan-to-value, borrower assets, etc.) and implementation timelines will run into 2021-2022."