Companies that sell vacant foreclosure properties are wary of a new Government Accountability Office recommendation that could lead federal agencies to measure the work they do in new ways.

Already one agency, the Department of Veterans Affairs, has committed to the recommendations of the report published last Friday. The report calls for the collection of new data that reflects if sales outcomes are in line with an agency's particular mission. In the VA’s case that means measuring veteran purchases of REO properties in its regular monthly performance reports.

The timing may be good for this change now because volumes are particularly low, companies that are active in the real-estate owned market acknowledge. But there is concern that either the collection process or reforms it may lead to could bog things down later when activity rises.

“I guess if you are going to add to the process, now is the time,” said Richard Kruse, principal at distressed asset manager Gryphon USA. “The question I would have in my head is about what happens when things open back up.”

The GAO may not have known that REO activity would be constrained to the degree it has been due to pandemic-related foreclosure bans and forbearance, but it did see that it was trending generally downward even before then due to a long-running economic expansion.

That trend played a role in its conclusion.

“The reduction in foreclosed properties presents an opportunity for the agencies to see if what they’re doing in this area aligns with their missions,” said John Pendleton, director, financial markets and community investment, at GAO.

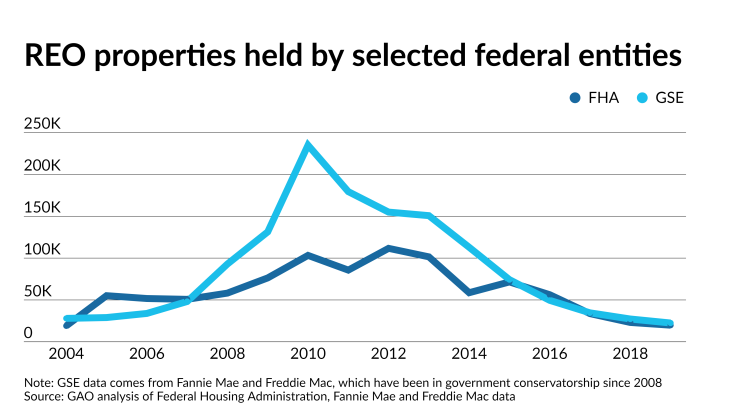

Last year, for example, the Federal Housing Administration’s foreclosed property inventory was at a low not seen since 2004 and Fannie Mae and Freddie Mac’s were at the lowest point seen since at least that year.

(There was limited data beyond that from Fannie in the study because of

The GAO’s research was done in response to Congress’ request a couple years ago for it to examine, “How federal entities monitor real-estate owned property conditions, including identifying any gaps in the process that could affect communities.”

That request was aimed at building upon prior congressional reviews and improvements in this area that stemmed from the foreclosure crisis during the Great Recession, but have new relevance amid the pandemic, according to the GAO.

With some exceptions like Freddie Mac’s First Look program, there’s relatively little data-based tracking of how or whether foreclosure sale outcomes reflect government-related agencies’ missions, the report found.

The Department of Housing and Urban Development did do a limited study back in 2002 that showed “positive” outcomes when homes were specifically sold to local teachers and law enforcement officers. But it has generally found “mission” impacts “are not easily quantifiable,” according to its response to the GAO report.

That agency will look into updating and expanding the previous research it has done, according to the response letter from HUD General Deputy Assistant Secretary John Garvin.

The REO sales industry has mixed feelings about programs like First Look and HUD’s, which collect more information about outcomes because they are specifically designed to give owner-occupants or nonprofits time to place offers on properties before they are offered to investors.

There’s debate around whether there’s more benefit to a community from selling a vacant foreclosed property quickly to avoid further deterioration of condition and value, or whether delaying the sale to be more selective about who the property is sold to is more beneficial.

In some instances, investors help stabilize a neighborhood because they prevent that kind of deterioration, both Kruse and the report noted. He suggested programs that accommodate faster sales might do more for a community.

The upshot for REO management companies is that they want to follow whatever reasonable directives they get from the federal agencies they work with, but they hope the work needed to do it has a clear purpose that doesn’t prove to be counterproductive, he said.

“We can get this information, but I think we should think about what the benefit in having it is,” said Kruse. “Getting the property to market and getting it sold is, to me, better for the community than letting it sit there and get an optimal buyer. But there are sometimes non-financial reasons to do things. I can appreciate that too.”