Bank of America's mortgage banking business reported a loss for the fourth quarter driven largely by representations and warrants provisions.

The mortgage business lost $108 million for the quarter, compared with a $20 million loss in the third quarter and a $519 million profit in the fourth quarter of 2016.

For the full year, B of A recorded $224 million of mortgage banking income, down from $1.9 billion in 2016.

The bank reports its mortgage lending results under two segments: consumer banking and all other. All other includes asset liability management and noncore mortgage originations and servicing activities as well as the net impact of any changes to the mortgage servicing rights valuation model.

While B of A had an $80 million fourth-quarter profit on the mortgage banking activities in its consumer banking segment, the all other segment had a $188 million loss as a result of a $218 million loss in the line that includes provisions for

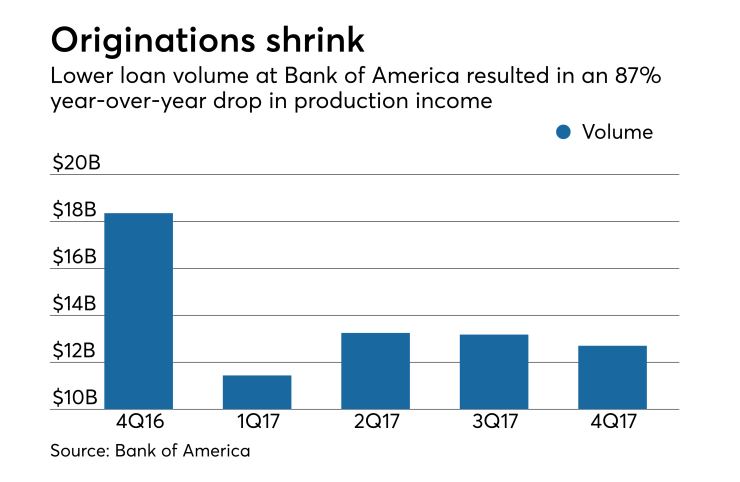

Total production income was $17 million, compared with $64 million in the third quarter and $131 million a year ago. It had $202 million of total production income in 2017, down from $663 million for the previous year.

B of A originated $12.7 billion of first mortgages in the fourth quarter. That included $8.4 billion in the consumer banking segment.

For the same period in 2016, it originated $18.4 billion, of which $12.3 billion came from the consumer banking segment.

But reflecting the changing interest rate environment, B of A originated $4 billion of home equity lines of credit during the quarter, up from $3.6 billion one year prior.

Total servicing income for the consumer banking segment was $63 million, compared with $76 million one year prior. The most recent period saw B of A earn $138 million in servicing fees.

Its loans serviced for investors fell to $256 billion as of Dec. 31, 2017, from $307 billion one year prior.