New York City Comptroller Scott Stringer and the city’s pension funds on Thursday announced a $450 million program to purchase and support mortgages for New Yorkers.

The investment in pension funds includes what Stringer called a first-of-its-kind infusion specifically to support veterans.

“New York City is facing an affordability crisis on everyday items. Our rising rents are sky-high and it feels harder than ever to purchase a home,” Stringer told reporters at the David N. Dinkins Municipal Building in lower Manhattan.

“These challenges become tragedies for our veterans.”

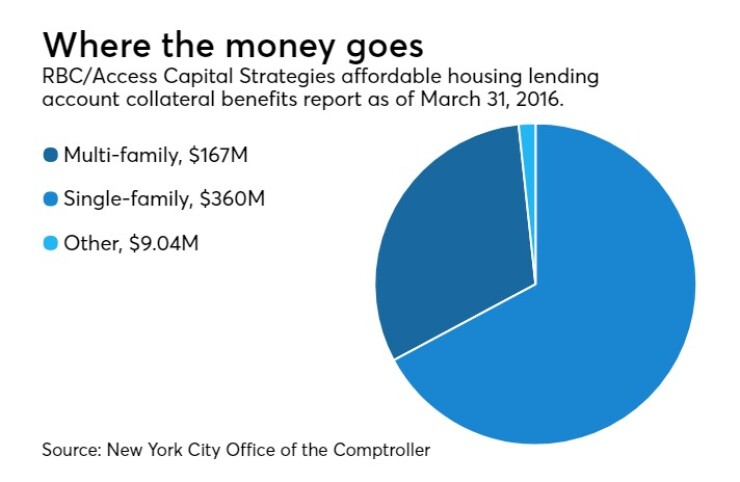

According to Stringer, the $450 million will go through a separately managed account with RBC Global Asset Management’s access capital community investment strategy. The strategy involves agency-backed mortgages from private and government affordable housing programs.

They include those run by a wide variety of federal, state and city housing and economic development agencies.

The city initiative features a renewal of $300 million that had previously been invested and the addition of $150 million in new funds. The initial agreement is for three years, with the option of two three-year extensions.

Each year at least $5 million will finance mortgages guaranteed by the Department of Veterans Affairs to veterans and their families living in the five boroughs, with the goal of 10% of all capital invested through RBC GAM Access Capital going to these mortgages.

The investment in the RBC program is part of the Economically Targeted Investments program, which the comptroller’s office runs. Launched in 1984, it seeks investments that deliver strong returns while also creating secondary benefits, such as affordable housing and good paying jobs.

The city's retirement systems allocate 2% of pension assets toward the ETI program.

“To be clear, we’re not investing in ETIs because it’s the right thing to,” said Stringer. “We’re investing in them because they’re the financially smart thing to do. Our partners at RBC have been among the strongest managers we’ve worked with.

“It shows we can grow our pension funds while also helping everyday families make it here.”

RBC Global Access Management describes its community development unit as “disciplined fixed income investing with a community development purpose.” GAM is a unit of Royal Bank of Canada.

“This is really to make available mortgage credit to people who can buy properties that are still affordable to New Yorkers,” Ron Homer, an RBC GAM managing director and co-founder of its access capital community investment strategy, said in an interview. “Midtown Manhattan is pretty pricey, but there are areas in New York City and the five boroughs where there’s still affordability, and where it’s a good place to buy a home and raise a family.

“We’re trying to just help people identify that there’s a way to get that financed if they want.”

Since 2007, said Stringer, investments from the pension funds in the separately managed account with RBC GAM Access Capital have totaled $397 million — resulting in 1,887 affordable single-family homes in New York City — as well as $170 million invested in multi-family buildings that delivered 33,390 affordable units across the five boroughs.

The pension funds have invested nearly $2.5 billion with an additional $500 million in future commitments. These investments have financed 105,000 units of affordable housing.

Stringer is investment advisor, custodian and trustee of the pension funds. They consist of the New York City Employees’ Retirement System, Teachers’ Retirement System, New York City Police Pension Fund, New York City Fire Department Pension Fund and the Board of Education Retirement System.