Dana Karni’s phone is ringing more this month as some of her clients are forced to decide between paying rent or making a car payment.

“For many of them, their car will be their next home,” said Karni, managing attorney with the Texas nonprofit Lone Star Legal Aid.

Karni and tenants' rights advocates around the country are seeing a housing crisis begin to crest in the surge of the coronavirus pandemic. Congress failed to reach a deal to extend a federal moratorium on evictions that expired on July 31, and President Trump’s executive order signed on Aug. 8

Now tenant and landlord groups are counting on banks that hold the mortgages underlying apartments or rental homes to take action. Specifically, these groups are calling on banks to require property owners — the borrowers — to pause eviction proceedings if they want forbearance on their mortgages.

“The bank really needs to say to their client we will provide help on your mortgage and then some if you pause eviction,” Karni said.

But banking industry executives say the best solution is another round of government stimulus. Mike Flood, a senior vice president at the Mortgage Bankers Association and an expert on commercial and multifamily policy, said that any extension of an eviction moratorium needs to come with expanded unemployment insurance and direct rental assistance to keep cash flowing through the system, he said.

In the meantime, he said, it’s unlikely that banks would interfere with their landlords’ ability to manage their properties.

“Absolutely no one wants anyone to lose a roof over their head,” Flood said. But, he added, “you have to allow the borrower to control the property. What we can do to the best of our ability is provide relief to the borrowers and allow them the best way to handle that.”

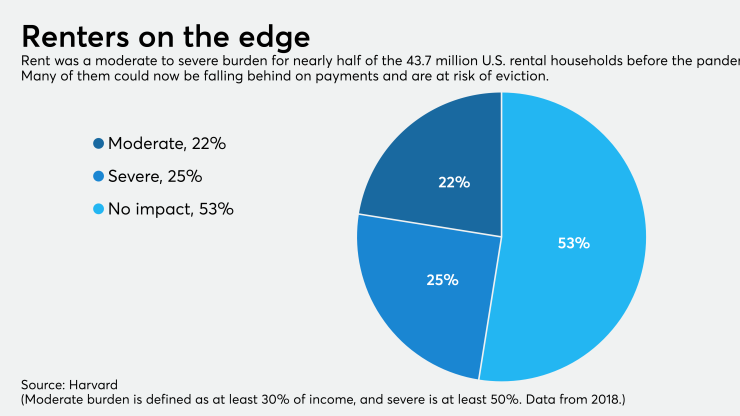

Even before the pandemic hit and wiped out millions of jobs, many households were living on the brink. Nearly half of renter households were already devoting what’s seen as a burdensome amount of their monthly income to housing, leaving them little safety net if they lose a job, according to a survey released this year by the Harvard Joint Center for Housing Studies. Nearly 11 million households spend more than half their monthly income on housing payments, the survey showed.

Many households were able to take advantage of expanded unemployment insurance and government-mandated forbearance programs to get through the first few months of the pandemic, but unemployment benefits have expired and households are stressed. Thirty-four percent of renters said at the end of July they were expecting to miss their August rent payment, according to a survey by the U.S. Census Bureau.

In 2021, Black and Hispanic homeowners were most prone to have suspended payments, but by 2023 they were just as likely to have resumed them as other groups, a study found.

The overall number for late payments hasn’t looked this favorable since at least 1999, according to CoreLogic’s December report.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

Emily Benfer, founding director of the Wake Forest Law Health Justice Clinic and chair of the American Bar Association’s COVID-19 task force committee on eviction, said banks “have a crucial role in stabilizing the housing market” as proceedings have started in many major cities now that the moratorium has passed even in states where extra protections were put in place.

Benfer said banks can enable property owners to enter into payment plans with tenants by forgiving rental debt and allowing landlords to pause their mortgage payments or restructure their loans at no cost.

For an increasing number of renters who are making their payments with a credit card, Benfer said banks should waive certain late fees and interest that could only make an economic recovery harder to reach. She also called on banks to donate to local rental assistance programs and preclude evictions that have taken place during the pandemic from affecting decisions to grant loans for those seeking new housing and are facing steeper security deposits to secure a place to stay.

“In the pandemic, these [bank] interventions mean protecting the 30 [to] 40 million individuals and children at risk of eviction as well as landlords and the communities that rely on rental income,” Benfer said.

The Senate is recessed until at least Sept. 7, and the House is not due to return until Sept. 14.

Some regulators have extended help. The Federal Housing Finance Agency, for instance, said on Aug. 5 it was extending a program that allowed landlords to receive forbearance on their commercial mortgages financed through Fannie Mae and Freddie Mac if they agree not to evict tenants during that period.

Some private lenders have attempted to provide relief on their own. The multifamily lender Arbor Realty Trust in Uniondale, N.Y., set up a $2 million rental assistance program in April to help tenants stay in their homes. Arbor is advancing $1 million to tenants that would be matched by participating borrowers that manage the property.

Dave Borsos, vice president for capital markets at the National Multifamily Housing Council, said that, without further regulatory guidance on eviction pauses, it will be up to individual banks and lenders to decide whether they will take on the coming issue themselves. Borsos said that without a package similar to one supported by Flood at the MBA, the economic situation could turn dire before Congress reconvenes.

“We have a concern, broadly, that things have the potential to get worse across the industry,” Borsos said.

The need for a bigger response than another moratorium on evictions is being pushed for by advocacy groups as well.

“Congress needs to implement at least $100 billion in rental assistance so landlords can pay their mortgage and renters won’t be inundated in back rent,” a National Low Income Housing Coalition spokeswoman said in an email.

Karni at Lone Star Legal Aid acknowledged that many banks don’t want to spar with their property management borrowers when it comes to decisions over evictions. But if they somehow incentivize landlords to halt evictions, banks may be able to shed some of the reputational problems that have dogged them since the last housing crisis, she said.

“To what extent are the banks going to feel responsible?"