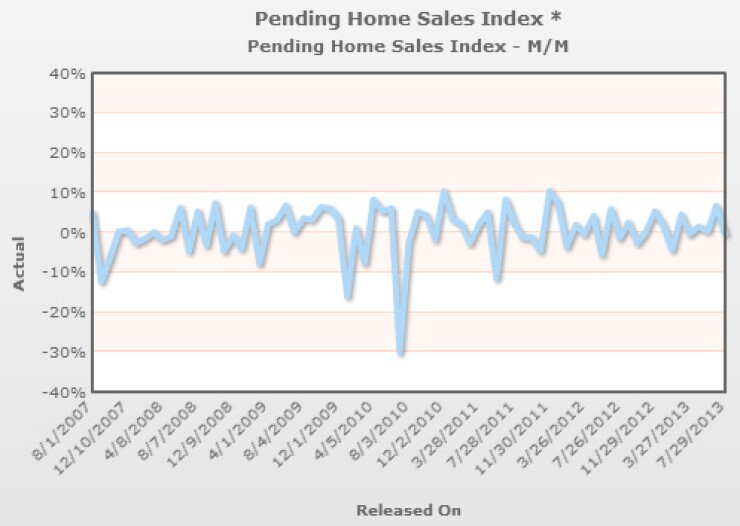

This morning, pending home sales were reported down 0.4%, a bit better than expectations of -1.4%. Pending home sales are transactions under contract for existing homes, which gives us an early look at the data. And this is the first real view we have of how homebuyers reacted to higher mortgage rates.

Today’s report for June has to be taken with a grain of salt because it’s quite possible that some of the activity in June is migration from individuals jumping in with the perception that rates were on the rise and they wanted to get in while the getting was good. This means that they accelerated purchases that might have normally occurred in July or August.

It will take a bit of time to see reports that wash out the impact of the spike in rates. Even though this report was slightly lower than last month, we have to remember that last month’s number was a 6-year high. Pending home sales are still up 11% from last year and are showing resiliency even in a higher rate environment. Overall, this was a very strong report.