-

The mortgage industry has long sought a reduction, which could make homes more affordable to entry-level buyers with limited incomes, but such a measure also would limit the agency’s claims-paying resources.

January 20 -

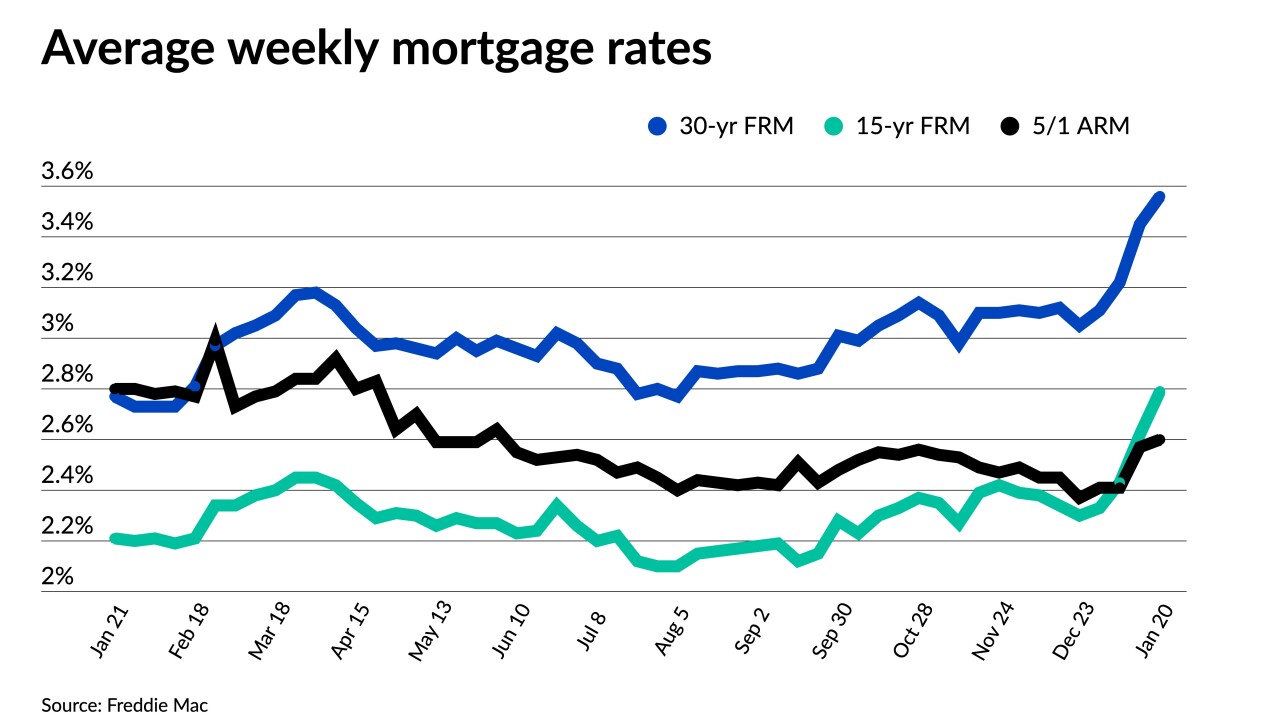

All major averages have risen to start 2022, with the 15-year surpassing the ARM.

January 20 -

The Federal Reserve Board would become far more diverse if Sarah Bloom Raskin, Philip Jefferson and Lisa Cook are confirmed by the Senate. Jefferson and Cook are respected economists seen as likely to get the nod, but Republicans will challenge Raskin's assertions that bank regulators can play a vital role in combating climate change.

January 14 -

Average prices were up 15% compared to the same month in 2020.

January 14 -

Despite that year-over-year decline, the company beat analysts' expectations with fourth-quarter net income of $5.8 billion. Stronger commercial lending and lower expenses cushioned the blow in consumer credit.

January 14 -

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The company reached an agreement with 39 states to pay $1.85 billion to resolve claims that it had used predatory lending practices.

January 13 -

Chief Operating and Growth Officer Pat Dodd becomes interim president and CEO following Frank Martell’s move to non-executive chairman of the company’s board.

January 13 -

The SEC claims Morningstar put investors at a risk when rating $30 billion in CMBS deals from 2015-2016. Morningstar defends its integrity and independence.

January 13 -

But the online real estate company is eliminating nearly half of the positions in its existing mortgage business as a result of the deal.

January 12 -

The tech industry’s attempts to simplify the process of selling a house depend on flipping properties to some of the biggest names in global finance.

January 7 -

The government-sponsored enterprise also unveiled two new tranche slices for investors to purchase.

January 6 -

While some in the industry support the change, mortgage broker trade group AIME called on the agency to reconsider it.

January 5 -

Federal Reserve officials said a strengthening economy and higher inflation could lead to earlier and faster interest-rate increases than previously expected, with some policy makers also favoring starting to shrink the balance sheet soon after.

January 5 -

The Trump-appointed head of the Federal Deposit Insurance Corp., Jelena McWilliams, said she plans to leave the agency in early February. The announcement comes weeks after Democratic appointees making up a majority of the board had threatened her leadership by acting on policy related to bank mergers without her consent.

December 31 -

Blackstone Inc. has agreed to acquire Bluerock Residential Growth REIT Inc. in a deal valued at $3.6 billion, extending its push into U.S. rental housing.

December 20 -

However, the unusual profitability residential finance firms have previously enjoyed, and a strong housing market, could help to sustain their bottom lines.

December 15 -

HUD official Alanna McCargo takes over the top job at the government corporation, which has had a series of acting leaders since 2017.

December 15 -

Consumer Financial Protection Bureau Director Rohit Chopra has helped assert the authority of the three Democrats — including himself — who serve on the governing body of the Federal Deposit Insurance Corp. GOP lawmakers responded with a bill to strip the consumer agency's head of voting powers on the FDIC board.

December 15