Federal Reserve

Federal Reserve

-

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

January 16 -

A handful of former Fed officials noted that the markets' measured response to a probe into Fed Chair Jerome Powell was a result of pushback from Trump allies.

January 15 -

President Trump Tuesday told reporters he would not delay announcing his pick to fill a new vacancy on the Federal Reserve Board despite threats from Republican Senators to block any Fed nomination until a recently-disclosed Justice Department investigation into Fed Chair Jerome Powell is resolved.

January 13 -

The Bureau of Labor Statistics reported Tuesday morning that consumer prices rose 0.3% in December, with annual inflation stuck at 2.7%, lending credence to the Federal Reserve's cautious stance toward interest rates heading into 2026.

January 13 -

Financial markets took a tumble Monday morning after Federal Reserve Chair Jerome Powell announced that he was the subject of a Justice Department inquiry concerning the central bank's headquarters renovation. Lawmakers and former Fed officials decried the move as political intimidation.

January 13 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

But a senior administration official said the DOJ, not Pulte, is behind the subpoena that relates to Powell's congressional testimony about Fed building renovations.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Yields across maturities were higher by less than three basis points after rebounding from session lows.

January 8 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

The rally sparked by the weekend US arrest of Venezuela's President Nicolas Maduro also faltered as oil prices rebounded from their initial declines

January 5 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

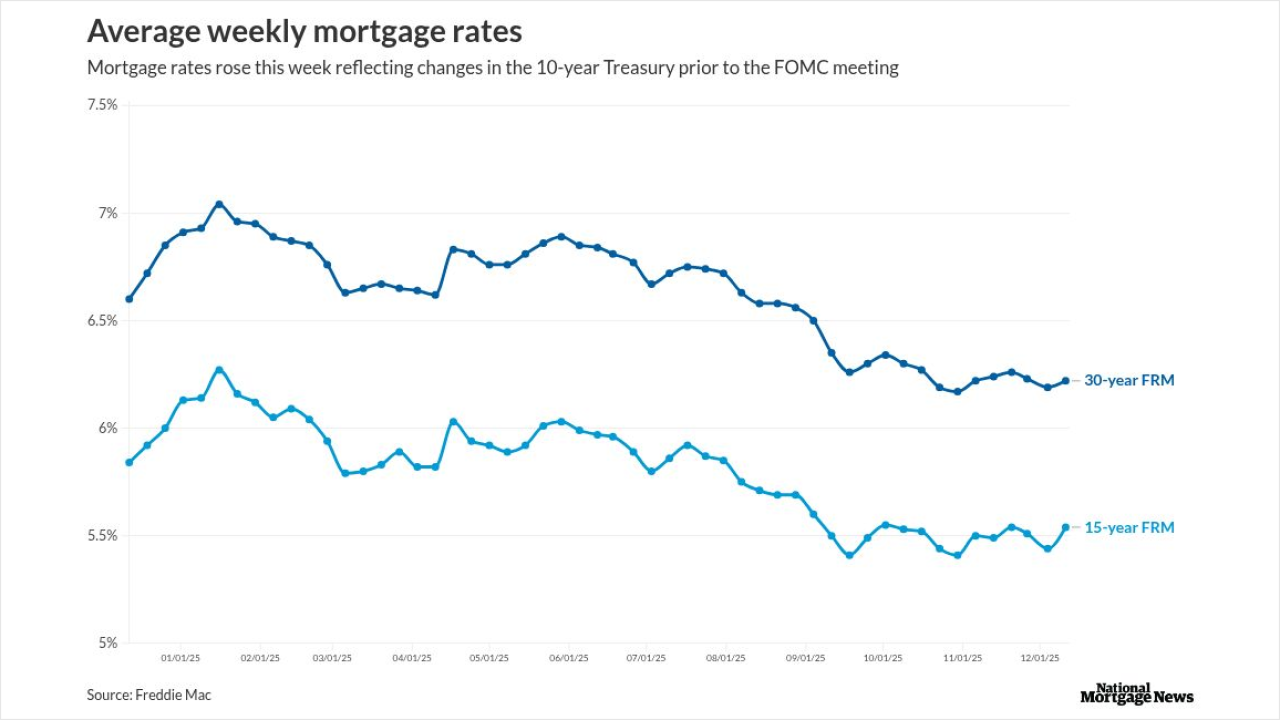

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

The president's latest commentary comes as he is looking to new leadership at the Fed to help reduce borrowing costs, as he increasingly feels political pressure to address voter concerns over affordability.

December 23 -

The Federal Reserve said in a statement that its "understanding of innovation products and services have evolved" since the initial guidance was published in 2023.

December 18 -

Federal Reserve Gov. Stephen Miran said higher goods prices could be the trade-off for bolstering national security and addressing geo-economic risks.

December 15 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

Leading Democrats on the Senate Banking Committee sent a letter to Chair Tim Scott, R-S.C., pointing out the as-yet unsatisfied legal requirement for prudential regulators to appear in Congress semiannually.

December 12 -

The Federal Reserve Board of Governors voted Wednesday to reappoint 11 sitting regional Fed presidents, without any dissents. The move precludes any effort the White House might have made to pressure the board to deny reappointments.

December 11 -

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11