-

The annual progress report on the Fannie Mae and Freddie Mac conservatorships reiterated that a new credit score model will likely not be operational until after the implementation of a new Single Security Initiative.

March 29 -

After several years of preparation, Fannie Mae and Freddie Mac will start issuing a new, common mortgage-backed security starting June 3, 2019, the Federal Housing Finance Agency said Wednesday.

March 28 -

Fannie Mae and Freddie Mac had a 9% increase in total foreclosure prevention actions taken during 2017 as a result of three September hurricanes, according to the Federal Housing Finance Agency.

March 26 -

A bill to allow captive insurance companies to be reinstated as members of the Federal Home Loan Bank System appears to be dividing the FHLB community.

March 21 -

A late addition to regulatory relief legislation would direct the Federal Housing Finance Agency to review credit-scoring alternatives, but some say the provision is redundant.

March 13 -

The Federal Home Loan banks could "design and implement" their own system for deciding how to allocate resources for affordable housing initiatives under the proposal by the Federal Housing Finance Agency.

March 6 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

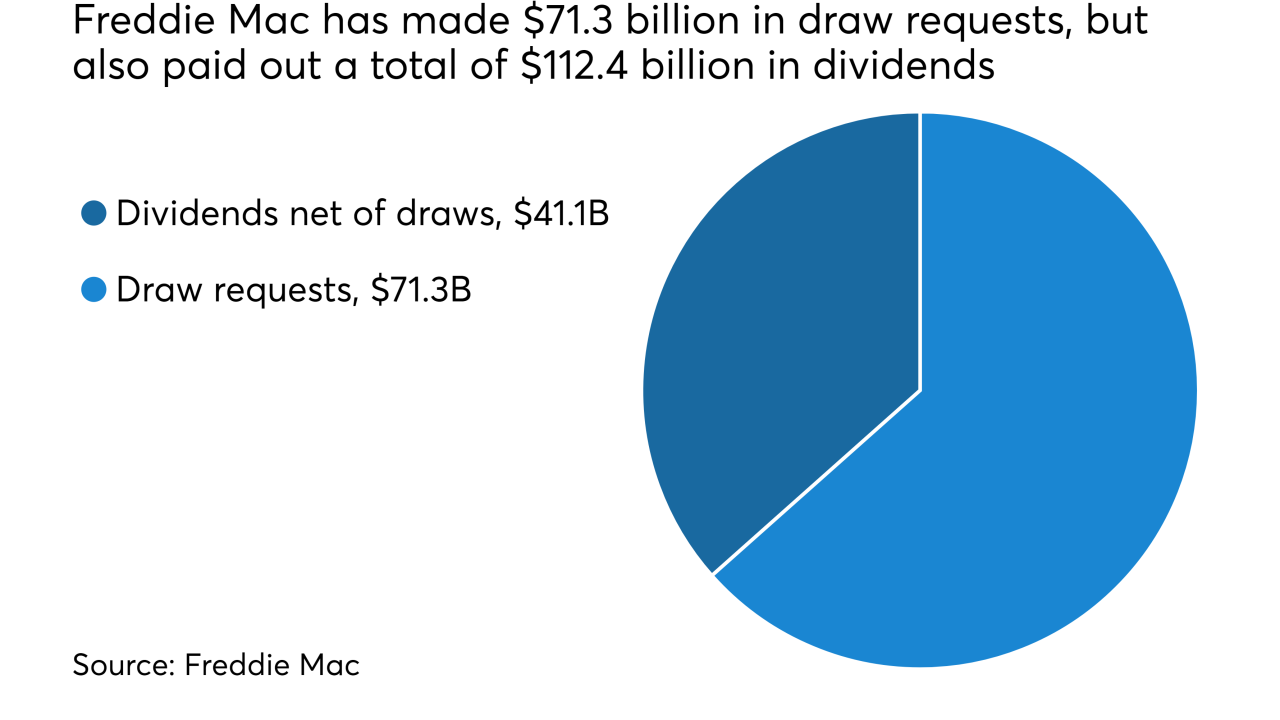

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

Tax reform caused Fannie Mae to burn through retained earnings that had been approved just two months ago and to post a fourth-quarter loss. CEO Timothy Mayopoulos argued it was a one-time event that overshadowed strong fundamentals.

February 14 -

As conservator, FHFA Director Mel Watt has substantial leeway to remake the government-sponsored enterprises without congressional input. Here's one way he might do so.

February 7 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

February 2 -

Three senators have unveiled a bill that would allow captive insurance companies to regain full membership in the Federal Home Loan Bank System.

February 1 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18 -

Craig Phillips, a top aide to Treasury Secretary Steven Mnuchin, said his department "broadly" agrees with the FHFA plan, which would return Fannie Mae and Freddie Mac to the private market and provide them an explicit government guarantee.

January 18 -

FHFA Director Mel Watt said Fannie Mae and Freddie Mac should be reincorporated as private entities and the government must provide an explicit guarantee for catastrophic losses in the secondary mortgage market.

January 17 -

Housing regulators should not adopt an alternative credit scoring model until the banking industry is on board.

January 16

-

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11