-

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal.

July 26 -

A divided Federal Reserve policy committee couldn’t reach agreement in June on the timing of when to begin shrinking its massive balance sheet, according to minutes of the meeting.

July 5 -

The Federal Reserve can be patient in setting monetary policy and the current rate may be the right level for the forecast horizon, Federal Reserve Bank of St. Louis President James Bullard said Friday.

June 23 -

Fed Chair Janet Yellen called the Treasury's report a "complicated document" that shared many of the central bank's objectives, including reducing regulatory burden without sacrificing safety and soundness.

June 14 -

Federal Reserve officials forged ahead with an interest-rate increase and additional plans to tighten monetary policy despite growing concerns over weak inflation.

June 14 -

Federal Reserve officials surprised some onlookers by unveiling a rough plan for balance sheet runoff in the minutes for their May meeting.

June 12 -

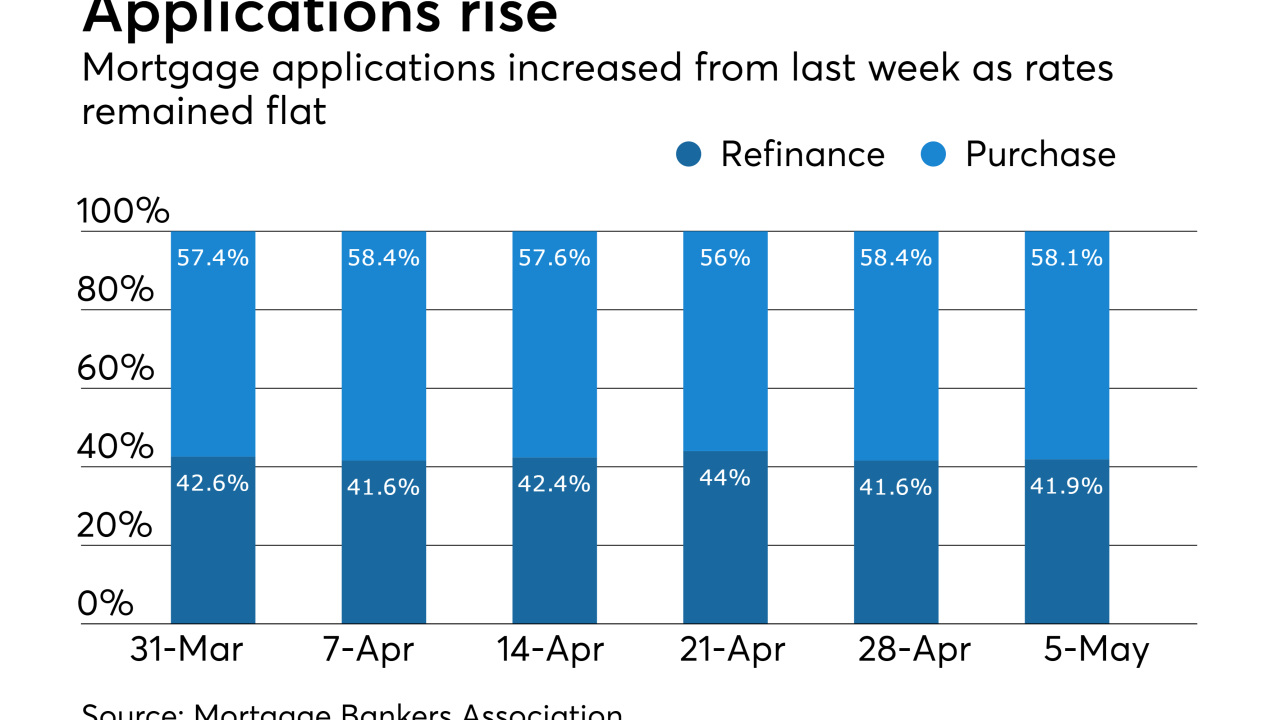

Mortgage applications increased 2.4% from one week earlier as there was little movement in interest rates, according to the Mortgage Bankers Association.

May 10 -

Mortgage rates held steady in anticipation of the Federal Open Market Committee not increasing short-term rates at its meeting Wednesday, according to Freddie Mac.

May 4 -

For the first time since the Federal Open Market Committee

acted five weeks ago , there was an increase in mortgage rates.April 27 -

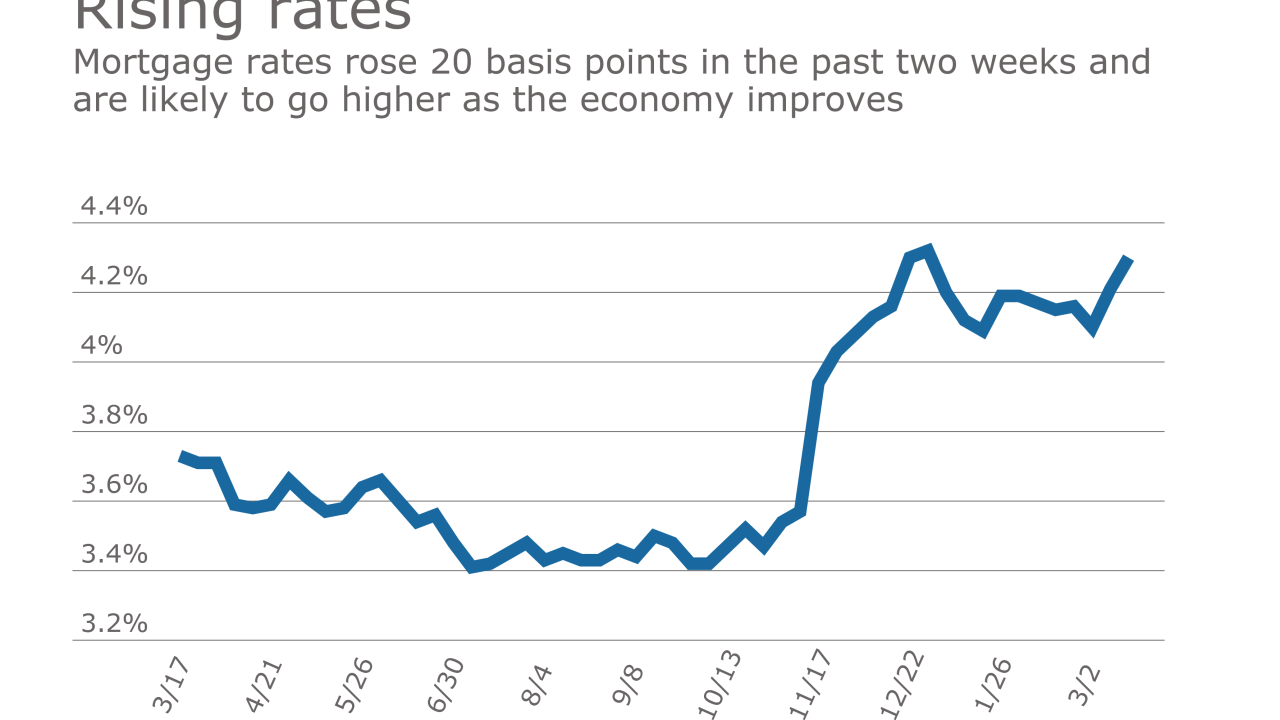

Mortgage rates have been on a steady decline since the March 15 Federal Open Market Committee meeting, hitting a new low for 2017, according to Freddie Mac.

April 13 -

Investors have reacted to the Federal Reserve's plan to shrink the balance sheet so far in exactly the opposite way that policymakers had feared.

April 7 -

The average weekly rate for a 30-year fixed-rate mortgage dropped to 4.1% from 4.14% despite the release of information about further tapering of the Federal Reserve's mortgage bond holdings.

April 6 -

Most Federal Reserve officials agree that they will begin shrinking their super-sized balance sheet later this year.

April 6 -

Richmond Fed President Jeffrey Lacker resigned Tuesday after revealing that he inadvertently disclosed confidential information about monetary policy to an analyst in 2012.

April 4 -

The 30-year fixed-rate mortgage averaged 4.14% for the week ending March 30,

down from last week when it averaged 4.23%.March 30 -

Federal Reserve Bank of Dallas President Robert Kaplan said the central bank should roll off both mortgage-backed securities and Treasury holdings when it begins to let its balance sheet shrink.

March 27 -

The 30-year fixed-rate mortgage averaged 4.23% for the week ending March 23, down from last week when it averaged 4.3%.

March 23 -

Mortgage rates are being pushed higher by the same economic factors that led the Federal Open Market Committee to increase short-term rates.

March 16 -

The Federal Reserve’s Federal Open Market Committee on Wednesday raised the federal funds rate 0.25%, marking only the third rate hike since the financial crisis.

March 15 -

Application activity increased 3.3% from one week earlier, even though mortgage interest rates rose on speculation the Federal Open Market Committee could act in March.

March 8