-

The CFPB is looking to rescind Obama-era policy that allowed it to punish banks and financial firms for unintentional discrimination.

May 21 -

Reducing unnecessary compliance burdens will pave the way for economic growth, larger job creation and wage increases, and re-evaluating technology will play an important role in doing so, according to Craig Phillips, counselor to the secretary at the Department of the Treasury.

May 21 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

Acting CFPB Director Mick Mulvaney has dropped agency plans to crack down on overdraft programs and large marketplace lenders. Here's what else he's changing.

May 16 -

Acting CFPB Director Mick Mulvaney suggested that digital mortgages should be held to different standards than ones originated by credit unions and banks.

May 15 -

The union representing employees at the CFPB is already fighting acting Director Mick Mulvaney's efforts to restructure the agency, and readying for a potentially larger conflict as rumors of layoffs swirl.

May 10 -

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

The group says Mulvaney, who also runs OMB, was not totally forthcoming with the Senate Budget Committee about the foreclosure of a property he owns in South Carolina.

April 30 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

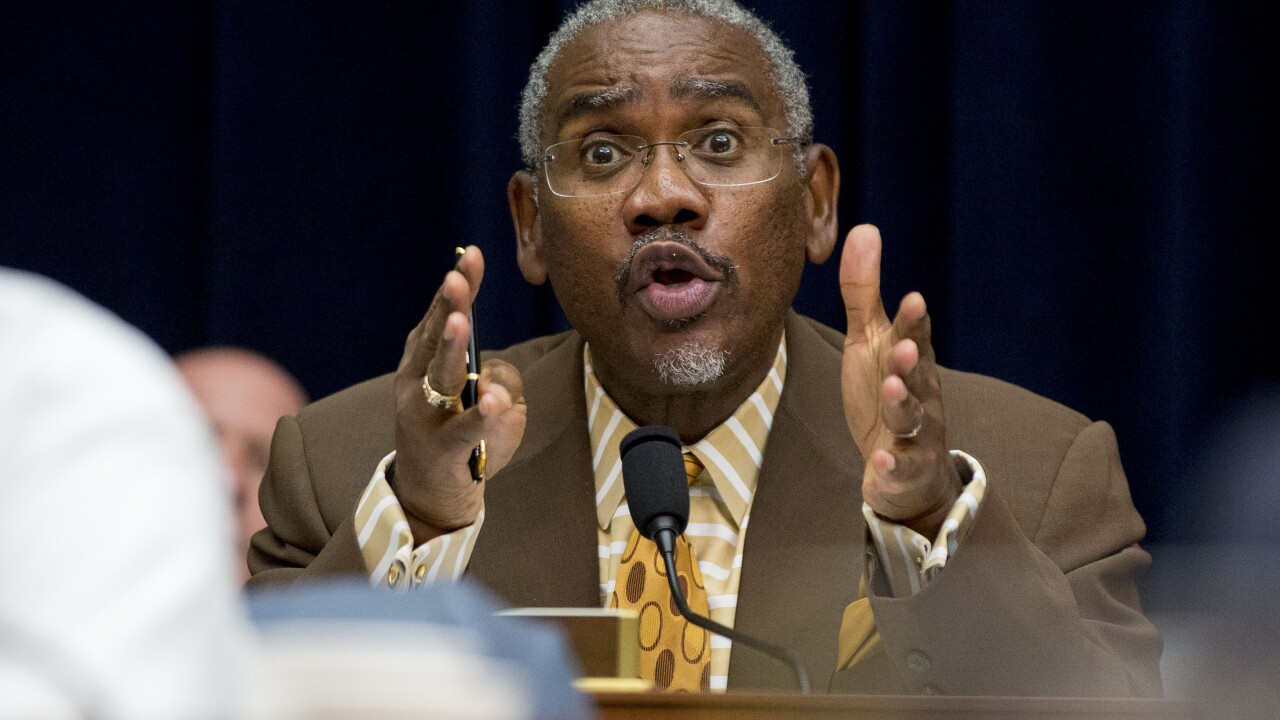

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

The Consumer Financial Protection Bureau on Wednesday asked for public input on the way it receives and processes complaints from consumers in what the agency said was a preliminary step toward making improvements.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

The information request is the 11th issued by the agency since acting CFPB Director Mick Mulvaney in January launched a review to examine the bureau's practices.

April 4