-

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

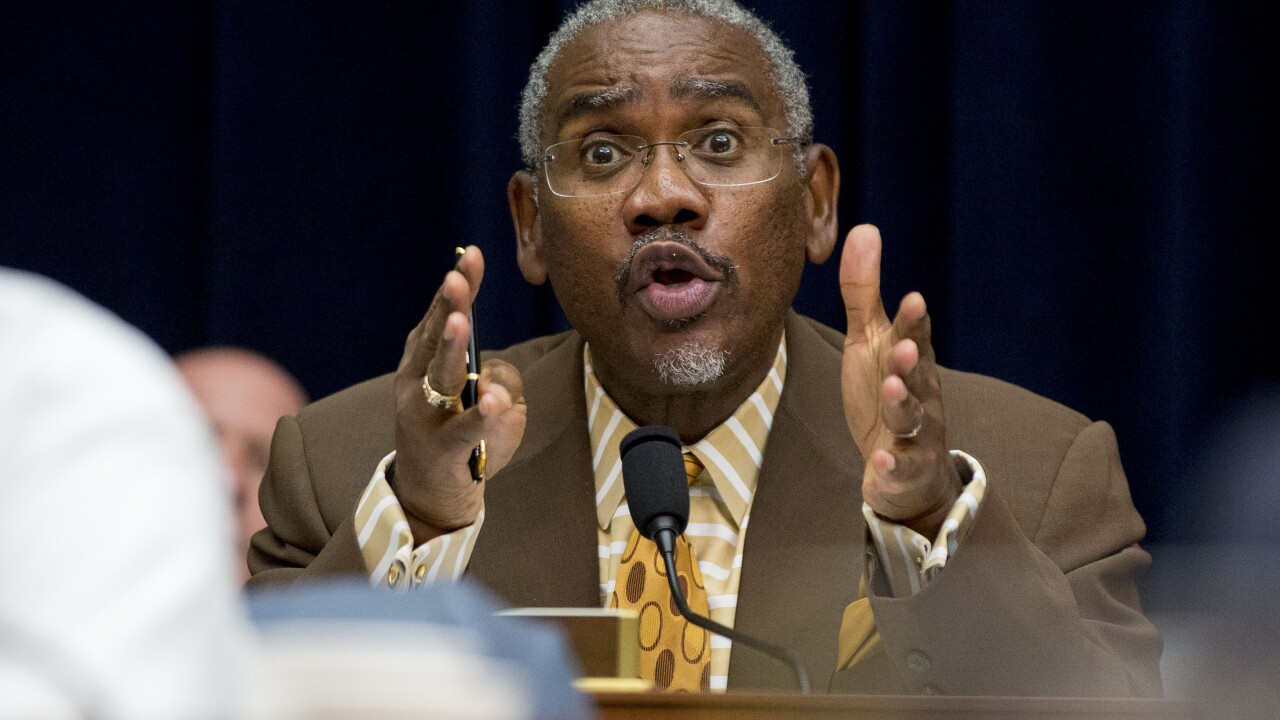

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

The Consumer Financial Protection Bureau on Wednesday asked for public input on the way it receives and processes complaints from consumers in what the agency said was a preliminary step toward making improvements.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

The information request is the 11th issued by the agency since acting CFPB Director Mick Mulvaney in January launched a review to examine the bureau's practices.

April 4 -

The latest salvo by the acting director of the Consumer Financial Protection Bureau — proposing in the agency's semiannual report that all CFPB rules be subject to congressional approval — left many observers stumped if not outraged.

April 2 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney proposed dramatic curbs to his agency's power in a report Monday, including a recommendation that all CFPB rules must be approved by Congress.

April 2 -

The new request for information is the 10th in the series that is part of acting Director Mick Mulvaney’s “call for evidence” to assess the CFPB’s overall effectiveness.

March 28 -

The information collection effort is consistent with acting CFPB Director Mick Mulvaney's efforts to set the agency on a more pro-industry, anti-enforcement course.

March 22 -

In the joint report with the Federal Trade Commission on debt collection practices, the CFPB said it had initiated four enforcement actions last year, had resolved one case and has five others pending.

March 21 -

Critics of the Consumer Financial Protection Bureau have long sought to convert its leadership structure from a single director to a five-member commission. Here’s why the idea is dead on arrival.

March 20 -

The eventual pick will likely encounter heavy scrutiny from senators and, if confirmed, would take the helm of an agency still defined by turmoil nearly seven years after its creation.

March 12 -

The Consumer Financial Protection Bureau finalized a rule on Thursday that gives mortgage servicers more latitude in sending periodic statements to borrowers in bankruptcy.

March 8 -

The Consumer Financial Protection Bureau issued a request for information Wednesday about certain "discretionary aspects" of the bureau’s rulemaking processes that are not already required by law.

March 7 -

The Dodd-Frank Act consolidated massive authority under the Consumer Financial Protection Bureau, but acting Director Mick Mulvaney wants the bureau to take a back seat to states and other federal regulators.

March 7