-

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants.

January 12 -

The agency finalized a policy allowing companies to submit formal requests for clarification on a regulatory issue. The bureau said it will publish the advisory rulings in the Federal Register.

November 30 -

The proposed regulation would codify a 2018 pronouncement by regulators that guidance does not carry the force of law.

October 29 -

The regulatory road ahead is as uncertain and risky to banks as the pandemic.

-

The agency has proposed letting firms seek specific guidance, which can be applied to other institutions. But consumer groups worry the plan circumvents formal rulemaking.

July 1 -

A lawsuit filed Tuesday argues that the bureau's establishment of the panel looking into regulatory changes violated the Federal Advisory Committee Act.

June 16 -

Sen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

March 9 - LIBOR

Federal Reserve Chairman Jerome Powell told senators that the central bank is willing to explore a credit-sensitive interest benchmark in addition to the secured overnight financing rate, which some banks say could cause problems during economic stress.

February 12 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 5 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 4 -

Recent Fannie Mae and Freddie Mac activities are “not the kind of day-to-day behavior that you would expect from companies” under federal control, the head of the Federal Housing Finance Agency said.

October 31 -

CFPB Director Kathy Kraninger announced the creation of a task force to research and identify potential conflicts in consumer finance law.

October 11 -

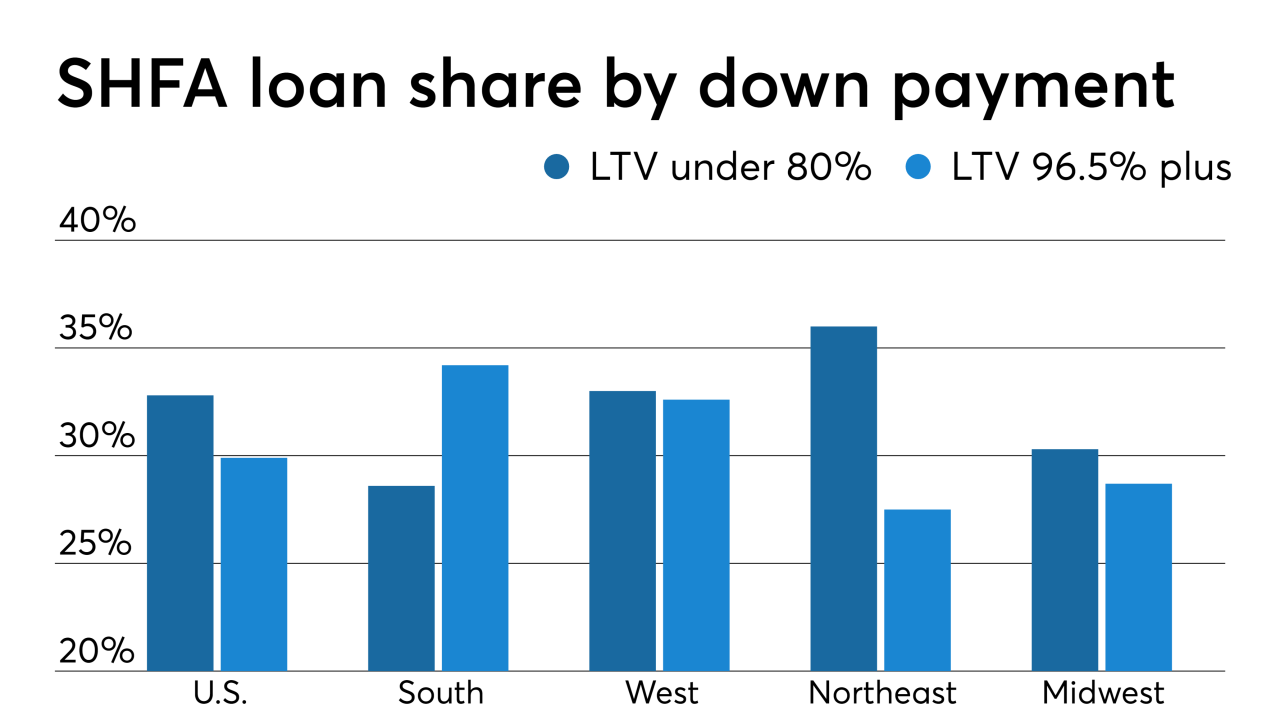

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

The Trump administration is not backing down even after a federal court blocked guidance that would have limited the operations of national housing funds.

September 4 -

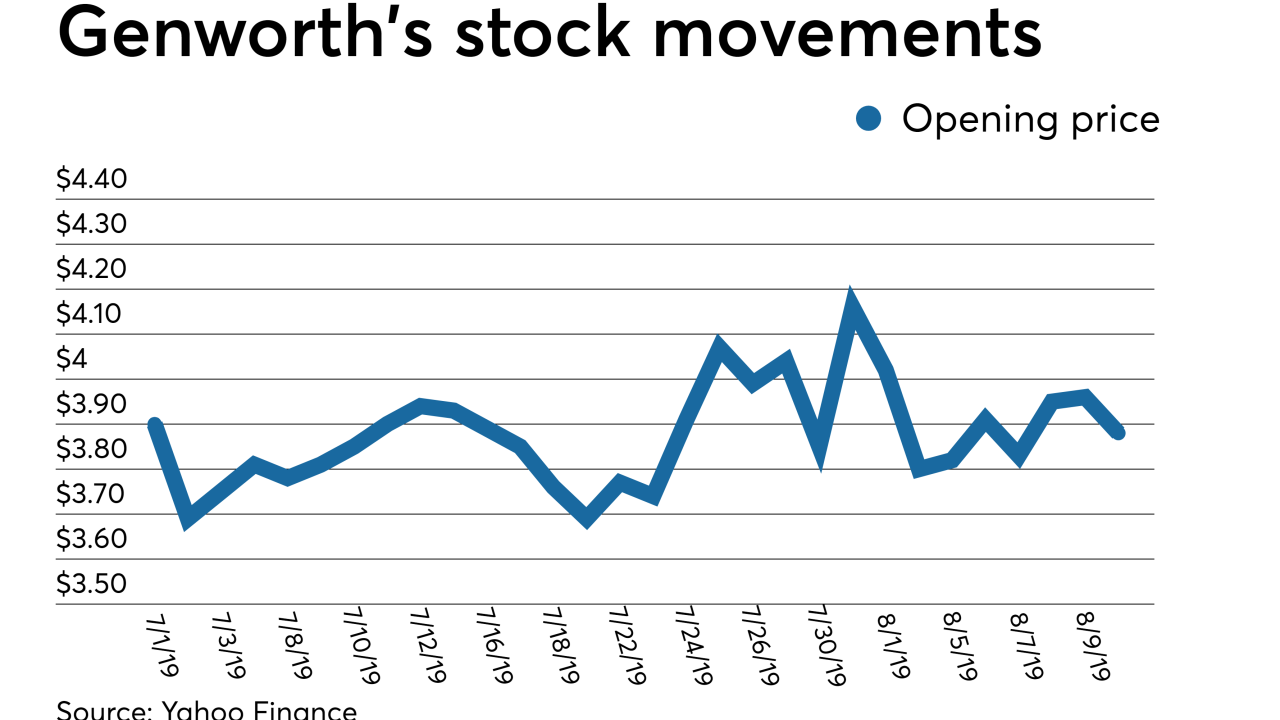

Genworth Financial agreed to sell its Canadian unit to Brookfield Business Partners for C$2.4 billion ($1.8 billion) as it works to win regulatory approval for its acquisition by China Oceanwide Holdings Group.

August 13 -

Genworth Financial's efforts to advance its sale to China Oceanwide hit a roadblock as bondholders did not respond to a consent solicitation for easing a possible Canadian mortgage insurance unit sale.

August 12 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17 -

-

The mortgage industry is calling for better alignment between the federal government and state of New York regarding proposed regulatory revisions that would affect local servicers.

July 1 -

The agency announced the series in April as an effort to encourage public dialogue on policy issues.

June 11