-

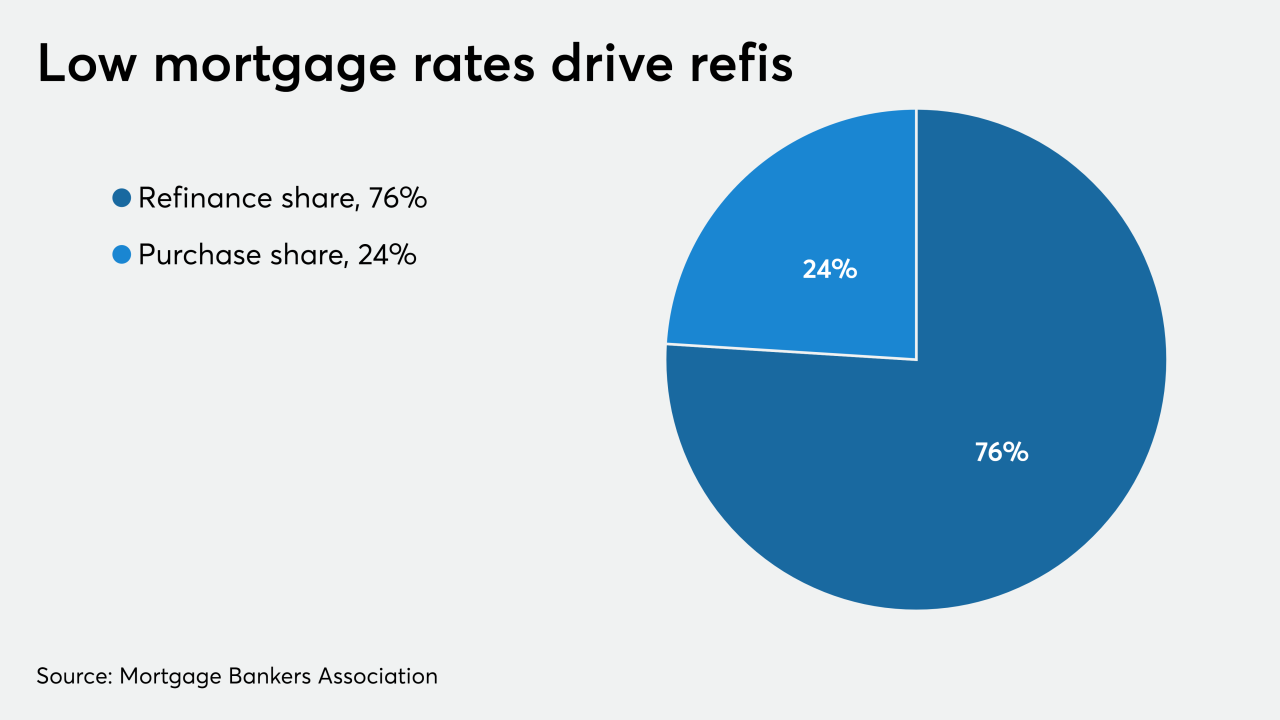

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

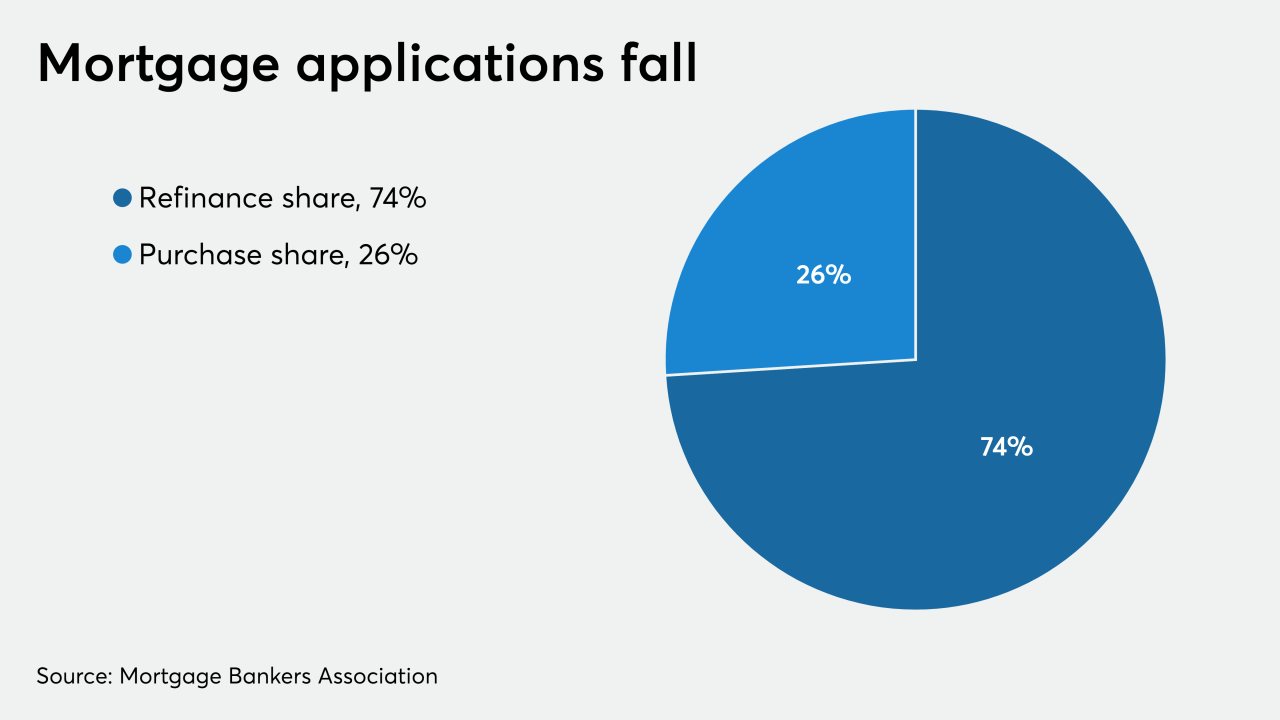

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

Community banks and credit unions could carve out an opportunity by refinancing mortgages from larger institutions.

April 3 Finastra

Finastra -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2 -

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1 -

With interest rates at historic lows and recent increases in Tucson, Ariz., home values, many jittery homeowners impacted by the coronavirus outbreak are looking to refinance to get their hands on cash.

March 31 -

Mortgage technology efforts have historically been behind the curve, but some recent responses to the coronavirus highlight instances where it rises to the occasion.

March 27 -

Residential estate brokers and agents are scrambling to determine what Massachusetts Gov. Charlie Baker's emergency order means for their industry.

March 27 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25