-

Mortgage rates are at record lows, but borrowers hoping to take advantage are running into the toughest loan-approval standards in years.

May 8 -

Mortgage rates ticked up slightly this week, but whether consumers are able to take advantage of them for purchases and refinancings depends on who looks at the data.

May 7 -

But it is still looking to conserve capital to cover future delinquencies and will likely halt dividends to the parent company.

May 6 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

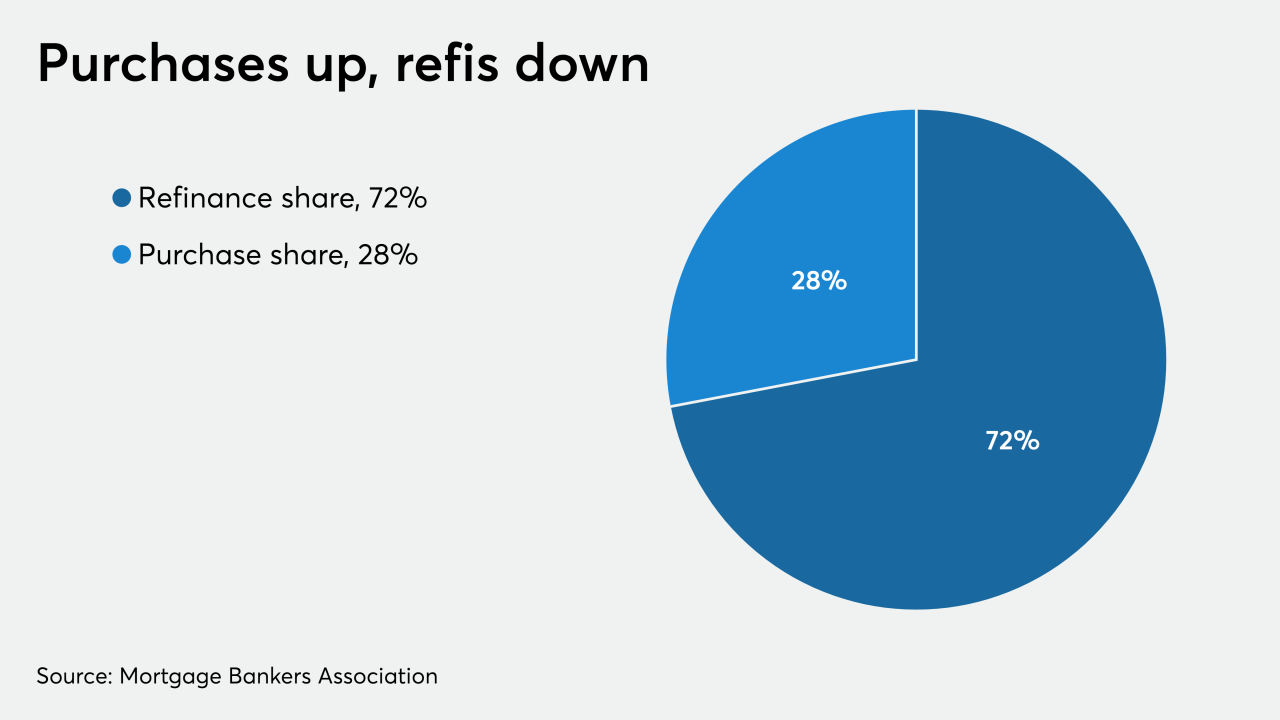

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

Mortgage fraud risk plummeted in the first quarter of 2020 amid historically low mortgage rates and a boom of refinances, but the coronavirus could create a new set of risks, according to CoreLogic.

April 22 -

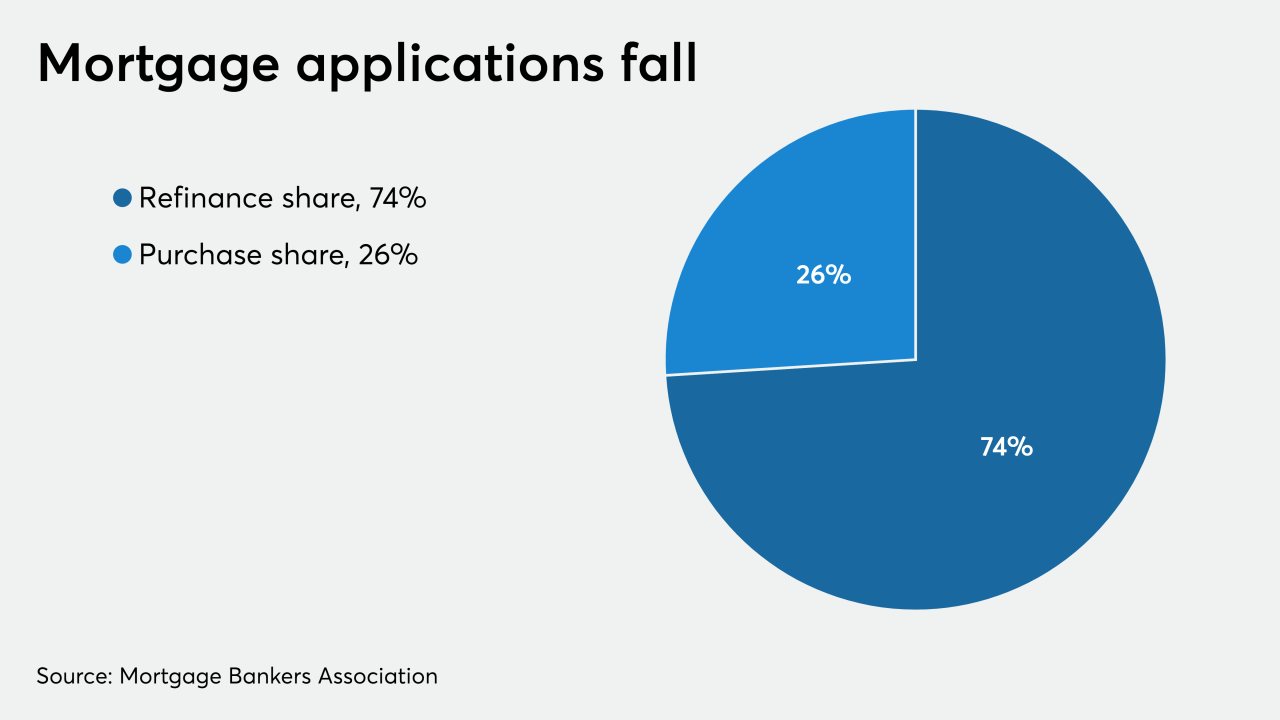

Mortgage applications decreased 0.3% from one week earlier, although purchase activity was higher for the first time in six weeks, according to the Mortgage Bankers Association.

April 22 -

The coronavirus outbreak, along with the shift to a lower paying refinance business, will likely limit commission earnings for the rest of 2020.

April 20 -

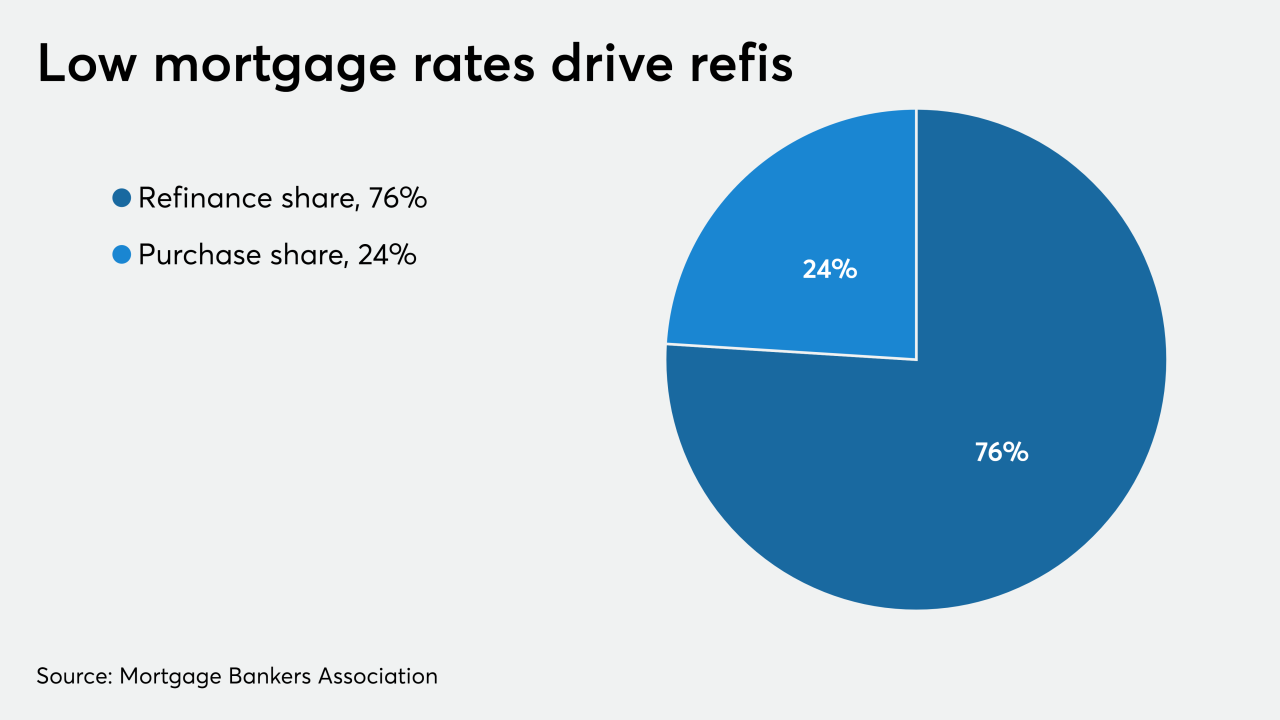

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

Community banks and credit unions could carve out an opportunity by refinancing mortgages from larger institutions.

April 3 Finastra

Finastra -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2 -

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1