- Two years of significant home price appreciation has resulted in national concerns about housing affordability. However, in new research by Freddie Mac, 6-in-10 individuals say they would consider purchasing the type of dwelling that has become the largest source of unsubsidized affordable housing in the United States: manufactured housing. Get specifics on who is most likely to purchase a manufactured home and why.Partner Insights from Freddie Mac Single Family

- Sad to say, fraudsters are creative and energetic. If you’re in the mortgage industry, you need to stay on top of what they’re up to – and what they’re planning next. What if the person applying for a loan isn’t who they say they are? Upon receiving some interesting tips, Freddie Mac Single-Family Fraud Risk (SFFR) investigated and identified a new twist on misrepresentation. Read the report summary to find out more.Partner Insights from Freddie Mac Single Family

- See how you can enhance agent efficiency and quality through the real time deployment of AI in messaging channels.Partner Insights from Sutherland Global Services

- Learn how the Notarize platform powers eClosings by fostering collaboration and offering signers the flexibility to review, sign, and notarize real estate documents from anywhere.Partner Insights from Notarize

- CARE is Sagent’s consumer platform to care and retain customers through good times and hardships, provide real-time views of home equity, make custom loan offers, and provide immediate hardship help from any device.Partner Insights from Sagent

- RemoteVal™ brings new technology to the market that reduces appraisal times to days instead of weeks – without compromising on quality and integrity.Partner Insights from Incenter Appraisal Management

- With Roostify’s digital home equity solutions, lenders can make it easier for homeowners to achieve their financial goals by taking advantage of their home equity. Our cutting-edge platform enables lenders to provide flexible home equity lending options and a streamlined experience that turns borrowers into lifelong customers.Partner Insights from Roostify

- According to the latest Purchase and Refinance Closing Cost Trends Reports from CoreLogic’s ClosingCorp, the average closing costs for a purchase mortgage in 2021, including transfer taxes, was $6,905, up 13.4% from the previous year.Partner Insights from CoreLogic

- Experts are predicting an above-normal number of Atlantic hurricanes in this year’s season, which runs from June through November. A look back at last year’s Hurricane Ida shows the effect these storms can have on local housing markets.Partner Insights from CoreLogic

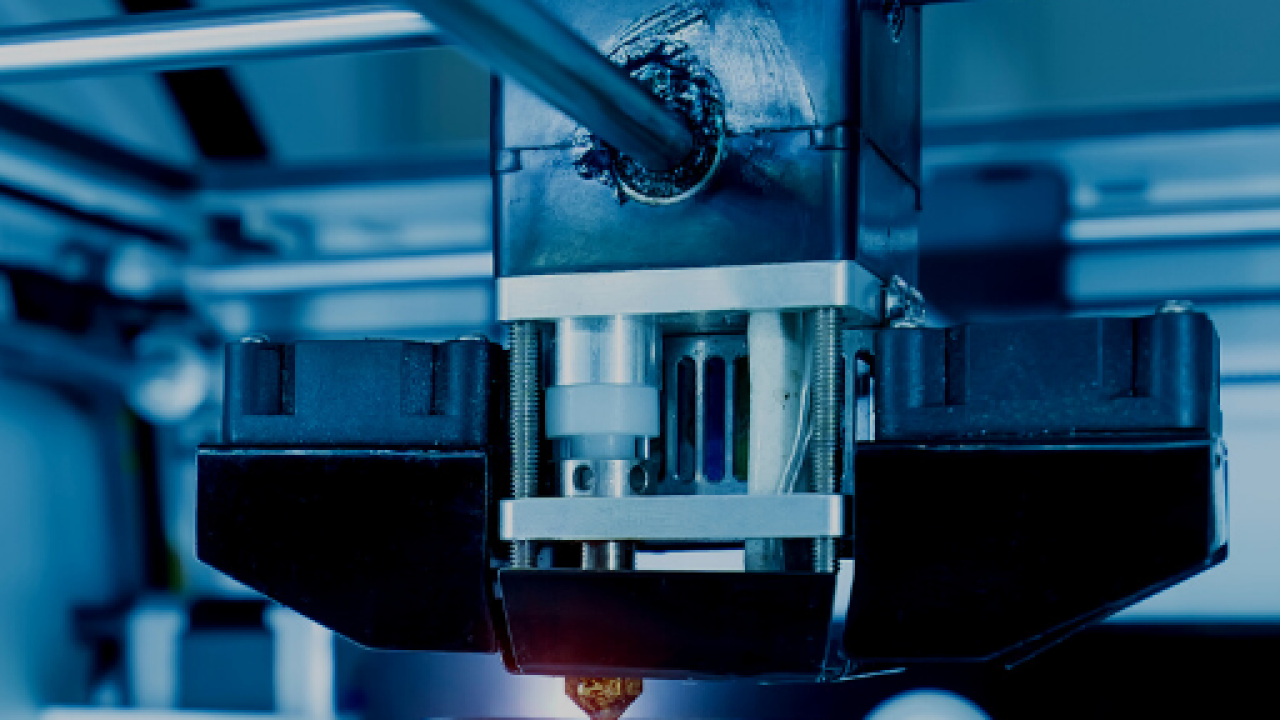

- Developments in artificial intelligence (AI) and robotics may be a ray of hope for current housing challenges, including inventory, affordability and materials and labor shortages, while promoting sustainability and equity. This article reviews the potential benefits and barriers of 3D-printed homes, and what needs to happen for them to become a viable option in the housing ecosystem.Partner Insights from Freddie Mac Single Family

- Manufactured housing has been on the decline since its peak in 1996. While several factors are driving this downtrend trend, a portion of the fall-off is related to local, state and homeowner association regulations. This article looks at how the greater acceptance of manufactured homes could result in a bevy of benefits, from chipping away at the housing deficit to shrinking the affordability gap. Read More.Partner Insights from Freddie Mac Single Family

- Ready or not? An important question when it comes to mortgage lending, as a successful loan agreement means both the lender and the homebuyer are confident the buyer is ready for the financial responsibilities of homeownership. This article sheds light on what it means to be mortgage ready – and provides a look at strategies that can help lenders find more qualified buyers. Read More.Partner Insights from Freddie Mac Single Family

- FHFA recently issued updated area median income (AMI) limits, which are used to determine whether borrowers meet the income eligibility requirements for Freddie Mac Home Possible and Refi Possible mortgages, as well as exemption from the Super Conforming Mortgage Credit Fee in Price. Get the full details, as you may be able to offer affordable mortgages to even more borrowers.Partner Insights from Freddie Mac Single Family

- While rural homeowners appreciate proximity to trees, mountains, water and an abundance of natural light, they also have concerns about outdated, lacking or non-functioning features inside their homes that could impact their physical health and stress levels. This article lists tangible ways to identify and address health-related home concerns so rural residents can live more comfortably and age in place.Partner Insights from Freddie Mac Single Family

- CHOICEReno eXPress is a new mortgage product that offers an additional financing option for borrowers who are looking to make smaller-scale home renovations. With CHOICEReno eXPress, lenders can offer a wide range of borrowers the ability to finance home repairs and help them attain and maintain affordable and sustainable homeownership.Partner Insights from Freddie Mac Single Family

- The typical U.S. family could save quite a bit of cash by using reliable information to help them make smart home improvement decisions. This article illustrates how to conduct home energy assessments that provide energy-saving home improvement recommendations that can help homeowners lower their utility bills, increase home value and enhance marketability. Learn More.Partner Insights from Freddie Mac Single Family

- Manufactured houses, also referred to as “prefab,” “modular” or “factory-built,” are a popular choice in Japan – thanks to their attractive design, advanced technology and trendy branding. This article looks at how some U.S. manufactured housing companies are evolving and improving manufactured home features in hopes of making this housing option all-the-rage in the States too. Read More.Partner Insights from Freddie Mac Single Family

- Homeowners rely on water for everything from drinking to cleaning to landscape irrigation. This article provides tips on how to decrease water usage, save money and preserve this vital resource by making changes to appliances, plumbing fixtures, hot water heaters and more – and how lenders can offer mortgage options that help finance these efficiency updates. Learn More.Partner Insights from Freddie Mac Single Family

- There are some significant benefits associated with refinancing, yet a disproportionate number of Black and Hispanic Americans don’t pursue the option. Discover what industry stakeholders can do to help broaden the funnel of homeowners looking to refinance, thereby increasing homeowner equity for minorities. Read More.Partner Insights from Freddie Mac Single Family

- The shortage of new construction homes coupled with high demand for existing supply has driven up the prices of affordable properties, making homeownership difficult for borrowers below the Area Median Income (AMI). This article explores how getting vacant and distressed properties back on the market can help address this challenge. Learn More.Partner Insights from Freddie Mac Single Family

LOAD MORE