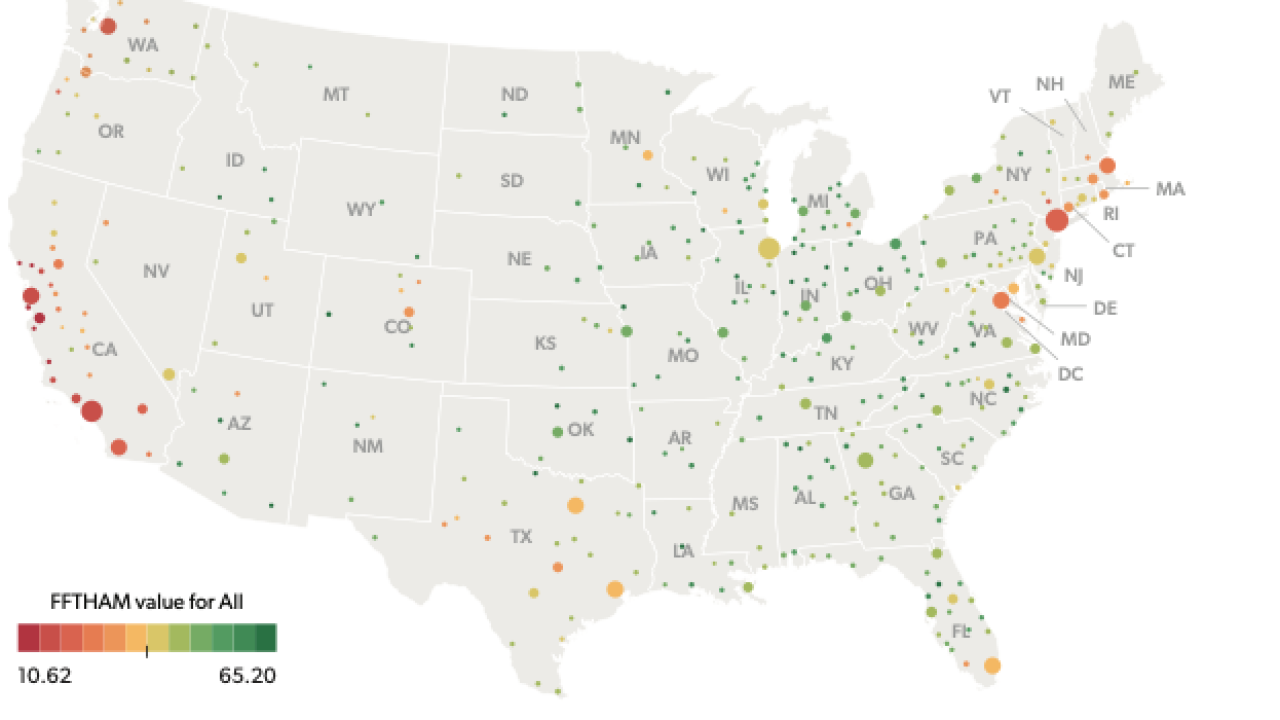

- First-time homebuyers play a critical role in sustaining the housing ecosystem. This research from Freddie Mac uses a new methodology to evaluate the local affordability for future first-time homebuyers, including a unique way to calibrate the affordability measure by race and income groups.Partner Insights from Freddie Mac Single Family

- Approximately 13% of all purchase mortgage applications — a total of nearly 650,000 — were denied in 2020, according to Housing Mortgage Disclosure Act data. Although the housing finance industry may understand the basic denial causes, discovering how applicants respond after a denial can inspire potential solutions to increase the pool of approved applications going forward. Learn more from a new survey conducted by the Freddie Mac's Market Insights team.Partner Insights from Freddie Mac Single Family

- Millennials have surged into rental markets recently, but many high earners in this demographic are more prepared for homeownership than they realize. When they learn about the array of flexible mortgages out there — in particular, the affordable loans with extremely low down payment options available to them — they can often realize their dreams much faster.Partner Insights from Arch MI

- A deep dive session on current homebuyer attitudes, motivations, and behavior as well as mortgage lending 'trends' that are quickly becoming table stakes.Sponsor Content from Doma

- Potential first-time homebuyers continue to look for ways to achieve affordable homeownership, particularly as house prices rise. Housing finance agencies (HFAs) can be a powerful resource for lenders serving very low-, low- and moderate-income aspiring homebuyers, including first-time homebuyers. Learn about the HFA Advantage mortgage, created specifically for HFAs, and its new features and expanded eligibilities.Partner Insights from Freddie Mac Single Family

- When severe weather events occur, they may be powerful enough to destabilize infrastructure or destroy homes. People are resilient, but severe weather can place financial and emotional strain on homeowners. If the frequency and severity of these events continue, it may cause many homeowners to reconsider their housing situation entirely. Get additional insights from a recent Freddie Mac survey.Partner Insights from Freddie Mac Single Family

- Helping first-time homebuyers is an increasing conundrum in a housing landscape fraught with frustration. One way some have approached homebuying is to pool financial resources and purchase a house with a group of friends or family members. Mortgage professionals working with buyers considering this scenario should be mindful of sharing both the benefits and the potential pitfalls of this creative arrangement. Learn more.Partner Insights from Freddie Mac Single Family

- As home prices have increased in recent years, homebuying has remained relatively affordable due to historically low mortgage interest rates. However, in early 2022, home prices continued to surge as mortgage interest rates also increased, cutting into buyer affordability.Partner Insights from CoreLogic

- Although the real estate market showed signs of receding in Q4 2021, investors resumed their buying spree in early 2022, accounting for 28.1% of all single-family purchases in February — a record high according to CoreLogic's data that goes back to 2011.Partner Insights from CoreLogic

- Internal migration plays an important role in understanding the ways population shifts are shaping the nation. Which metro areas are the gainers and which are the losers? Will growing markets face high costs, limited space and reverse migration faced by gateway markets? Freddie Mac’s automated underwriting system offers a real-time view into the residential mobility of American homebuyers. Access the research.Partner Insights from Freddie Mac Single Family

LOAD MORE