-

Mortgage fraud risk took a serious dive in the second quarter amid lower interest rates, which brought more refinance transactions into the market, according to CoreLogic.

July 25 -

Ginnie Mae is requesting feedback on a new proposed stress test for mortgage-backed securities issuers that would take into account the government agency's increased nonbank counterparty risk.

July 24 -

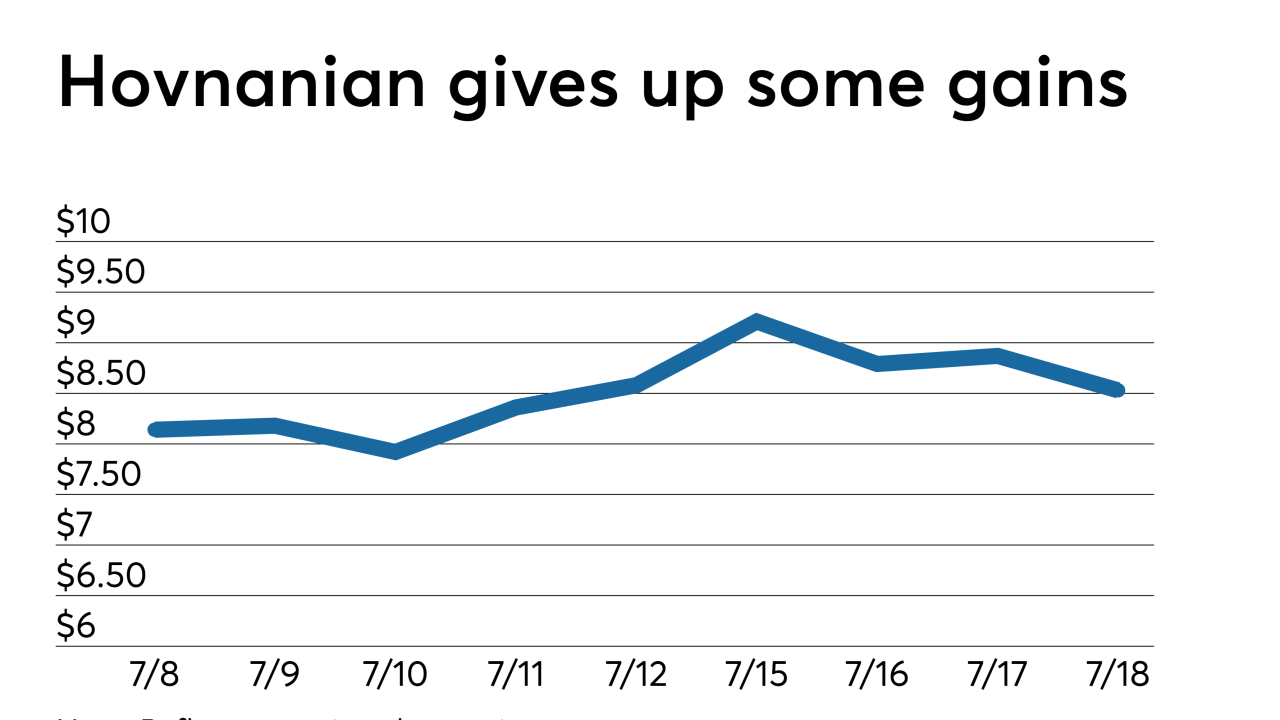

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

Ginnie Mae is examining whether the shift in business to nonbank issuers has implications beyond the risks it has historically looked at, and identifying advantages that should be nurtured as well.

June 10 -

The Federal Housing Finance Agency has far more authority to upend the status quo than most realize, according to a new report.

June 7 -

Private mortgage insurers can help to ease banks' compliance burden when it comes to the Current Expected Credit Loss accounting standard, an industry executive said.

May 22 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

Having poor credit doesn't necessarily keep someone looking to become a mortgage broker from obtaining a surety bond, but it can complicate matters.

May 1 JW Surety Bonds

JW Surety Bonds -

Learning to understand the risk rather than adding steps to the mortgage application process is the way to mitigate fraud.

April 10 CoreLogic

CoreLogic