-

Despite that year-over-year decline, the company beat analysts' expectations with fourth-quarter net income of $5.8 billion. Stronger commercial lending and lower expenses cushioned the blow in consumer credit.

January 14 -

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The SEC claims Morningstar put investors at a risk when rating $30 billion in CMBS deals from 2015-2016. Morningstar defends its integrity and independence.

January 13 -

The portfolio of MSRs from three types of government-related loans has a particularly large California concentration, and could be sold on a component basis, according to the Mortgage Industry Advisory Corp.

January 12 -

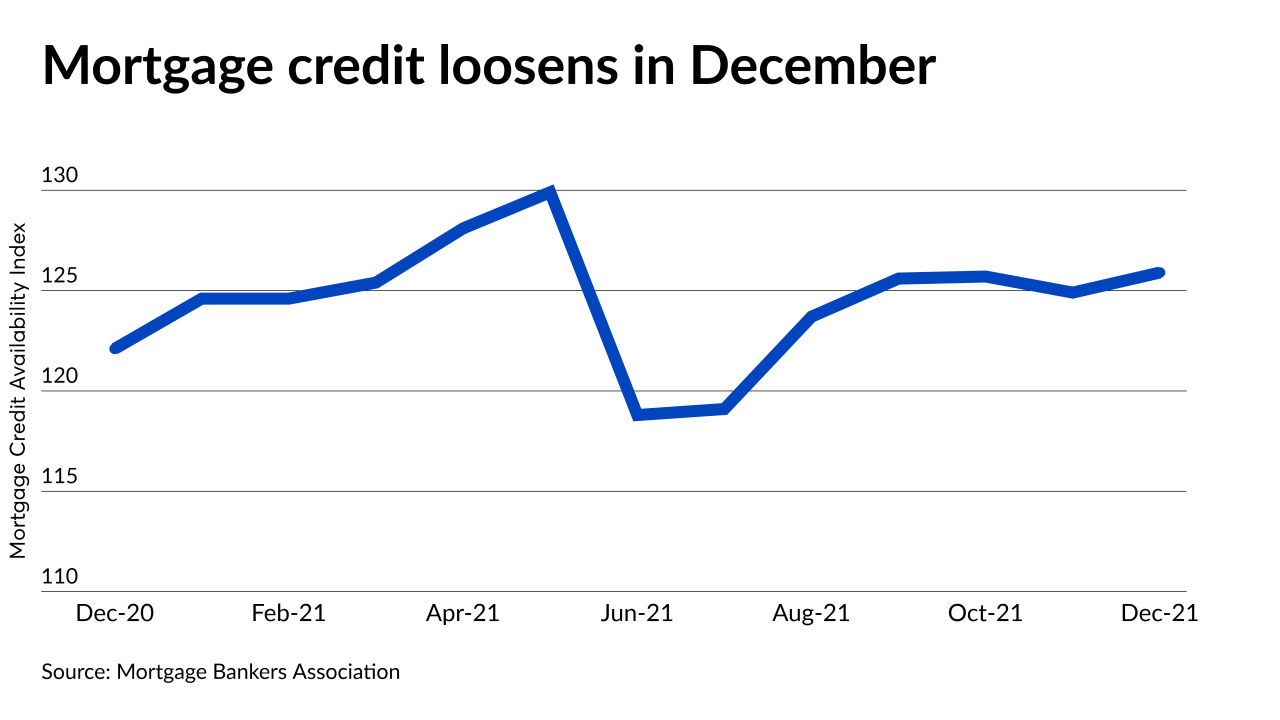

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

The change reflects a growing focus on an emerging banker segment that sells loans to the company on a non-delegated basis and includes a greater focus on servicing retention.

January 10 -

The loans in the portfolio on offer have nearly 11 months of seasoning, indicating they were amassed during a loan production boom that has contributed to higher average servicing deal sizes.

January 7 -

The Duty-to-Serve goals currently under review drew some objections from a coalition of affordable housing groups last year.

January 6 -

The government-sponsored enterprise also unveiled two new tranche slices for investors to purchase.

January 6