-

The home purchase target for Fannie Mae and Freddie Mac would set a new 10% benchmark for qualified single-family lending in census tracts that meet certain demographic and income targets.

August 18 -

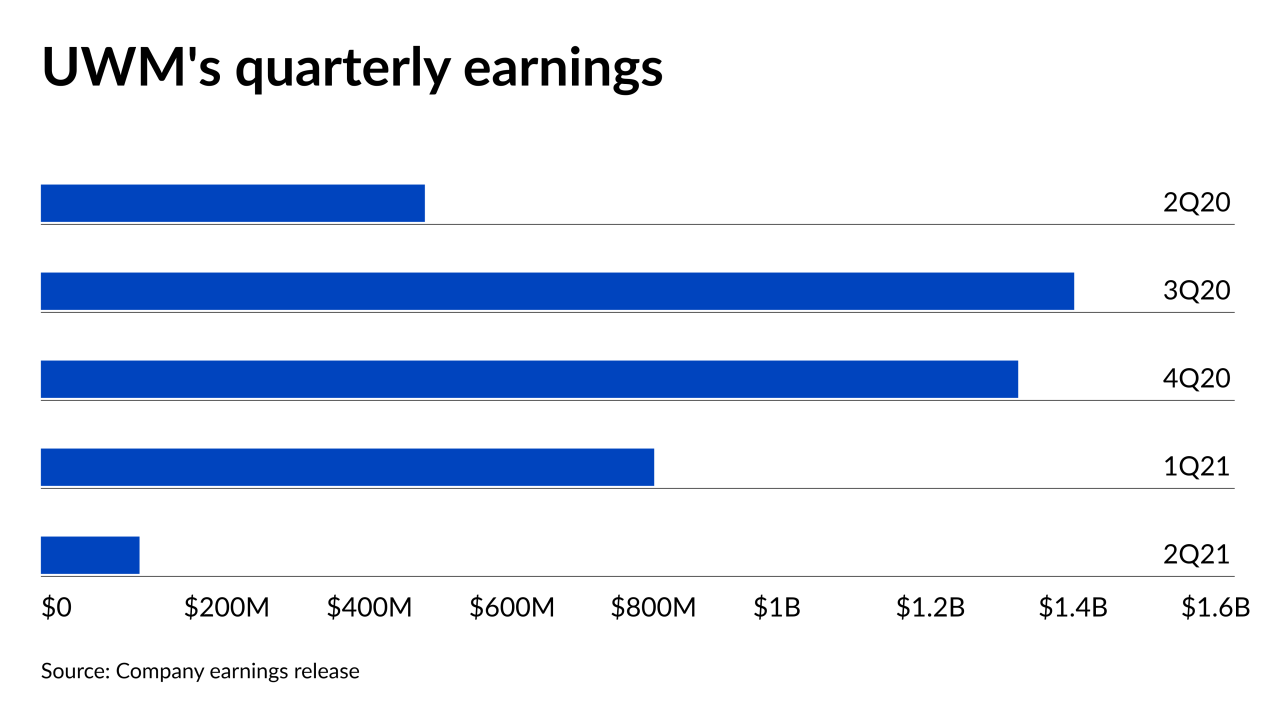

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

Depressed margins and a $219 million hit to its servicing rights fair value translated to a lower bottom line at the wholesaler.

August 16 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

Financial institutions will have until early October to weigh in about new risk-based capital requirements for nonbanks.

August 13 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

This year's assessment for Fannie Mae and Freddie Mac is the first to take into account a January agreement between the Federal Housing Finance Agency and the Treasury Department that allowed the companies to retain more earnings.

August 13 -

Shrinking gain-on-sale margins also ate into earnings, with growth expected to slow for the rest of 2021.

August 12 -

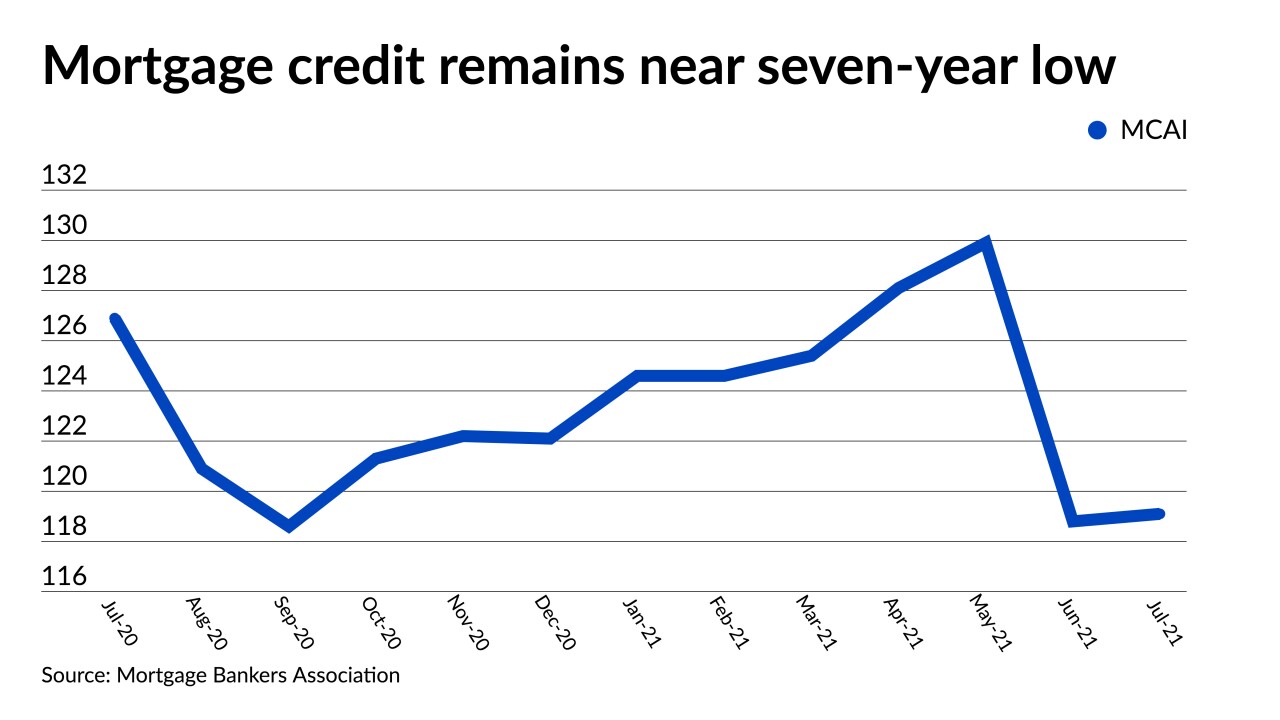

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10