-

Southern states' government-sponsored enterprise share lags outside of a small number of metros, the Center for Mortgage Access' analysis of HMDA data shows.

November 5 -

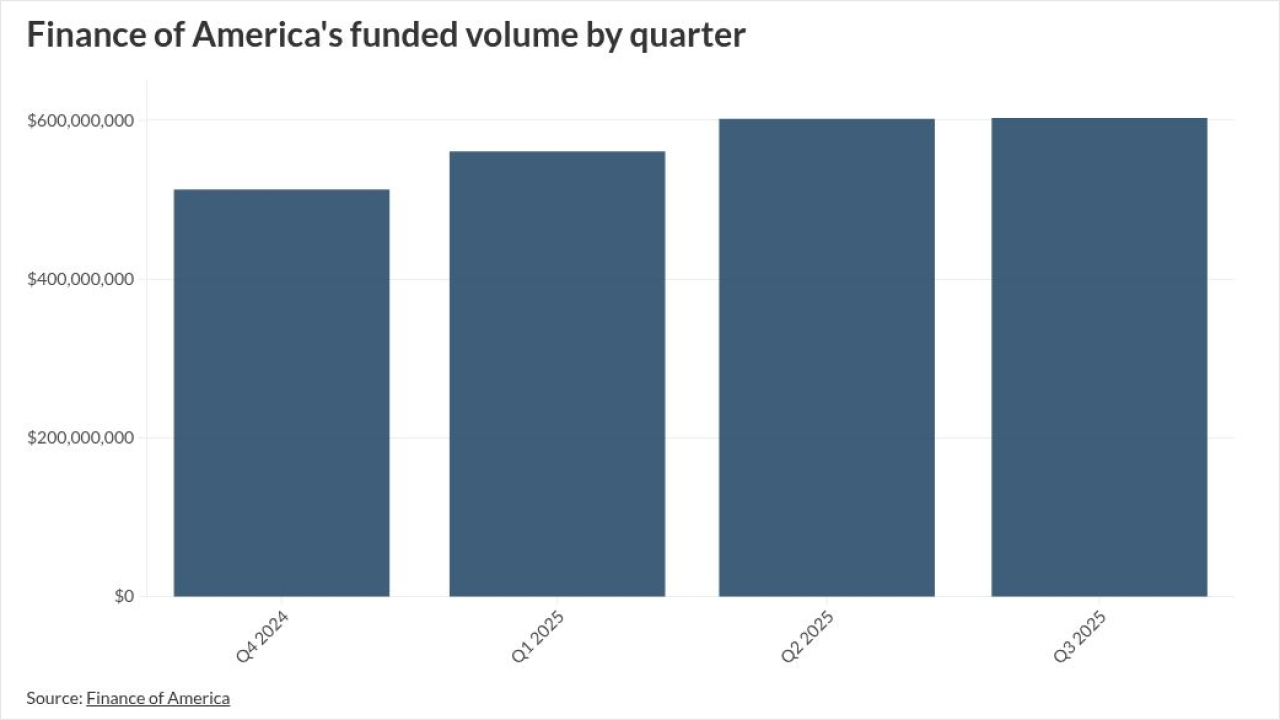

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.

October 31 -

The head of the government-sponsored enterprise's oversight agency said the cuts were made to positions that weren't central to mortgages and new home sales.

October 30 -

Rocket Companies lost $124 million on a GAAP basis, but its management celebrated milestones regarding its Redfin and Mr. Cooper acquisitions.

October 30 -

The tech giant provided context around Flagstar and Pennymac's moves, as it reported more Encompass and MSP clients and greater mortgage income.

October 30