A

Michael Koblentz also named Two President and CEO William Greenberg and the company's board of directors as defendants in the lawsuit filed Wednesday in an Illinois federal court. The case, which is not a class action complaint, doesn't name UWM as a defendant nor accuse the pending TWO buyer of wrongdoing.

UWM announced its

The new lawsuit alleges several discrepancies in UWM's registration statement last week, including questions about a financial advisor's valuation that could mean a difference of $0.25 per share for shareholders. Koblentz also questions the work the advisor, investment bank Houlihan Lokey, performed to warrant its $2.5 million fee.

The merger filing also fails to fully explain stock trading arrangements, or 10b5-1 plans, by Greenberg and other board members, according to the suit. The Two leaders made nearly $3 million combined in stock sales two days after the UWM announcement, according to SEC filings.

The plaintiff also describes a $25.4 million deal termination fee as "preclusive" to prevent other bids from arising.

The lawsuit accusing Two and the individuals of violating SEC regulations seeks to either halt the transaction until the alleged discrepancies are corrected, or to pay out damages to Koblentz should the deal go through.

Neither attorneys for Koblentz, nor spokespersons for UWM and Two responded to requests for comment Thursday.

TWO weighed several offers

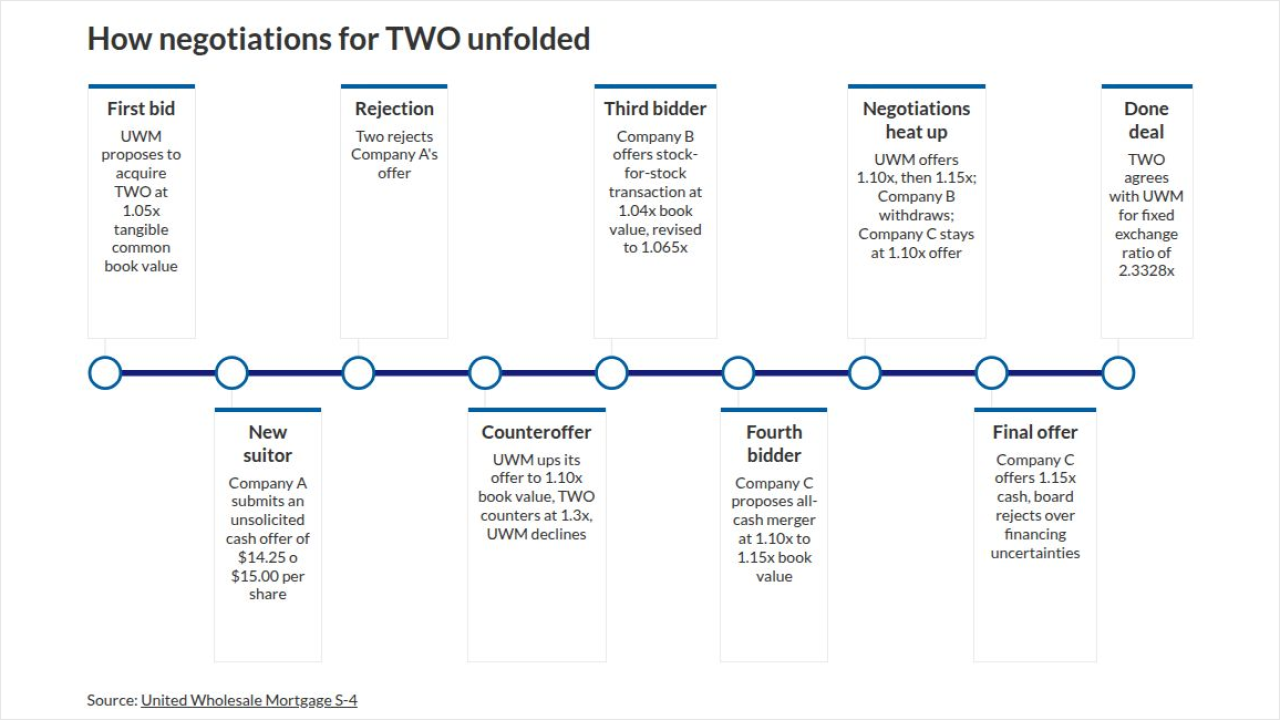

Greenberg, in an earnings call this week, told investors his company chose UWM because it needed a larger origination effort. The company has been mulling bids since December 2024, according to the registration statement.

UWM was the first to approach Two, sending Greenberg an unsolicited proposal letter on December 9, 2024. Weeks later, "Company A" offered $14.25 to $15.00 in cash for each share of Two. The board rejected Company A's proposal last January, but kept UWM in mind.

Two and UWM exchanged deal terms that spring, but did not significantly advance their discussions for another six months. During that time,

A "Company B" approached Two with a separate offer in September, which Two countered. By October, a "Company C" had joined the fray with yet another bid. UWM and Company C were the final contenders, before a Two committee determined in mid-December that UWM's offer was the best.

TWO in the red

Reporting earlier this week, the REIT fell short of Wall Street expectations with a $1.3 million net loss in the fourth quarter. For the year, Two lost $507.1 million, a figure including

The UWM deal would create the industry's eighth-largest servicer, with a mortgage servicing rights portfolio of around $400 billion. The Pontiac, Michigan-based lender said the acquisition would also generate over $1 billion of recurring servicing revenue. The deal is expected to close in the second quarter.