-

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Sales of new homes in the US were little changed in October near the strongest pace since 2023 as builders lured anxious customers with price cuts and incentives.

January 13 -

The deal which brings hundreds of thousands of agents under one roof also combines retail lender Guaranteed Rate's separate joint ventures with each brokerage.

January 9 -

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

Housing starts in the US fell in October to the lowest level since the onset of the pandemic as data delayed by last fall's government shutdown showed builders continued to cut back amid still-high prices and mortgage rates.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

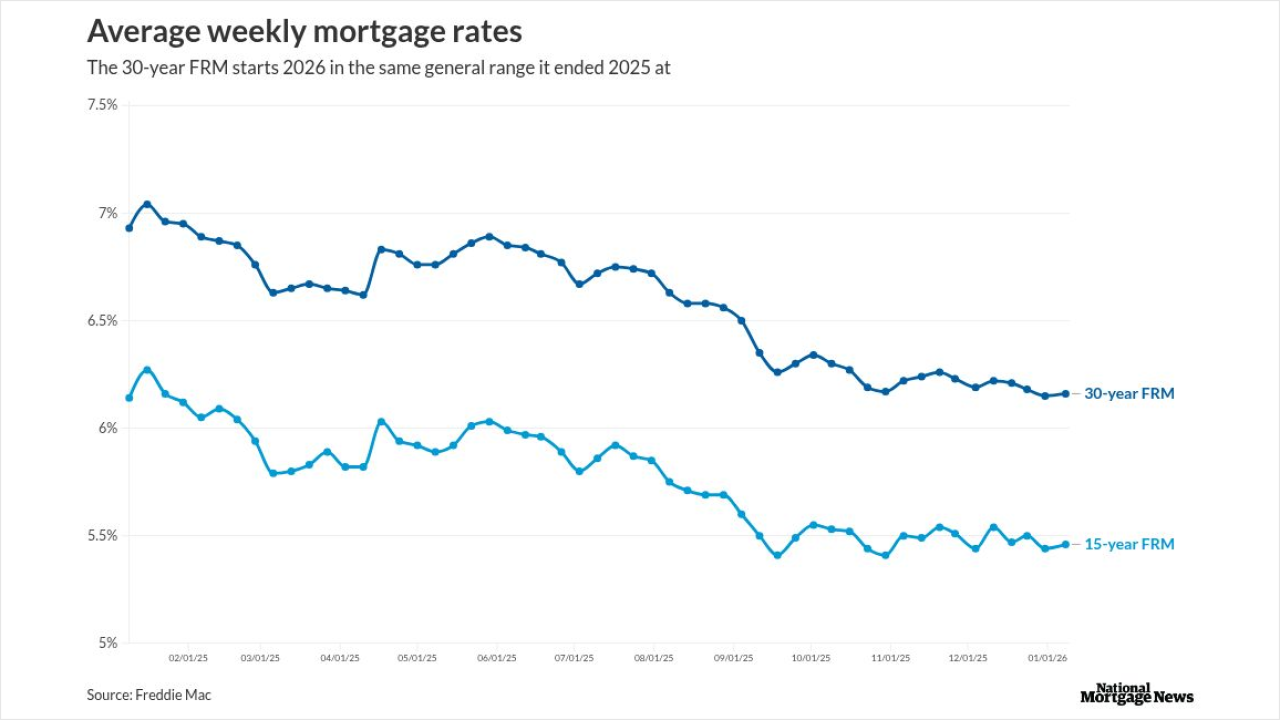

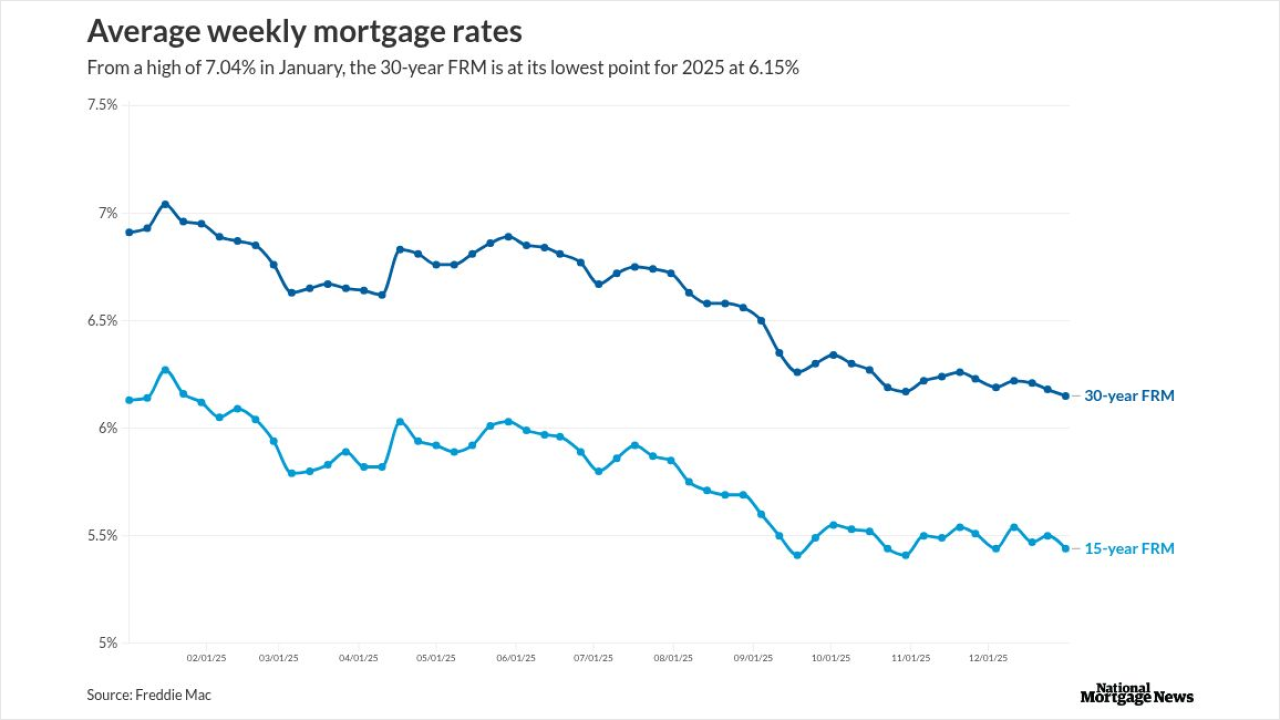

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

Loanlogics rolled out the LoanBeam NQM income analyzer in October and has four users for the non-qualified mortgage underwriting technology, including Pennymac.

January 7 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Blackstone stock fell by as much as 9.3% after Trump said he was "immediately taking steps to ban large institutional investors from buying more single-family homes."

January 7 -

Although some of the cohort surveyed were flush with savings, others admitted having precarious debt situations and steadfast attitudes toward luxury purchases.

January 6 -

The number of remodeling establishments hit at a record high earlier this decade and now accounts for over 60% of home construction-related businesses.

January 2 -

Kind Lending, Class Valuation, also add CFOs, Mortgage Capital Trading boosts artificial intelligence efforts and Acra welcomes an industry veteran.

January 2 -

A majority of recent sellers said they offered to cover closing costs, with many also buying down mortgage rates, according to a new report from Zillow.

December 31 -

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

December 30 -

This year it took a homebuyer seven years to save for a typical down payment on a house, compared with 12, according to Realtor.com.

December 29 -

A modest improvement in prices and mortgage rates encouraged buyers. Signings have now increased for four straight months, matching a pandemic streak.

December 29