-

Other investors in the round include Caffeinated Capital Andreessen Horowitz, Singapore's GIC, GGV Capital and Moore Specialty Credit.

August 16 -

Republicans on the Senate Banking Committee objected to Biden administration picks for key jobs at the Department of Housing and Urban Development based on their past criticism of police practices. The nominees, including the prospective Federal Housing Administration chief, said their statements were taken out of context.

August 5 -

Offered through the company’s 11 chartered units in 12 states, the five-year fixed-rate installment loan is secured by the home and is available between $5,001 and $14,999.

August 2 -

A renter making minimum wage would have to work 77 hours a week — nearly two full-time jobs — to afford a two-bedroom apartment in Michigan.

July 30 -

The company's Series A funding round, led by Sequoia Capital, added $165 million in capital, which will allow it to expand its home buying operations into more states.

July 27 -

The White House's firing of Federal Housing Finance Agency Director Mark Calabria sparked immediate speculation about who will run the agency and help chart the future of the two mortgage giants. Potential nominees include ex-Obama administration officials, congressional staffers and members of the Biden transition team.

July 8 -

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

Financial inclusion is the civil rights issue of our generation — and getting more Americans, especially younger and minority families, into decent, affordable housing is a critical step on the ladder to financial capability, writes a board member of the National Credit Union Administration.

June 29

-

The Supreme Court decision cleared the way for further revisions to the agreements between the Federal Housing Finance Agency and the Treasury, which could include dismissing the January changes.

June 25 -

Gordon is currently president of the National Community Stabilization Trust, a nonprofit organization that promotes neighborhood revitalization and housing affordability.

June 24 -

Thompson, who was most recently the deputy director of the FHFA’s Division of Housing and Mission Goals, replaces Mark Calabria, who was fired Wednesday afternoon.

June 23 -

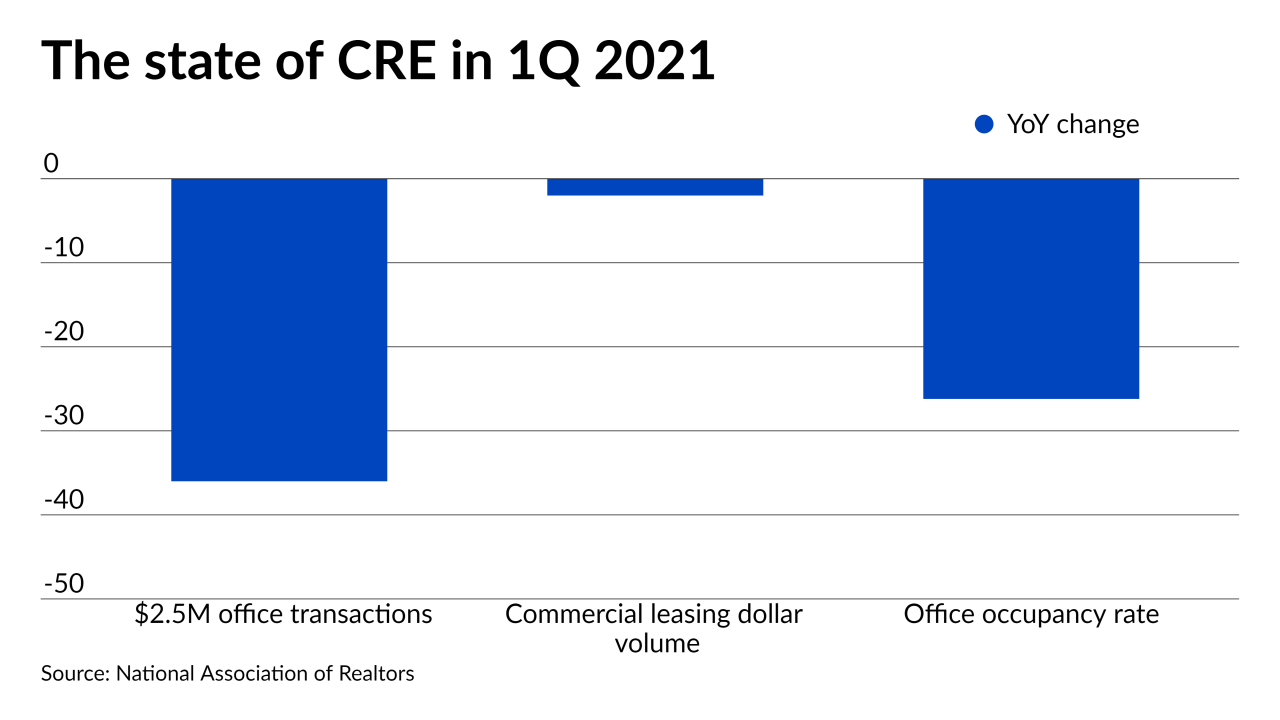

With residential supply severely lagging behind demand, redeveloping unused office space into multifamily properties seems like a perfect solution, but it’ll take governmental collaboration and tax breaks to make such projects financially compelling, developers say.

June 11 -

The Department of Housing and Urban Development reinstituted the “affirmatively furthering fair housing" measure, which the Trump administration had argued was overly prescriptive, and promised a later rulemaking to bolster the policy.

June 10 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

May 28 -

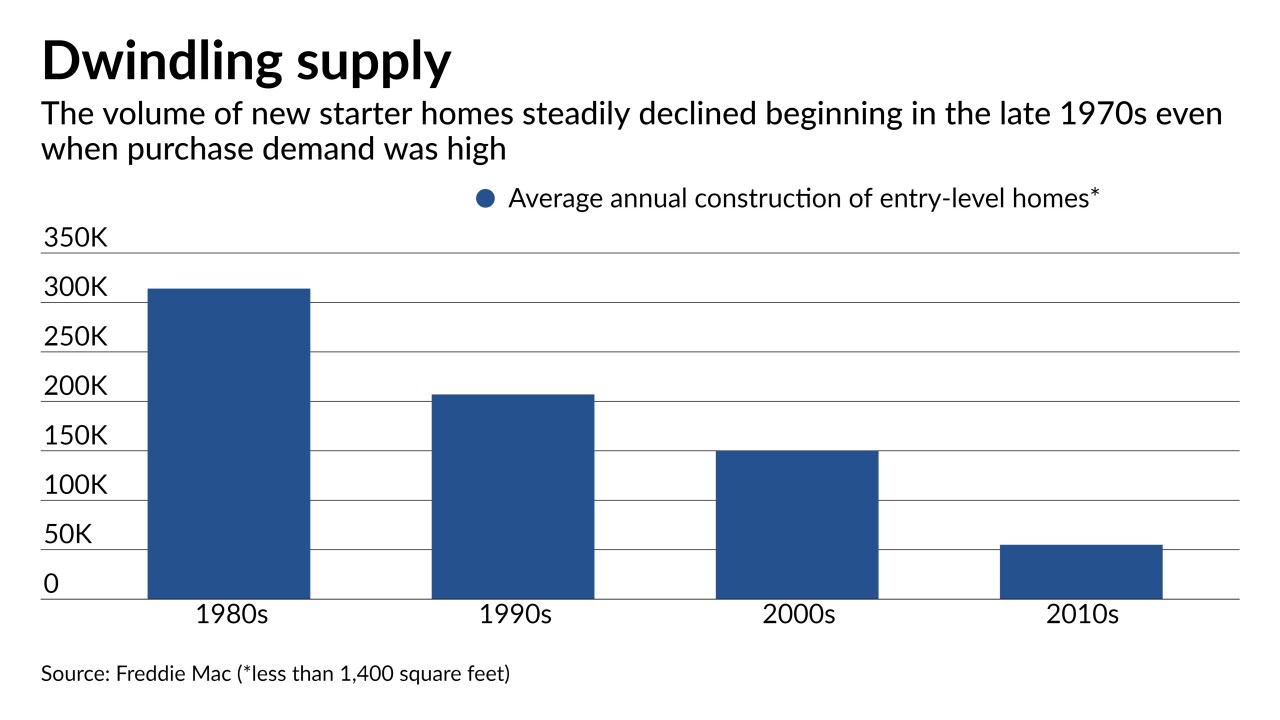

Reviving a long-dormant loan guarantee program could go a long way toward restocking the supply of starter homes and helping households of modest means create wealth, writes the President and CEO of University Bank.

May 24 University Bank

University Bank -

Groups active in low-income and rural housing expressed frustration that the post-pandemic resumption of long-term goal-setting didn’t do more to raise the bar.

May 19 -

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

If passed, the Affordable Housing Credit Improvement Act introduced last week could spur development of 2 million rental units for low- and moderate-income households over the next decade, writes the president of Enterprise Housing Credit Investments

April 20 Enterprise Housing Credit Investments LLC

Enterprise Housing Credit Investments LLC -

The city is working with a nonprofit that aims to sell some of the city's most affordable houses to lower-income buyers rather than developers.

April 19 -

The SmartBuy program, offered by the Illinois Housing Development Authority, has drawn interest from out-of-state buyers too.

April 5