-

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

The trade group's letter to FHFA Director Bill Pulte pointed out that lenders were facing credit report price hikes for four straight years.

December 16 -

Rohit Chopra is named senior advisor to the Democratic Attorneys General Association's working group on consumer protection and affordability; Flagstar Bank adds additional wealth-planning capabilities to its private banking division; Chime promotes three members of its executive leadership team; and more in this week's banking news roundup.

December 12 -

The rent reporting platform says it's helped tenants raise their credit scores by double digits and unlocked $30 billion more in mortgage lending.

December 11 -

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

December 10 -

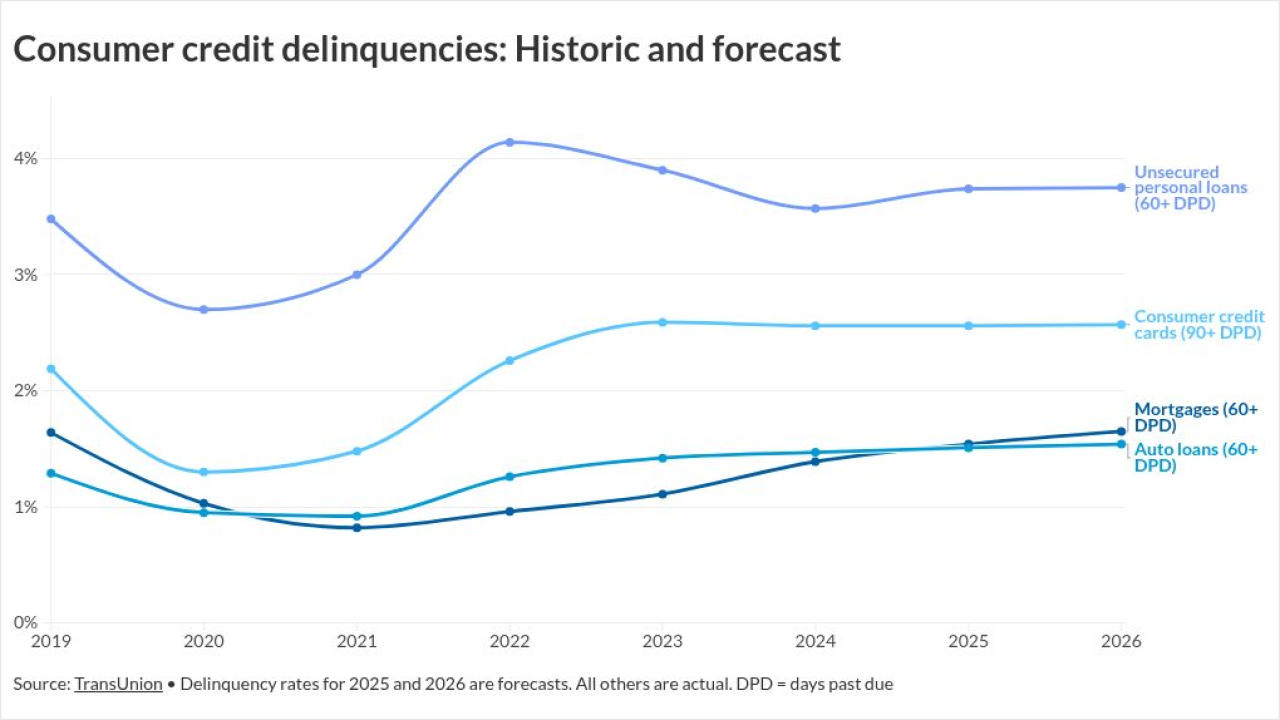

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

The all-stock acquisition of Mountain Commerce Bancorp in Knoxville marks the Arkansas-based company's first M&A foray since 2022.

December 8 -

A bipartisan housing provision has emerged as a critical negotiating point for passage of an uncommonly bank-relevant defense authorization bill.

December 4 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

Federal Reserve bank supervisors are monitoring community and regional banks' commercial real estate portfolios amid concerns over "lower commercial property values," the agency said.

December 1 -

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

November 24 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

Renters can now enroll in CreditClimb through Zillow to have their on-time rent payments reported to the three major credit bureaus.

November 21 -

While some international purchasers are reluctant to buy in the U.S. right now, interest in investment properties still abounds, the CEO of Waltz said.

November 21 -

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

President Trump has nominated Stuart Levenbach, associate director of the Office of Management and Budget, to be the director of the Consumer Financial Protection Bureau. His selection allows acting CFPB Director Russell Vought to remain in place for at least another 210 days.

November 19