-

The number of credit-sensitive borrowers who request alterations in their loan terms for income reduction could be a bellwether for loan performance as pandemic-related contingencies are rolled back.

February 2 -

Efforts aimed at modernizing outdated sets of PLS mortgage information could facilitate electronic transmissions and benefit lenders looking to broaden opportunities for secondary market sales.

February 2 -

In addition to hinting at a March rate hike, the central bank this week announced an intention to have Treasury securities make up a greater share of its holdings, which has implications for securitized home loans.

January 27 -

New player Tomo is entering this niche while a trio of established players enhance their existing offerings for their third-party channels.

January 27 -

Esusu, a financial technology company that aims to help bridge the racial wealth gap by reporting rent payments to credit agencies, has become one of only a few Black-owned startups to reach a valuation of $1 billion after closing a Series B round led by SoftBank Vision Fund 2.

January 27 -

Among the mortgage industry investors in the product and pricing engine provider are Movement Mortgage and First American Financial.

January 26 -

The company will leverage its diversified consumer-finance model while optimizing a traditional mortgage business with thinner margins as the business cycle turns, CEO Patti Cook said.

January 26 -

Due to the rollback in stimulus and uncertainties related to other mortgage policy measures and rates, servicers are moving into uncharted waters, according to a Fannie Mae economist.

January 25 -

The change aims to streamline the processing of certain pandemic-related loan options that accommodate lower monthly payment amounts for borrowers with long-term economic hardships.

January 24 -

The researchers found that the disparities that emerged from the analysis of 1.8 million appraisals from 2019 and 2020 were statistically significant.

January 21 -

Home valuation professionals have had mixed feelings about automation out of concern that some forms could result in less accurate assessments.

January 19 -

The equity commitment by M&G Investments adds to signs that the MSR market is heating up as mortgage rates rise and some buyers have become more confident in their prepayment rate projections.

January 18 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The portfolio of MSRs from three types of government-related loans has a particularly large California concentration, and could be sold on a component basis, according to the Mortgage Industry Advisory Corp.

January 12 -

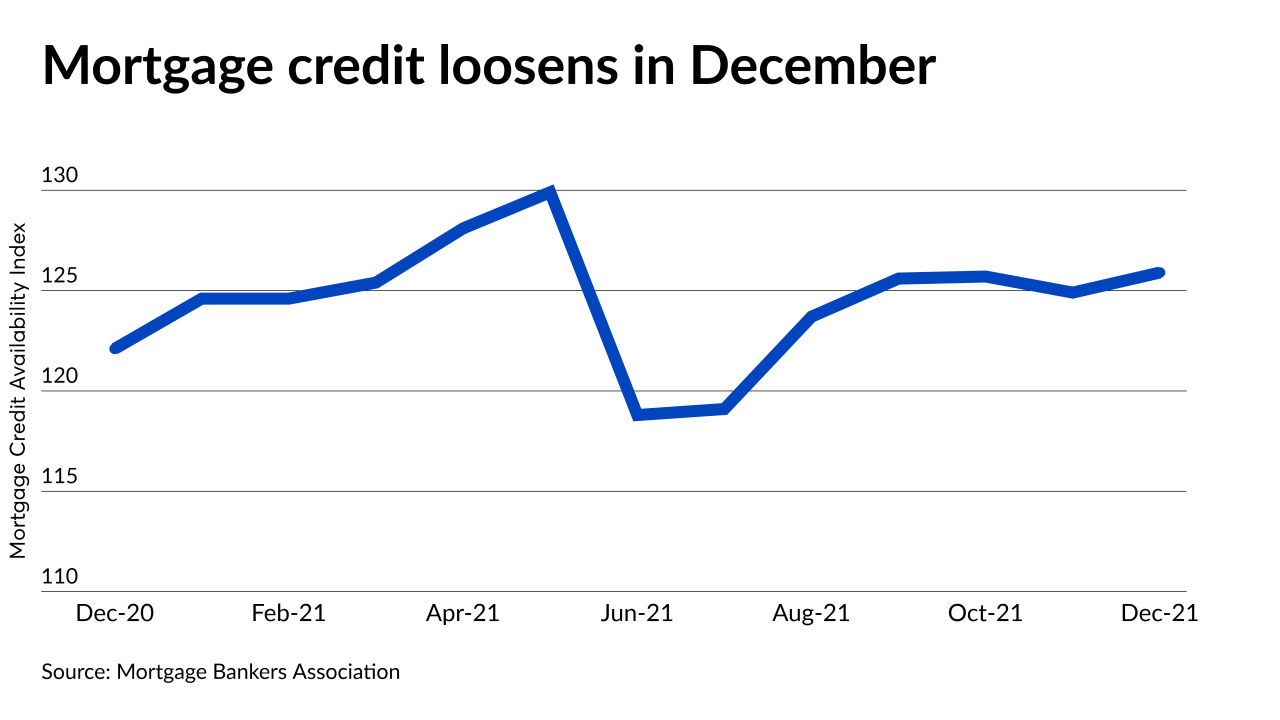

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

The change reflects a growing focus on an emerging banker segment that sells loans to the company on a non-delegated basis and includes a greater focus on servicing retention.

January 10 -

The loans in the portfolio on offer have nearly 11 months of seasoning, indicating they were amassed during a loan production boom that has contributed to higher average servicing deal sizes.

January 7 -

The Duty-to-Serve goals currently under review drew some objections from a coalition of affordable housing groups last year.

January 6 -

The government-sponsored enterprise also unveiled two new tranche slices for investors to purchase.

January 6 -

The company plans to hire an unspecified number of people in servicing as a result of the shift, with a particular focus on recruiting people for “customer-facing” positions.

January 4