-

The Federal Home Loan banks of Topeka and San Francisco have signed up to participate in a Mortgage Partnership Finance program that pools and securitizes government-backed loans via Ginnie Mae.

June 28 -

Fitch Ratings has updated its new loan level due diligence residential mortgage-backed securities grading methodology to include compliance grading related to the TILA-RESPA integrated disclosure rules.

June 28 -

The Connecticut Housing Finance Authority intends to offer up to $63 million in fixed-rate bonds on Tuesday and $23 million as variable rate on July 13.

June 28 -

Freddie Mac investors will now have access to loan-level disclosures with FICO credit scores calculated from Experian consumer credit data.

June 28 -

Nationstar Mortgage is issuing its fifth securitization of nonperforming reverse mortgages, a unique esoteric RMBS class the mortgage servicer has engaged in four previous transactions.

June 28 -

Fitch Ratings will now conduct reviews of residential mortgage-backed securities deal agents as part of its RMBS master criteria, with Clayton Holdings as the first deal agent to receive an assessment.

June 27 -

New York City broke ground on a $67 million reconstruction project at the Ocean Bay-Oceanside development in the Rockaways.

June 27 -

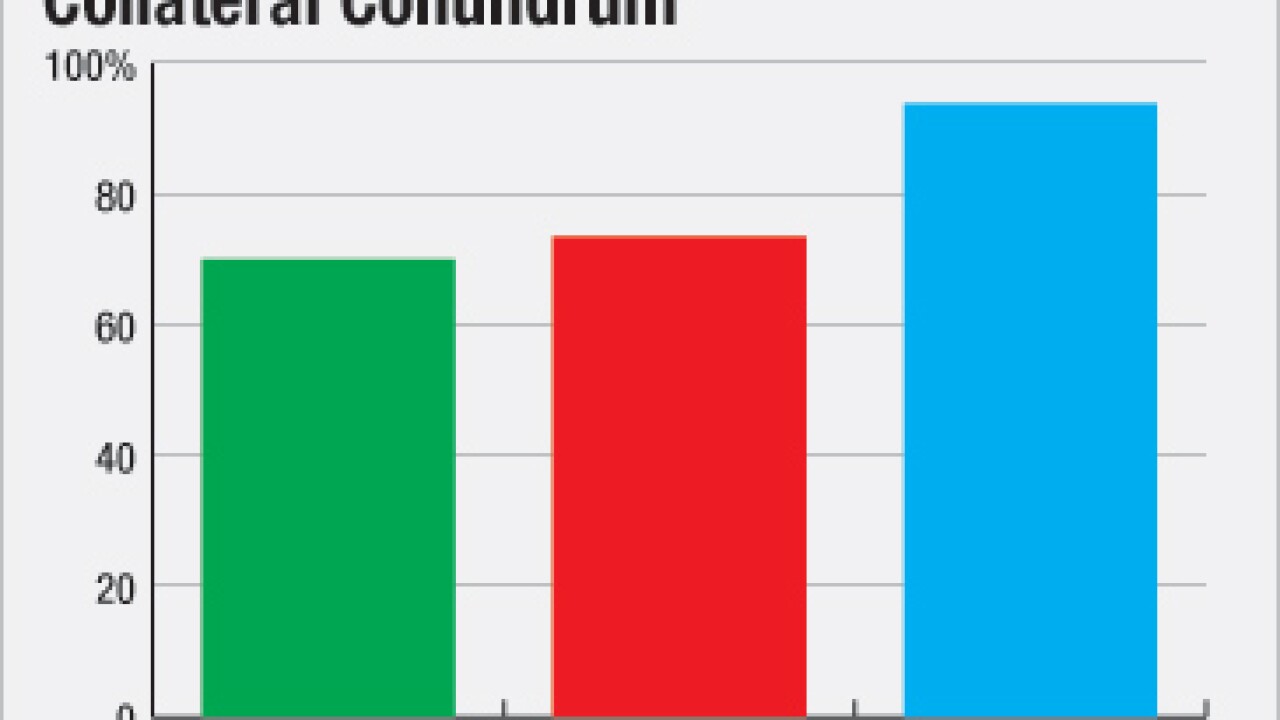

The deadline has arrived for mandatory submissions to the Federal Housing Administration's Electronic Appraisal Delivery portal, but as many as one-third of lenders that originate FHA-insured mortgages have yet to use the new system.

June 27 -

The market gyrations following the United Kingdom's vote to leave the European Union have an upside for mortgage lenders, as already-falling interest rates are expected to boost home purchases and refinancing.

June 24 -

For the first time, Ginnie Mae has edged out Freddie Mac as the second largest securitization platform.

June 24