-

JPMorgan is taking a riskier route for its second jumbo mortgage loan securitization of 2016.

August 15 -

Impending rules allow sponsors of commercial mortgage bonds to satisfy a requirement to keep "skin in the game" of their deals by selling the risk of first loss to a designated third party.

August 12 -

Fifth Third Bancorp, Ohio's largest lender, fired Chief Legal Officer Heather Russell last month after she disclosed a romantic relationship with the chief executive officer of Fannie Mae, Timothy Mayopoulos, The Wall Street Journal reported.

August 11 -

A Federal Housing Finance Agency rule that will force some members of the Federal Home Loan Bank System out next year is likely to have a material effect on several of the cooperative institutions.

August 11 -

Mortgage rates were little changed from the previous week as they rose two basis points on better-than-expected economic news, according to Freddie Mac.

August 11 -

Fannie Mae has released the details of its next nonperforming loan sale, which will include its fifth "community impact" pool.

August 10 -

PricewaterhouseCoopers LLP failed to spot for seven years a multibillion fraud that led to the demise of Taylor Bean & Whitaker Mortgage Corp., a lawyer for the lender's bankruptcy trustee told a Miami jury on Tuesday.

August 9 -

Securities regulators are investigating and preparing to bring a civil case against Edwin K. Chin, a mortgage bond trader who was fired from Goldman Sachs Group Inc. in 2012, according to people with knowledge of the matter.

August 9 -

Farmer Mac posted lower net income than during the second quarter of 2015 on a loss on financial derivatives and hedging activities.

August 9 -

Redwood Trust reported higher net income during the second quarter from a year ago, thanks to an increase in net interest income and a decrease in operating expenses.

August 9 -

Freddie Mac has released a new online tool for lenders that determines whether a borrower's income qualifies them for a low down payment mortgage on a particular property.

August 9 -

Marketplace lender Lending Club has added Fannie Mae Chief Executive and President Timothy Mayopoulos to its board of directors.

August 8 -

Fannie Mae and Freddie Mac could need as much as $126 billion in bailout money from taxpayers in a severe economic downturn, according to stress test results released by their regulator.

August 8 -

The former officers and directors for Midwest Bank & Trust have reached a $26.5 million settlement with the Federal Deposit Insurance Corp. over charges of negligence during the financial crisis.

August 8 -

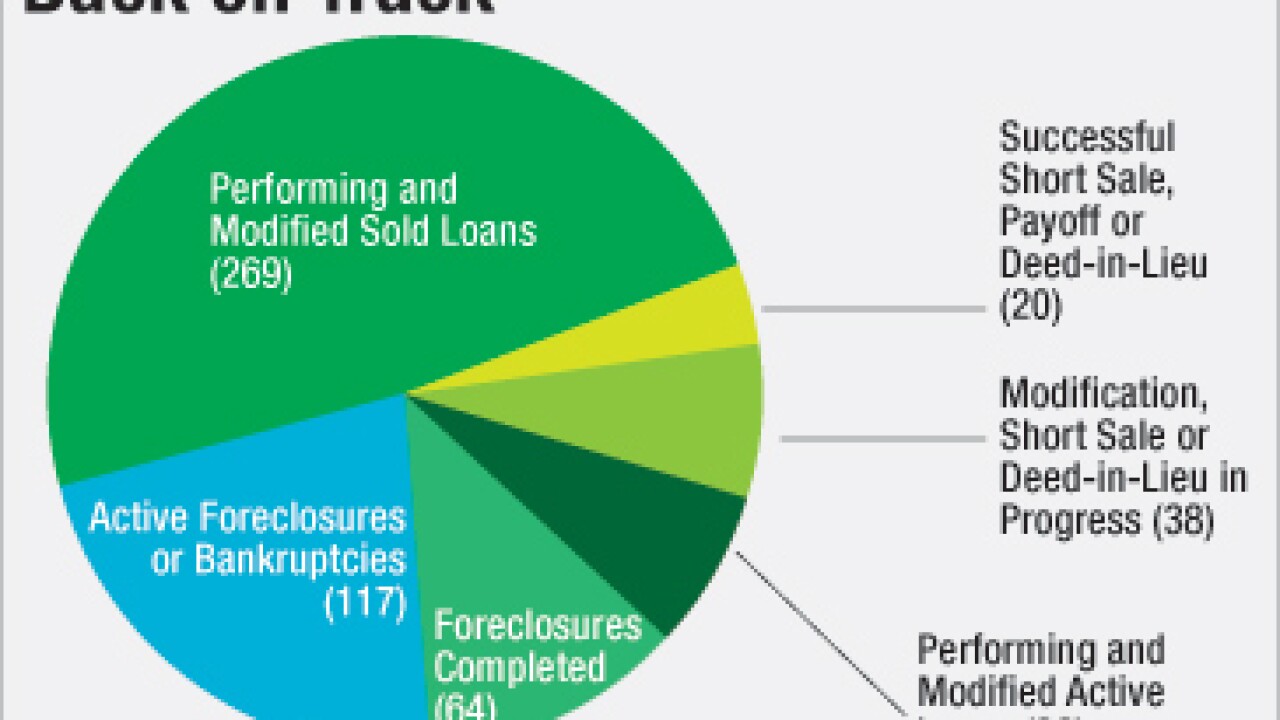

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

Two Harbors, which last week announced it was getting out of the private-label mortgage securitization business, is marketing one last deal.

August 5 -

Returning Fannie Mae and Freddie Mac to their status as privately owned public utilities is consistent with their mandate and makes the most policy sense.

August 4

-

Settlements related to court fights over private-label mortgage-backed securities are significantly boosting the bottom lines at a few Federal Home Loan banks.

August 4 -

Incenter Mortgage Advisors is brokering the sale of an $8.9 billion Ginnie Mae bulk residential mortgage servicing rights portfolio.

August 4 -

Essent Group reported higher net income for the second quarter of 2016 as the company wrote more insurance year-over-year.

August 4