-

JPMorgan is sounding the alarm about bank capital rules on the horizon that could nearly wipe out secondary trading in most kinds of asset-backed securities.

December 3 -

The sweeping, five-year highway bill may include some key concessions for small financial institutions, but the deal has left many in financial services frustrated. Here's why.

December 2 -

Anticipation of rising interest rates has stirred more talk among mortgage lenders about the need to originate loans to borrowers with low credit scores.

November 30 -

Broadway Financial Corp. in Los Angeles has been released from an enforcement action requiring it to improve its corporate governance.

November 30 -

Freddie Mac's Multi-Indicator Market Index is pursuing its slow climb, but still shows housing recovering unevenly across the nation.

November 30 -

A plan by the government-sponsored enterprises to begin collecting the new Closing Disclosure data is designed to promote Fannie Mae and Freddie Mac's loan quality goals. But the initiative may also prompt broader use of e-signatures and paperless processing.

November 30 -

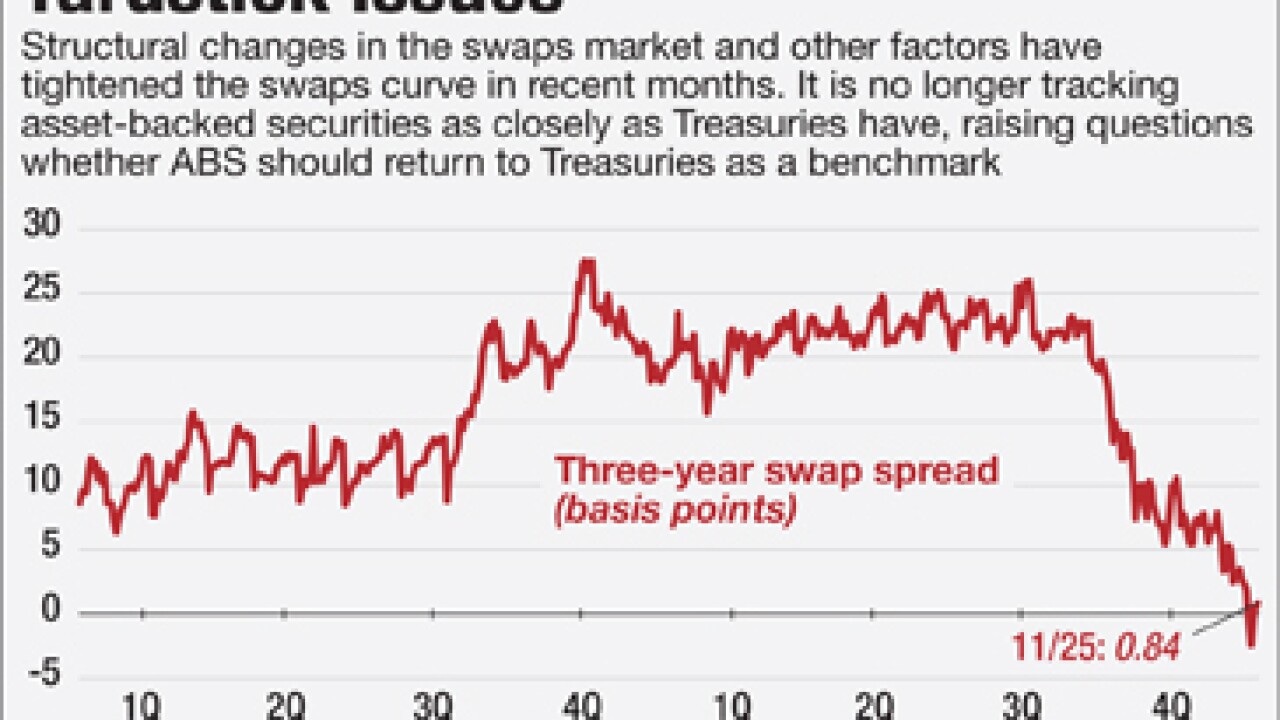

Commercial-mortgaged-backed, auto-loan and other securitizations use what is known as the swaps curve to price floating-rate deals. But pricing volatility is causing some to ask whether the market should go back to Treasuries after a 15-year hiatus.

November 25 -

Commercial mortgages bundled into securities will keep seeing their underwriting standards deteriorate from this year into 2016, said JPMorgan analysts in a report Wednesday.

November 25 -

Pacific Investment Management Co. sued Citigroup Inc. over the bank's role as trustee for $13.8 billion of mortgage-backed securities made toxic when the housing bubble burst, leading to "substantial damages."

November 25 -

The Federal Housing Finance Agency said Wednesday that conforming loan limits for mortgages purchased by Fannie Mae and Freddie Mac will remain at existing levels except in 39 high-cost counties.

November 25