-

The deadline has arrived for mandatory submissions to the Federal Housing Administration's Electronic Appraisal Delivery portal, but as many as one-third of lenders that originate FHA-insured mortgages have yet to use the new system.

June 27 -

The market gyrations following the United Kingdom's vote to leave the European Union have an upside for mortgage lenders, as already-falling interest rates are expected to boost home purchases and refinancing.

June 24 -

For the first time, Ginnie Mae has edged out Freddie Mac as the second largest securitization platform.

June 24 -

The U.S. government's decision to take all profits from Fannie Mae and Freddie Mac was the right thing to do even in light of the companies' subsequent return to profitability, a former Treasury Department official said..

June 23 -

Incenter Mortgage Advisors is brokering the sale of a $1.6 billion Freddie Mac residential mortgage servicing rights portfolio for an undisclosed independent mortgage banker.

June 23 -

Fannie Mae has delayed the roll out of its new automated underwriting system that will require mortgage lenders to use trended data for the first time in submitting their loans for approval.

June 23 -

Mortgage rates are up two basis points over the previous week, but they are not increasing as fast as the benchmark 10-year Treasury yield.

June 23 -

Industry and consumer groups are calling on the Federal Housing Finance Agency to reduce the loan fees that homebuyers have to pay on Fannie Mae and Freddie Mac guaranteed mortgage loans.

June 22 -

Fannie Mae has released the details of its next sale of nonperforming loans, including the fourth "community impact" pool the government-sponsored enterprise has offered.

June 17 -

Optimal Blue will be acquired by private equity firm GTCR in a deal that makes Mortgagebot founder and tech veteran Scott Happ CEO of the Texas-based product and pricing engine software vendor.

June 17 -

U.S. prosecutors have abandoned their case against Angelo Mozilo, a pioneer of the risky subprime mortgages that fueled the financial crisis, after a two-year quest to bring a civil suit against him.

June 17 -

The 30-year fixed-rate mortgage saw interest rates fall to the lowest level in three years as expectations for the Federal Reserve's June meeting and Britain's potential exit from the European Union drove investors to the safety of U.S. bonds.

June 16 -

Costs for finishing Fannie Mae's new headquarters have increased $36 million without the knowledge of the Federal Housing Finance Agency employee responsible for monitoring the project, the agency's inspector general claims.

June 16 -

Seneca Mortgage Servicing has chosen Nationstar Mortgage Holdings as the subservicer for its existing mortgage servicing rights portfolio as well as for future acquisitions.

June 15 -

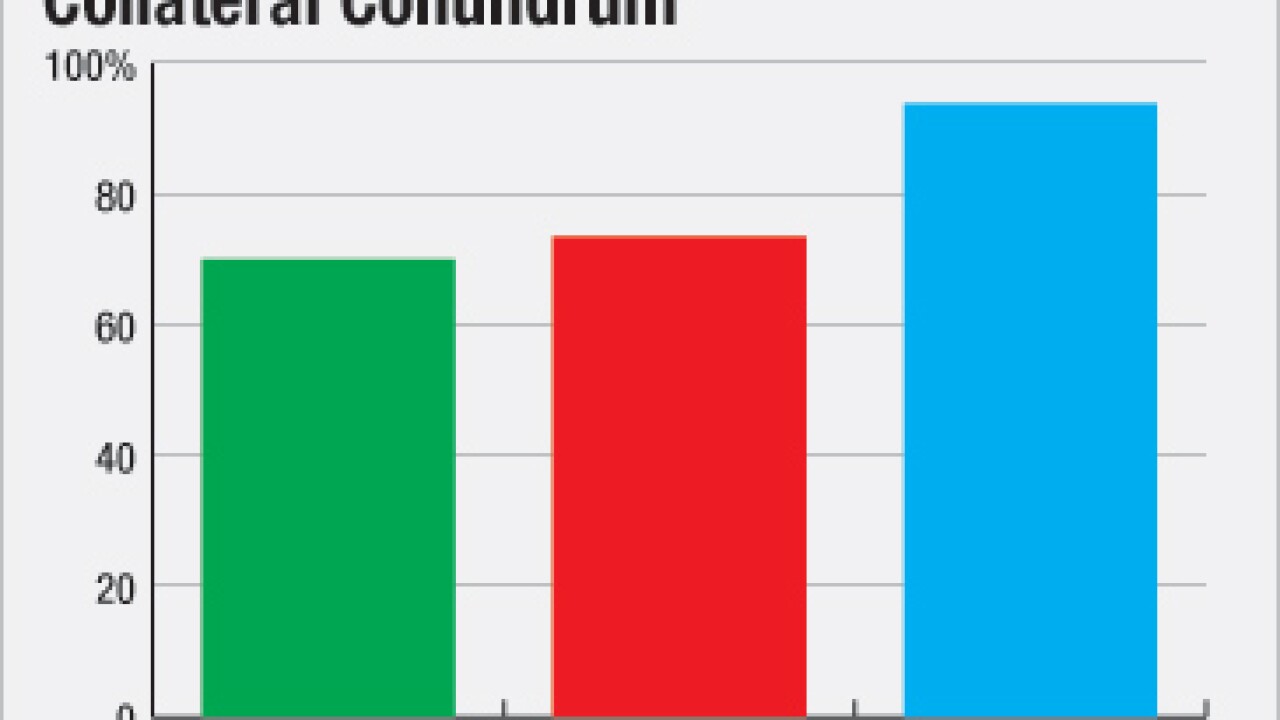

Fears about repurchase requests made by Fannie Mae and Freddie Mac persisted beyond the crisis, but those fears don't match actual repurchase numbers.

June 15

-

There's been plenty of speculation about insurance companies crowding out commercial mortgage bond investors this year.

June 14 -

Open Mortgage, a multichannel lender based in Austin, Texas, has been approved as a Fannie Mae seller.

June 13 -

Caliber Home Loans is marketing a residential mortgage-backed securitization mainly backed by nonprime loans, called COLT 2016-1 Mortgage Loan Trust.

June 10 -

Formal guidance from the Consumer Financial Protection Bureau about investors' liability for errors on the upfront Loan Estimate disclosure could go a long way toward easing secondary market anxieties about purchasing mortgages with TRID errors.

June 9 -

The National Association of Realtors has called on the Consumer Financial Protection Bureau to make changes to the TILA-RESPA integrated disclosures' post-consummation timelines to provide more lenders wiggle room for rectifying errors.

June 8