Commercial banking

-

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

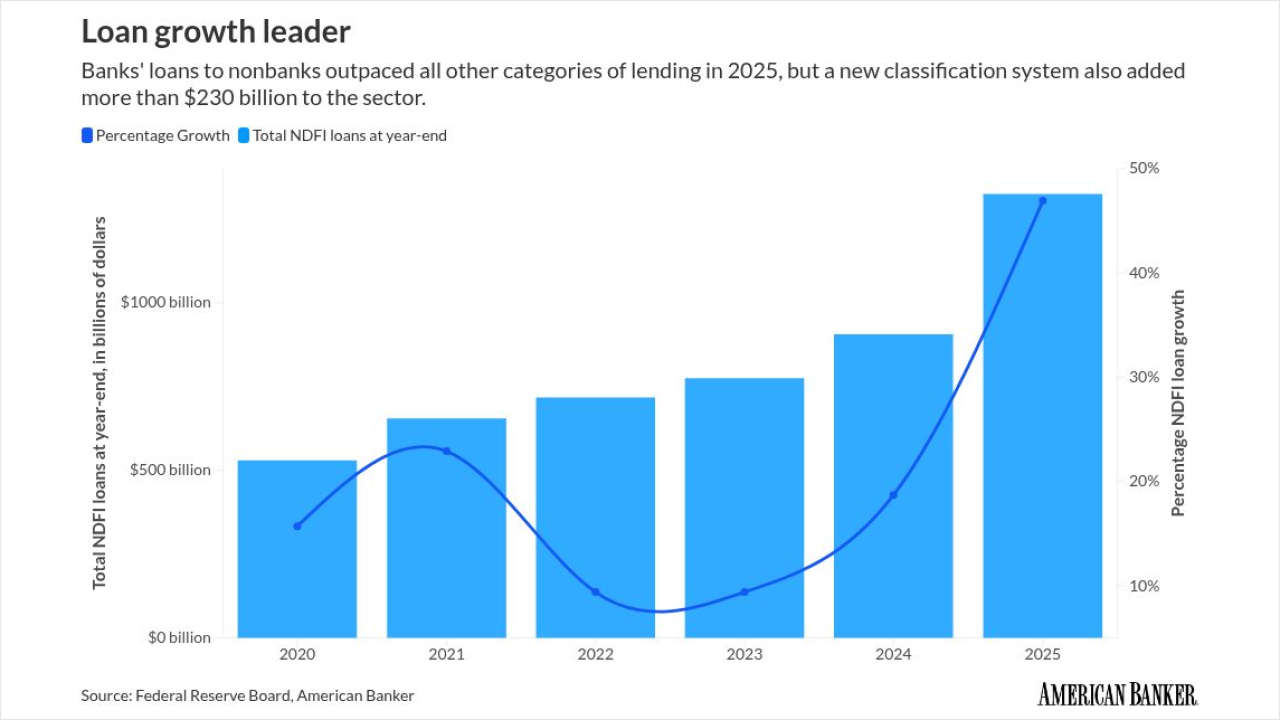

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

The Long Island-based bank hasn't been profitable in eight quarters, but executives maintain that it's on the right path, citing more loan book diversity, lower expenses and an improved margin.

October 24 -

The Charlotte, North Carolina-based bank reported net income of $1.45 billion for the third quarter and earnings per share of $1.04, which beat analysts' forecast of $0.99 per share.

October 17 -

America's second-largest bank revised its net interest income target upward after what analysts called a "clean" third quarter.

October 15 -

The megabank's multiyear effort to simplify its business model and improve its risk management is starting to pay off in the form of more consistent profitability and improved returns, CEO Jane Fraser told analysts.

October 14 -

Fifth Third announced it plans to buy the Dallas bank in a $10.9 billion transaction.

October 6 -

Data suggests that the beleaguered commercial real estate market isn't going to get worse. And now that banks have had time to build reserves, any losses they do take shouldn't be disastrous, analysts say.

August 27 -

The Long Island-based company's second-quarter net loss was the seventh consecutive quarter in which it has reported a net loss. CEO Joseph Otting remained optimistic Friday about the bank's future, saying it should return to profitability in the fourth quarter.

July 25 -

Eagle Bancorp in Maryland took a major quarterly loss due to challenges in its office loan portfolio. It's one of many banks working to trim down their commercial real estate loan books.

July 25 -

CEO Brian Moynihan plans to keep directing some of the bank's excess capital into new market expansions, he said Wednesday. "Organic growth is the reality," given the bank's already dominant U.S. market share, he said.

July 16 -

The global bank reported solid second-quarter results as executives maintain confidence in the bank's ability to achieve a return on tangible common equity of 10-11% next year. But an analyst said Citi's progress on reducing expenses will hinge on its ability to get freed from various enforcement actions.

July 15 -

Chairman and CEO Jamie Dimon said in a Tuesday statement that "the U.S. economy remained resilient" during the second quarter, adding that the recent tax cuts and potential deregulation are "positive for the economic outlook."

July 15 -

Steep trade barriers that were set to go into effect on July 9 have once again been put on pause, giving banks a welcome reprieve, but adding still more pressure and uncertainty on the Federal Reserve and the broader economy.

July 9 -

Lenders have been working to shrink their rent-regulated real estate loan portfolios since a watershed state law passed in 2019, but those plans may be accelerated.

June 26 -

New self-regulatory guidelines for credit cards and checking accounts are arriving at a time of deregulation in Washington, D.C.

June 25 -

The Long Island-based regional bank, which reported another quarterly loss Friday, continues to hire in the commercial-and-industrial lending sphere as it seeks to diversify its commercial real estate-heavy business.

April 25 -

The super-regional bank cited "a material slowdown" in investment banking and trading income as one reason for the lower revenue forecast. Interest rates are also a factor, executives said.

April 17 -

From reduced demand for auto loans to a slowdown in mergers and acquisitions, here's some of the new trade war's potential fallout for lenders.

April 7