Community banking

Community banking

-

The Arkansas bank said CRE is no longer its principal growth driver, yet it is still the bank's most prominent business and a big part of its robust lending activity.

October 18 -

The veteran turnaround executive was hired in 2020 to salvage the troubled banking company after the Justice Department launched a far-reaching probe of its mortgage lending practices. It agreed to sell to Florida-based EverBank.

October 8 -

An American Bankers Association panel of forecasters predicted slower growth, but it said the U.S. economy would likely avoid a recession, sparing lenders deep credit quality woes.

September 30 -

The $17 billion-asset Suffolk-based company is convinced paying $120 million for an in-state rival is a more productive use of capital than share buybacks

September 24 -

The bank faced credit setbacks in the nation's capital and margin pressure this year. But it made a series of hires to reduce risk and diversify its loan portfolio, preparing for a new era of demand as the industry awaits interest rate cuts.

September 9 -

REV Federal Credit Union in suburban Charleston, South Carolina, plans to acquire First Neighborhood Bank in West Virginia. It marks the 15th deal this year involving a credit union buying a bank, closing in on 2022's record of 16 deals.

September 4 -

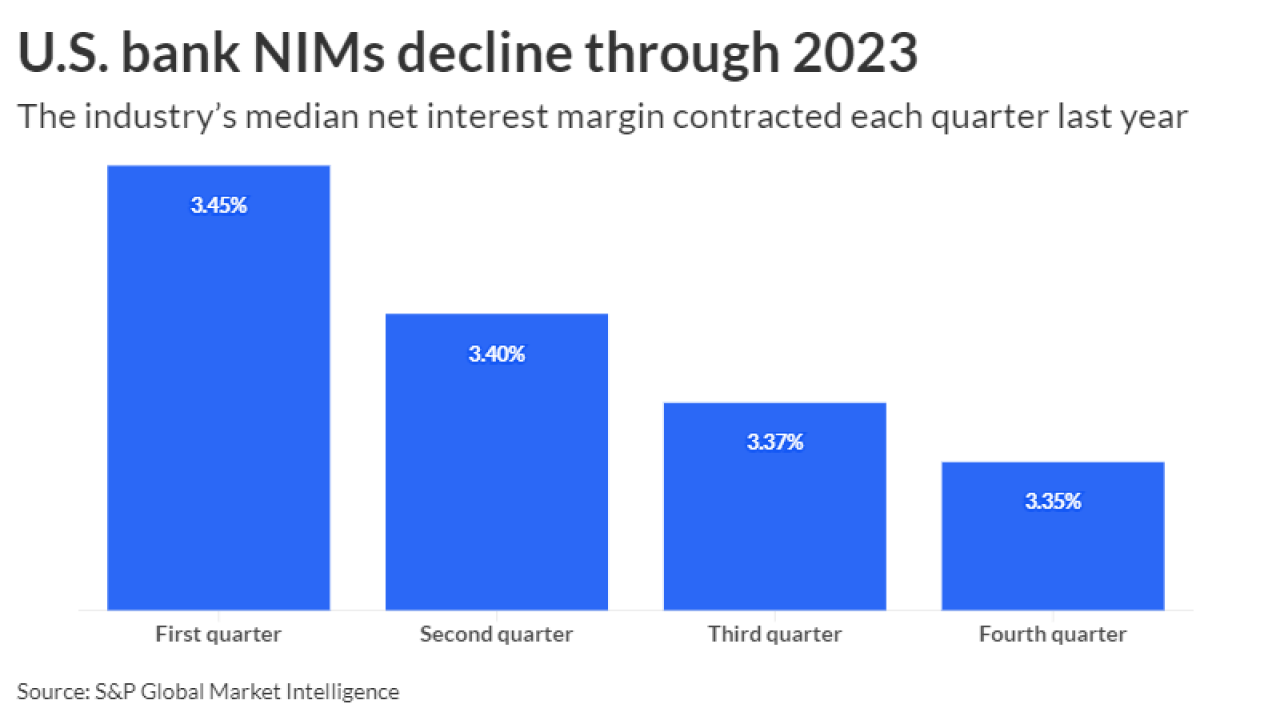

Lower interest rates could bolster loan demand, credit quality and securities portfolios. But they could also curb lending profitability faster than they ease deposit costs, crimping net interest margins and eating into near-term profits.

August 26 -

The Federal Housing Finance Agency wants to update the dual mission of the Federal Home Loan Banks. Members of the private bank cooperative say their regulator has no authority to redefine the mission.

August 8 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

The buyer said the all-stock deal to buy The First Bancshares would create a combined bank with $25 billion of assets.

July 29 -

Sandro DiNello, who briefly led New York Community Bancorp amid turmoil earlier this year, is staying on the company's board. But Joseph Otting, the company's recently installed CEO, is taking on the executive chairman position.

June 4 -

The Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency issued a 30-page guidebook on managing affiliate risks. The report builds on formal guidance issued last year.

May 3 -

In talks with OCC officials, "it became obvious that we would not gain near-term approval given their recent experience with multifamily and CRE positions," FirstSun CEO Neal Arnold says. The companies announced other revisions to their deal, too.

May 3 -

Consolidation has slowed since the pandemic, but UMB's agreement to buy Heartland Financial — the largest deal in three years — is one of several merger announcements in the past two weeks. Talks among other potential buyers and sellers are said to be picking up.

April 30 -

The Philadelphia-based bank's parent company, Republic First Bancshares, had been roiled by a yearslong proxy battle involving activist investors groups and its former CEO.

April 26 -

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Houston-based Prosperity Bancshares said it closed its purchase of Lone Star State Bancshares about a year later than initially planned.

April 2 -

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

Lower commodity prices and decreases in government assistance are expected to push farm income lower this year and raise credit risk for banks.

March 25 -

The Justice Department and the CFPB are increasingly relying on emails among employees that contain discriminatory comments to strengthen their hand in cases against lenders.

March 24