Community banking

Community banking

-

The Federal Savings Bank is trying to persuade a judge to look beyond its CEO's alleged complicity in a fraud perpetrated by President Trump's former campaign chair.

November 29 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

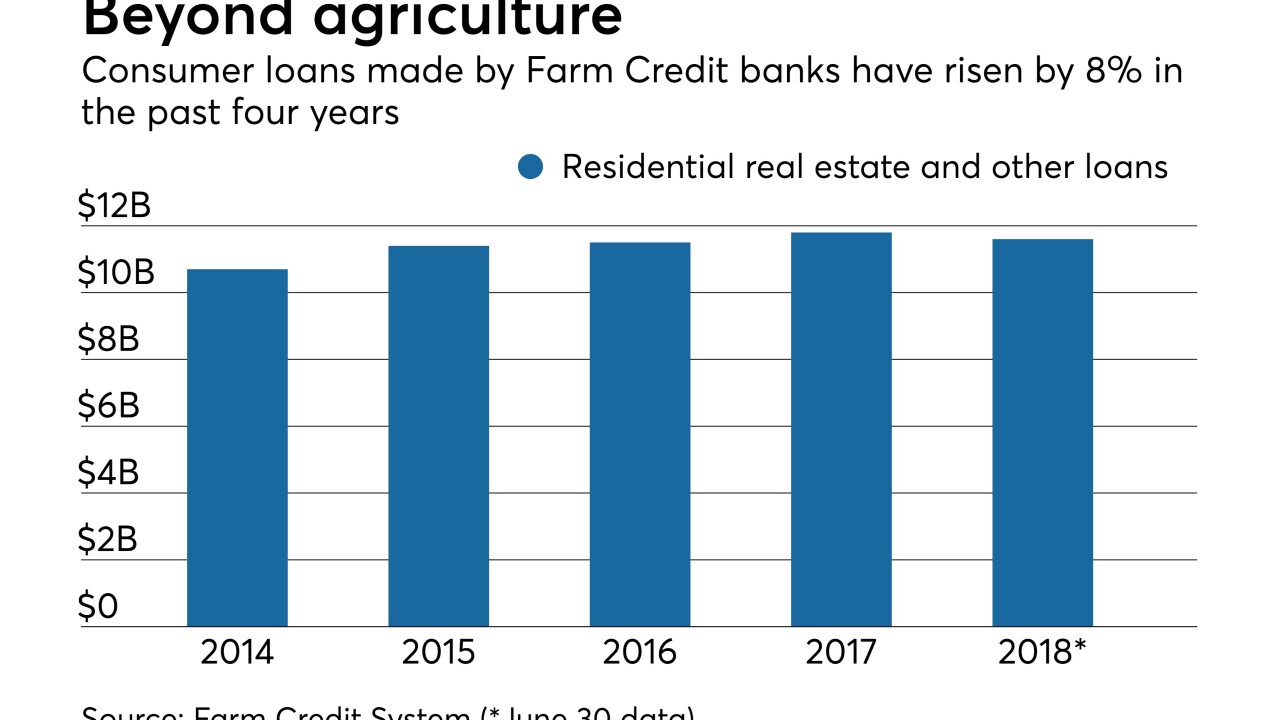

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

A deal between TD Bank and a Vermont nonprofit is just one example of how banks are getting creative in addressing affordable housing needs while reaping financial and regulatory benefits.

October 30 - Non-profits

City National Bank said the foundation will buy houses and hold onto them until the buyer lines up financing.

October 25 -

The company is facing criticism after a big chargeoff on two properties, showing that investors have little patience when a risky business model shows signs of distress.

October 19 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

Casey Crawford, CEO of Movement Mortgage, bought First State Bank in Virginia last year. He has since injected more capital into the bank in an effort to reinvent it.

September 10 -

The Ohio company agreed to buy TransCounty Title Agency, which has five offices around Columbus.

September 4 -

A number of banks have stepped up efforts to lend to residential developers, though they are mindful of missteps made before the financial crisis.

August 20 -

The Michigan company had been operating under the supervisory agreement since 2010.

August 17 -

Steve Calk, the head of The Federal Savings Bank, was a "co-conspirator" in an effort to defraud the Chicago bank, a prosecutor said at the trial of former Trump campaign chair Paul Manafort. Could Calk be charged with a crime?

August 13 -

Stephen Calk, the CEO of The Federal Savings Bank, expedited approval of a mortgage to the onetime Trump campaign chair in hopes of winning a job as Treasury secretary or housing secretary, a former bank employee testified Friday.

August 10 -

Five potential witnesses against Paul Manafort, including accountants and bankers, were identified Monday as a U.S. judge gave the former Trump campaign chairman's lawyers more time to review tens of thousands of documents handed over to them in recent weeks.

July 25 -

Level One Bank in Farmington, Mich., has hired a team of mortgage bankers from MB Financial, which previously announced it was shutting down this business line.

July 10 -

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6 -

The deal is designed to improve capital ratios and reduce risk at the Seattle company.

July 3 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29