-

Some lenders have asked whether the bureau would adjust its so-called resubmission guidelines which determine whether lenders have to refile data based on errors found in samples and it has responded with a request for further industry input.

January 8 -

Clayton Holdings in Shelton, Conn., has opened a consulting office in Silicon Valley to work with financial technology companies.

January 6 -

The more aggressive nonbank lenders are attracting top producers by essentially allowing loan officers to set their own rate of pay. While so-called "pick-a-pay" compensation plans are not illegal, critics say they can encourage loan officers to steer consumers into more expensive loans in order to increase their own pay.

January 6 -

Increased enthusiasm for automated valuations presents an opportunity for the appraisal industry to develop tools that combine high-efficiency, low-cost processes with the accuracy of human expertise.

January 6 ISGN

ISGN -

The demand for affordable rental properties has long outstripped the supply, with the gap widening as incomes have stagnated, homeownership rates have fallen and rents have soared in recent years. But now, banks are finding a profitable path to helping ease this severe national shortage.

January 5 -

WASHINGTON JPMorgan Chase and EverBank were released from business restrictions stemming from the foreclosure reviews that originated in 2011, but also face new civil money penalties for their earlier violations of those restrictions, the Office of the Comptroller of the Currency said Tuesday.

January 5 -

As the mortgage industry begins the New Year, National Mortgage News takes a look at the biggest trends and topics that will shape 2016.

January 5 -

Tech-enabled shortcuts that borrowers might assume are harmless or what loan officers, real estate agents and borrowers consider good customer service may in fact lead to very risky, or even illegal, habits.

January 5 Mortgage Quality Management & Research

Mortgage Quality Management & Research -

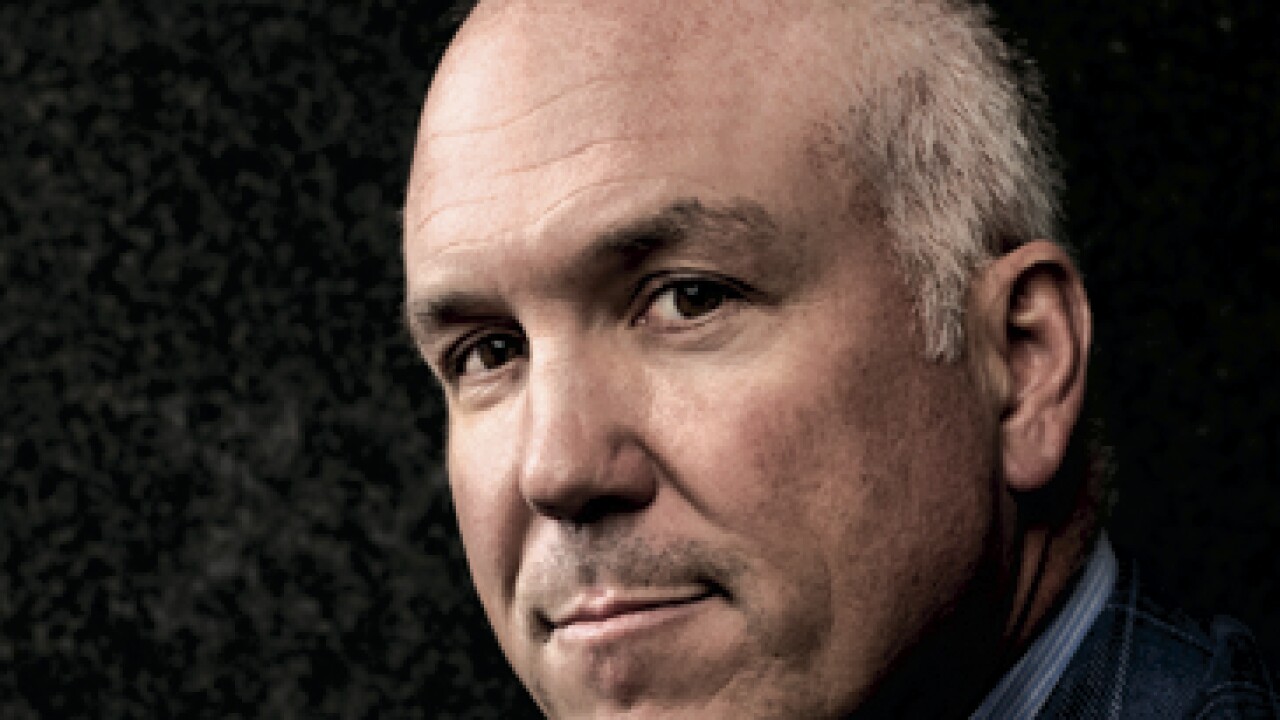

The Sarbanes-Oxley Act of 2002 is important, but it barely scratches the surface of former House Financial Services Committee Chairman Michael Oxley's impact on banking.

January 4 -

U.S. judge rejects Quicken Loans' effort to move FHA loan case to Detroit courtroom.

January 4