-

The answer to lower costs, higher efficiency, and better record keeping for compliance lies in eSignature, e-documents, and e-mortgages, the foundation for which has legally been in place for 15 years now.

December 14 DocuSign

DocuSign -

Ellie Mae has released an updated version of its mortgage management software, with updates on compliance and overnight rate protection for secondary marketing.

December 14 -

Mortgage lenders and servicers weary from a raft of regulatory changes in recent years may see some respite in 2016, but still face some tough issues ahead. Here's the most pressing.

December 14 -

WASHINGTON Fannie Mae and Freddie Mac would be able to evaluate and use new credit scoring models under a bill introduced in the House that seeks to create more competition in the credit scoring industry.

December 11 -

The Morgan Stanley settlement follows a similar agreement with Barclays Capital in October that resulted in a recovery of $325 million.

December 11 -

The House Financial Services Committee approved a bill Tuesday that would direct the Federal Housing Administration to relax restrictions on its condominium loan program.

December 9 -

Calvin Hagins, the Consumer Financial Protection Bureau's deputy assistant director for originations, warned mortgage lenders this week about four contentious areas that its examiners will zero in on next year.

December 9 -

Indications of fraud ebbed when refinancing was more prevalent, but now that home purchases are picking up, misrepresentations could increase, too.

December 8 -

A former Jefferies & Co. managing director accused of lying to customers about bond prices had his fraud conviction overturned in the latest blow to the governments effort to hold individuals accountable for alleged wrongdoing on Wall Street.

December 8 -

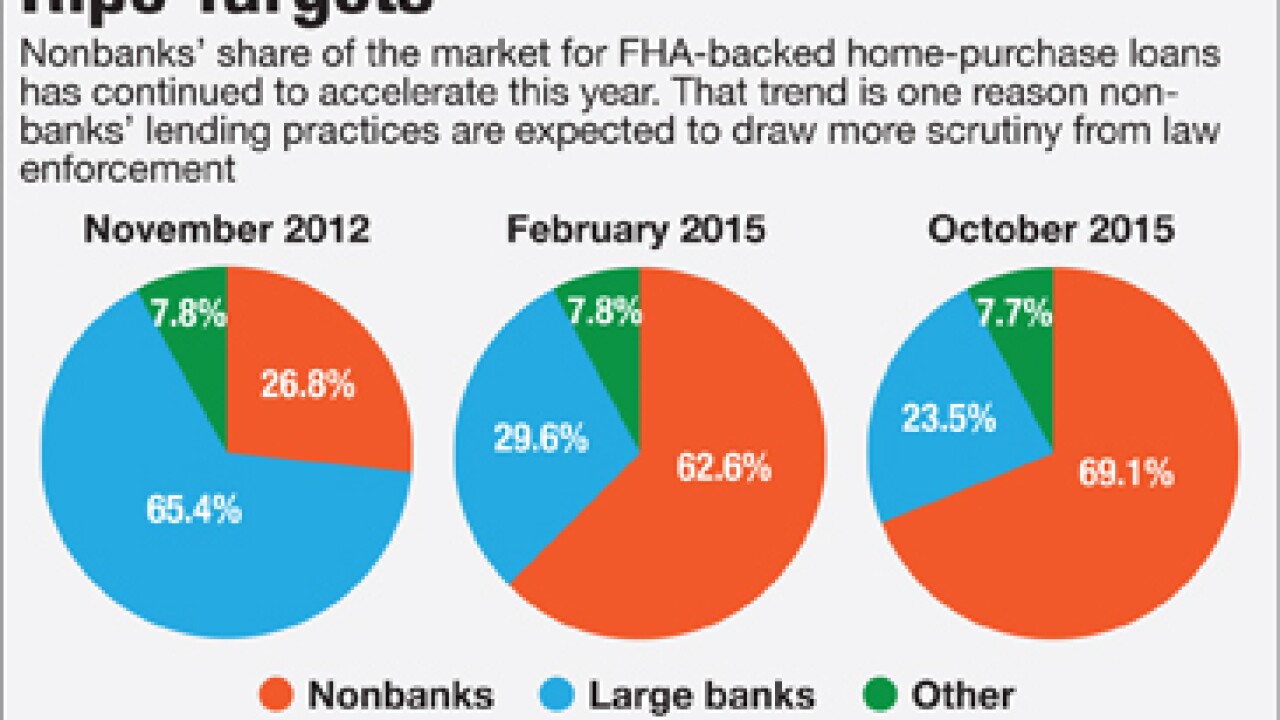

Two independent mortgage banks agreed to settlements in the past week with the Justice Department for failing to meet Federal Housing Administration guidelines. The cases are a warning to nonbank lenders that they need to beef up self-reporting of deficiencies, and they remind large banks about the legal risks associated with FHA lending.

December 7