-

GOP presidential contender Jeb Bush unveiled a plan to reform the regulatory process, including at agencies like the Consumer Financial Protection Bureau.

September 24 -

Officials signaled that Hudson City Savings Bank's nearly $33 million settlement over redlining charges is only the first in what is likely to be a string of other cases.

September 24 -

Appraisers and appraisal management companies do important, and different, work. Their fees should be listed separately and transparently in the TILA-RESPA integrated disclosures.

September 24 Nadlan Valuation

Nadlan Valuation -

Federal officials on Thursday ordered Hudson City Savings Bank to pay more than $27 million to resolve redlining allegations, the largest order of its kind and one that is likely to put larger banks on notice that redlining cases will be aggressively pursued.

September 24 -

The Consumer Financial Protection Bureau's method for detecting disparate impact discrimination can overestimate potential bias, resulting in higher payments for lenders cited by the agency, according to internal CFPB documents.

September 23 -

Benjamin Solomon, Deutsche Bank AG's former global head of securitized-product trading, accused the company in a lawsuit of firing him on frivolous and unjust grounds amid an industry focus on supervisors responsibilities.

September 23 -

From due diligence and portfolio analysis to strategies for compliance and raising capital, the rapidly-evolving market for buying and selling distressed mortgage assets has created both challenges and opportunities for investors, servicers and portfolio managers.

September 23 -

The Securities and Exchange Commission has settled with Thomas Lund, the former head of Fannie Mae's single-family lending unit, for $10,000, according to news reports.

September 23 -

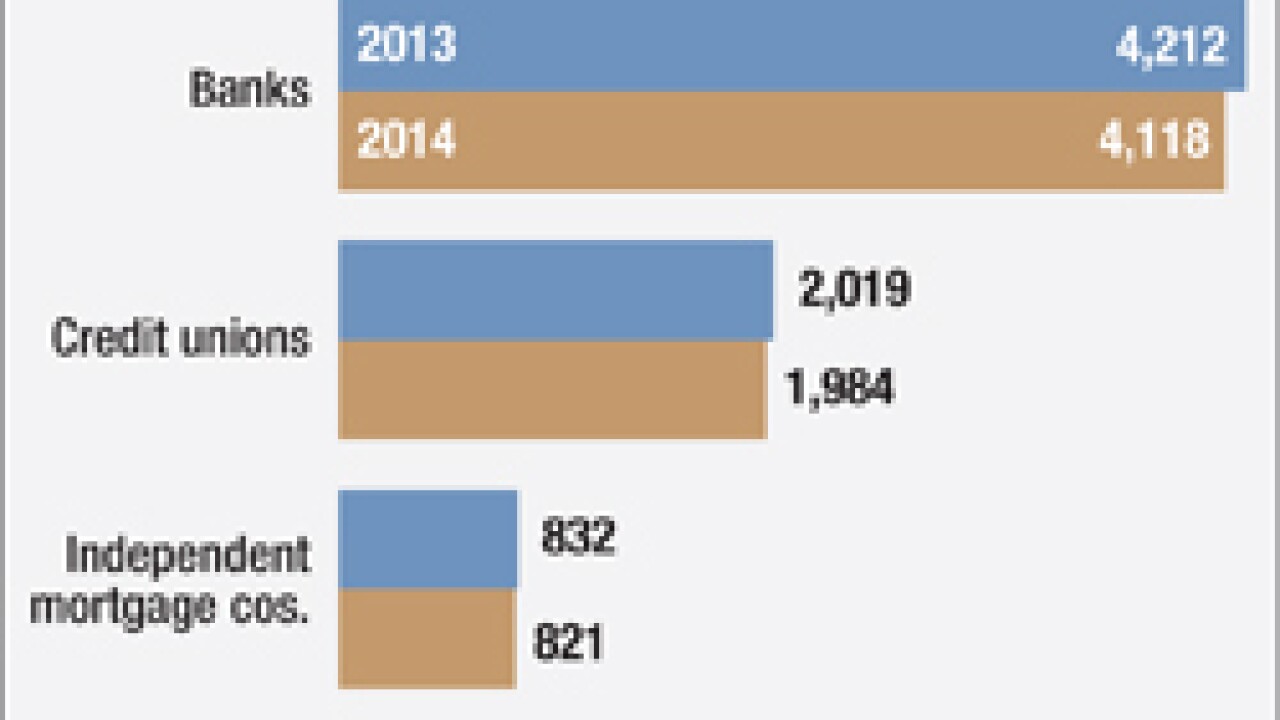

Although new HMDA data shows no negative effects from CFPB mortgage rules that went into effect last year, industry representatives argue it isn't showing the full picture.

September 22 -

Ginnie Mae may soon raise its liquidity and cash requirements for independent mortgage banking firms since it seems almost certain that Congress won't increase the agency's budget for fiscal year 2016.

September 22