-

Fitch Ratings has updated its new loan level due diligence residential mortgage-backed securities grading methodology to include compliance grading related to the TILA-RESPA integrated disclosure rules.

June 28 -

The Supreme Court on Monday agreed to hear an appeal by Wells Fargo and Bank of America in a lawsuit brought by the City of Miami to determine whether the city can seek redress for lost tax revenue from allegedly predatory mortgages.

June 28 -

LendingTree is rolling out a new tool designed to help lenders identify borrowers who meet Community Reinvestment Act criteria.

June 28 -

Big banks have drastically reduced their share of the Federal Housing Administration market, a massive shift that has big implications, according to new analysis by the American Enterprise Institute.

June 27 -

Suffolk Bancorp said increased oversight of commercial real estate contributed to and may have accelerated its decision to sell to People's United. Other banks could make a similar choice.

June 27 -

The deadline has arrived for mandatory submissions to the Federal Housing Administration's Electronic Appraisal Delivery portal, but as many as one-third of lenders that originate FHA-insured mortgages have yet to use the new system.

June 27 -

The market gyrations following the United Kingdom's vote to leave the European Union have an upside for mortgage lenders, as already-falling interest rates are expected to boost home purchases and refinancing.

June 24 -

Ten banks have invested a total of $25 million in the fund, which buys up mortgage-backed securities tied to loans made for the development or rehabilitation of affordable single- and multi-family homes.

June 24 -

The U.S. government's decision to take all profits from Fannie Mae and Freddie Mac was the right thing to do even in light of the companies' subsequent return to profitability, a former Treasury Department official said..

June 23 -

Ocwen Financial Corp. has agreed to a $30 million settlement in two lawsuits alleging that the West Palm Beach, Fla.-based company violated the False Claims Act.

June 23 -

Mortgage servicers have failed to make significant investments in technology and compliance systems, resulting in substantial harm to consumers, according to a report issued Wednesday by the Consumer Financial Protection Bureau.

June 22 -

Industry and consumer groups are calling on the Federal Housing Finance Agency to reduce the loan fees that homebuyers have to pay on Fannie Mae and Freddie Mac guaranteed mortgage loans.

June 22 -

The ultimate approval of the CIT-OneWest merger by regulators represents a giant step backwards for the Community Reinvestment Act.

June 22

-

Brokers remain perplexed over how to strike a balance between helping borrowers shop for the best deal and maintaining compliance with the TILA-RESPA integrated disclosures. Specifically, how do brokers and wholesalers meet TRID's delivery deadline and accuracy requirements when a loan is resubmitted to a new lender?

June 21 -

Home Equity Conversion Mortgages can be a valuable retirement tool to older borrowers who qualify for the product, and lenders who shy from offering them are doing their clients a costly disservice.

June 21 ReverseVision

ReverseVision -

The decline in homeownership can be stopped, and even reversed, by taking action on credit access, better evangelizing for down payment programs and offering borrower counseling.

June 20 NeighborWorks America

NeighborWorks America -

U.S. prosecutors have abandoned their case against Angelo Mozilo, a pioneer of the risky subprime mortgages that fueled the financial crisis, after a two-year quest to bring a civil suit against him.

June 17 -

Costs for finishing Fannie Mae's new headquarters have increased $36 million without the knowledge of the Federal Housing Finance Agency employee responsible for monitoring the project, the agency's inspector general claims.

June 16 -

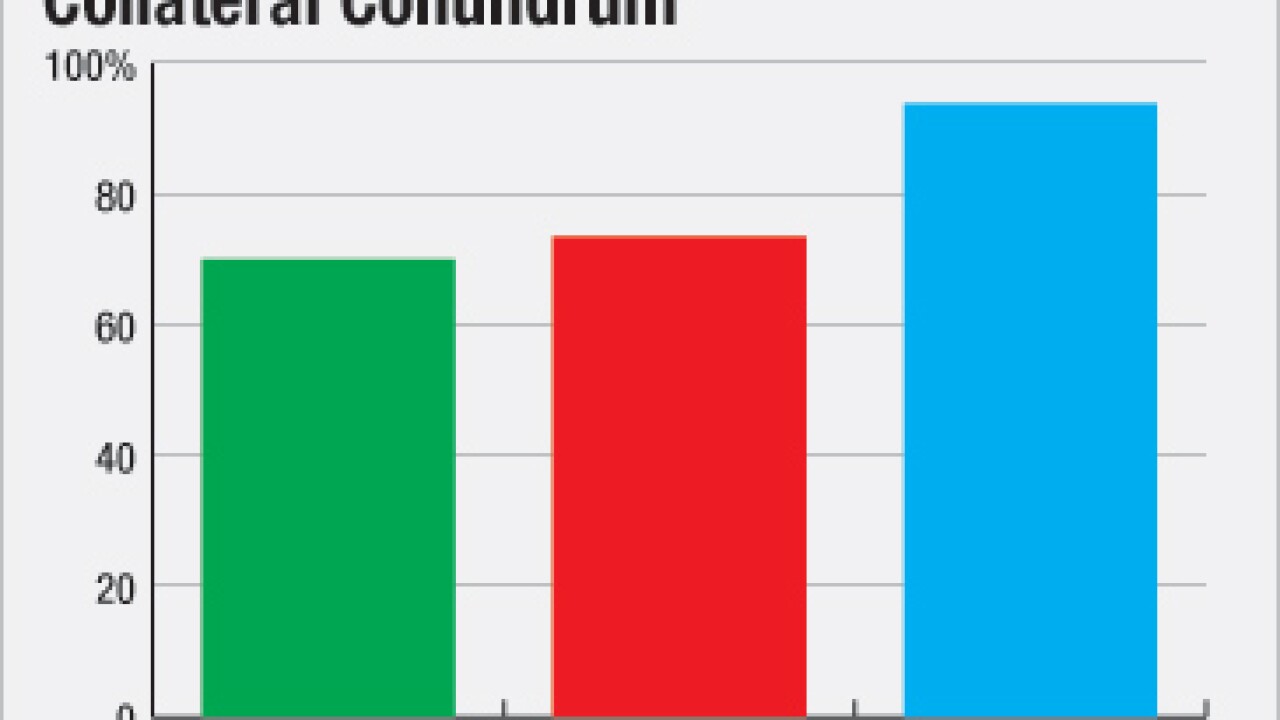

Fears about repurchase requests made by Fannie Mae and Freddie Mac persisted beyond the crisis, but those fears don't match actual repurchase numbers.

June 15

-

Delinquencies on non-owner-occupied commercial real estate loans ticked up in the first quarter after years of steady declines. Some are shrugging off the increase, saying it was expected given the strong demand for CRE loans, but others say there's good reason to be concerned.

June 14