-

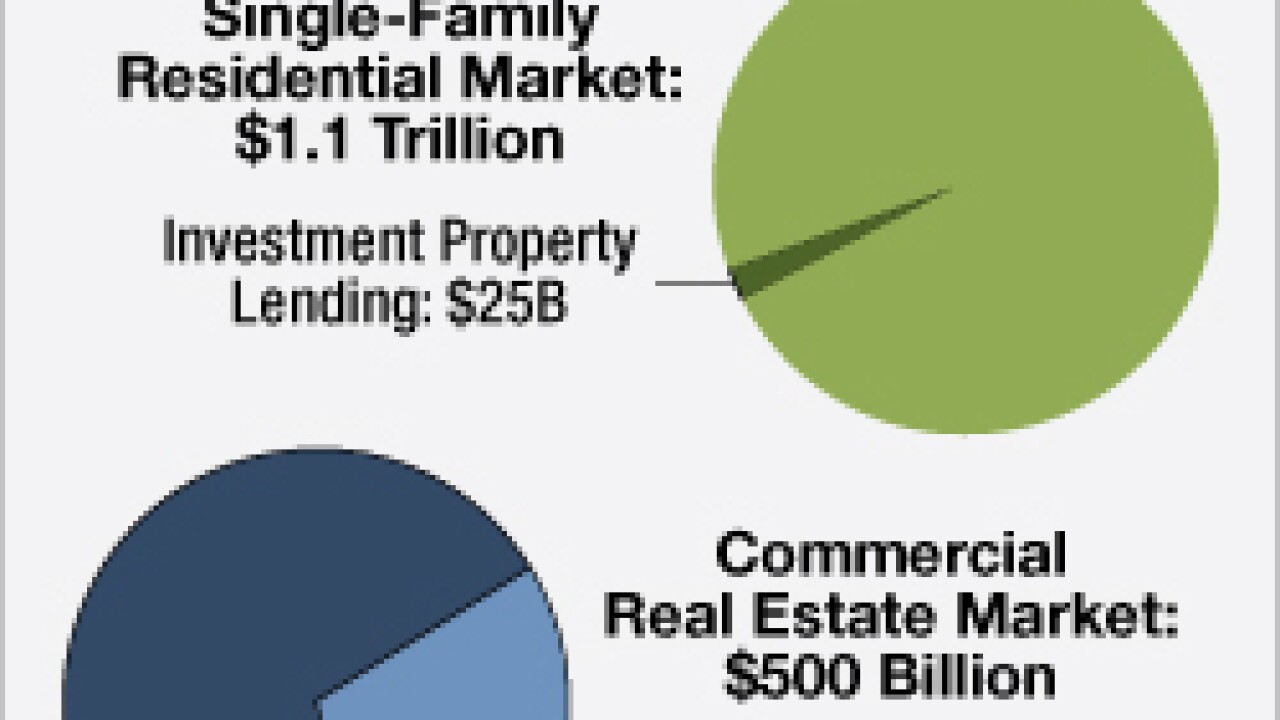

Marketplace lenders seek to disrupt traditional financial services with online platforms that connect borrowers to investors. But in real estate, this burgeoning sector has taken an approach that seeks to co-exist with, rather than supplant, the traditional mortgage market.

August 31 -

The $3.9 billion-asset Luther Burbank Savings has opened retail loan origination offices in several Southern California cities to produce more jumbo mortgages. It is one of several lenders in the region that think jumbo loans are worth the risks to achieve growth.

August 18 -

The New York metro area leads the nation in commercial and multifamily construction starts, according to a new report.

August 14 -

As the Small Business Administration's flagship 7(a) loan program breaks records, its other loan program stagnates. Advocates for so-called 504 loans hope a drive to permit CRE refinancing will inject new life.

August 13 -

Jones Lang LaSalle in Chicago has agreed to acquire Oak Grove Commercial Mortgage, to expand its debt-finance offerings.

August 13 -

The delinquency rate for commercial mortgage-backed securities was little changed from June to July, according to Fitch Ratings.

August 10 -

1st Service Solutions warned that the Las Vegas, Phoenix and Chicago markets could cause problems for commercial mortgage-backed securities investors.

August 7 -

Walker & Dunlop reported a higher second-quarter profit, citing gains from mortgage banking and servicing fees.

August 7 -

Capital One Financial is in exclusive talks with General Electric to buy the company's health-care finance unit, people familiar with the matter said.

August 7 -

delinquencies, CMBS, commercial mortgage-backed securities,Trepp

August 5 -

Stark Enterprises, a commercial real estate developer in Cleveland, has formed a capital-markets division to provide equity and debt financing and related services.

August 5 -

An Astoria Financial investor is demanding that the Lake Success, N.Y., company explore a possible sale or other ways to increase shareholder value.

August 4 -

Commercial real estate borrowing and lending continued at a strong clip in the second quarter, according to the Mortgage Bankers Association.

August 4 -

Banks are seeing stronger consumer demand for credit for a range of products, including residential mortgages, auto loans and credit cards, according to a Federal Reserve Board survey of senior loan officers released Monday.

August 3 -

Freddie Mac has launched its first securitization of small-balance loans on multifamily properties. The 44 mortgages backing the $108 million of SB1 Certificates are underwritten by Freddie Mac and originated by Greystone Servicing Corp.

August 3 -

Investors Bancorp reported higher second-quarter profit on expanded multifamily, commercial real estate and business lending, as well as lower expenses.

July 31 -

AssetAvenue, a marketplace lender that specializes in commercial real estate finance, announced that it has hired Peter Coleman as its chief financial officer.

July 31 -

Ares Commercial Real Estate reported a higher second-quarter profit on growth in principal lending and mortgage banking.

July 30 -

The price of loans that underlie commercial mortgage-backed securities fell from May to June, according to DebtX.

July 28 -

Flagstar Bank far outpaced expectations for its second-quarter results due to high loan sales and a strengthened portfolio from the subtraction of lower performing loans.

July 28