-

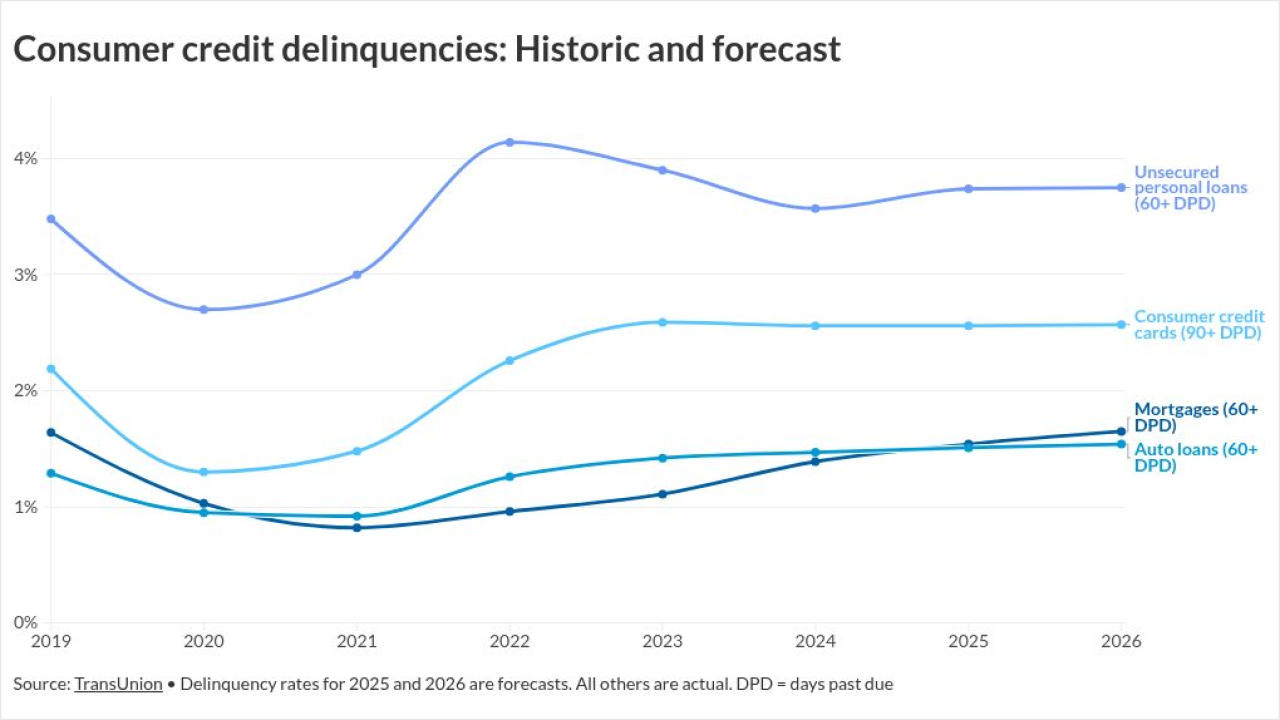

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

Renters can now enroll in CreditClimb through Zillow to have their on-time rent payments reported to the three major credit bureaus.

November 21 -

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

The multi-year, $100 million agreement will allow users to take financial actions without leaving the ChatGPT app.

November 18 -

Mortgage credit availability increased 2.3% to 106.8 last month, marking the fourth consecutive month of growth.

November 10 -

Late-stage mortgage delinquencies hit the highest level since January 2020 in September, a new report from VantageScore found.

October 28 -

Several claims in a recent Loan Think column misrepresented how credit scores and resellers work in mortgage lending, according to the president of the National Consumer Reporting Association.

October 24 National Consumer Reporting Association

National Consumer Reporting Association -

Regulators are nearing a key step in overhauling credit scoring as the MBA touts its influence on GSE policy and close alignment with Washington leaders.

October 21 -

Following a $60 million credit hit, the Salt Lake City bank said that it hasn't found any other related problem loans.

October 20 -

Other studies have found fewer credit pulls could be viable, but this shows millions more would be adversely impacted than in a bi-merge.

October 20 -

Transunion will offer the credit scoring model for $4 in 2026, following previous moves made by VantageScore partners Experian and Equifax.

October 18 -

Renters who pay on time deserve credit toward homeownership, and new data tools can make that possible, according to the owner of Burkentine Real Estate Group.

October 17 Burkentine Real Estate Group

Burkentine Real Estate Group -

The Cincinnati, Ohio-based bank delivered third-quarter earnings that mostly met expectations, even as it took a $200 million blow to credit.

October 17 -

Zions Bancorp. is among the latest banks to report material losses due to alleged borrower fraud. Stocks of regional lenders plunged on Thursday.

October 16 -

Plaid said LendScore should be viewed as complementary to FICO and other traditional players in the space, but there could be room for disruption in the future.

October 15 -

If Experian eventually charges for VantageScore 4.0, it will be offered for at least a 50% discount compared to what Fair Isaac Corp. charges for its FICO score.

October 14 -

In order to believe in the idea of "competition" in credit scores, the Washington housing community must believe that large institutional investors who buy whole loans and mortgage-backed securities are really, really dumb, writes the Chairman of Whalen Global Advisors

October 14 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Equifax will hold costs for scores from FICO rival Vantagescore through 2027 and offer other incentives meant to drive adoption of the alternative metric.

October 8