-

Wire and other payments fraud affected a record number of businesses last year, and the FBI is warning in particular about real estate scams.

August 1 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

Federal law enforcement authorities have arrested 74 people in this country and abroad, accusing them of participating in a wire fraud scam whose victims included real estate attorneys and settlement service providers.

June 12 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

WEI Mortgage discovered a data breach from an email phishing scam last fall that may have exposed loan package information and identifying data such as Social Security numbers.

April 24 -

The agency's acting chief said hundreds of data breaches justified a halt on collecting information from firms, but experts question that logic.

April 23 -

The news of the data breach cast a shadow over relatively strong first-quarter earnings for the Atlanta bank.

April 20 -

Mortgage companies should model cybersecurity protocols after their compliance strategies to avoid being underprepared in the event of a data breach.

April 19 -

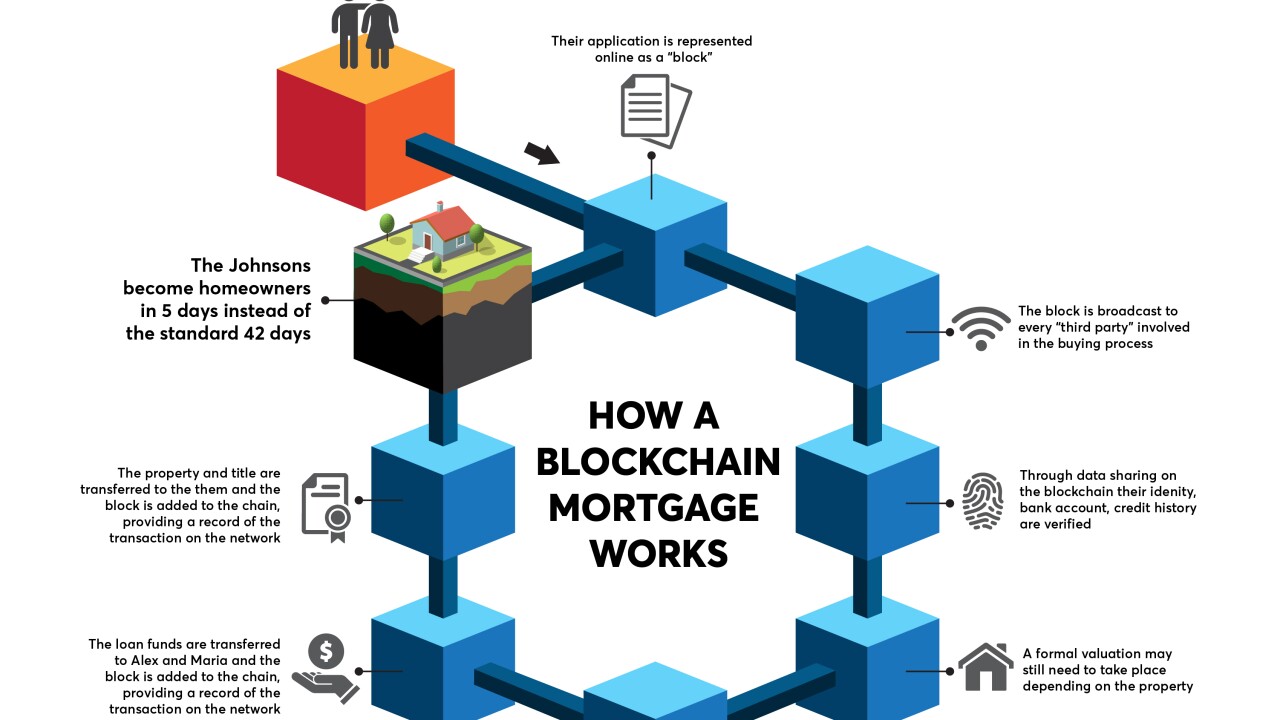

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

The Consumer Financial Protection Bureau is among several agencies that "continue to investigate events related to" last year's Equifax brief, the credit reporting firm said in a securities filing.

March 2 -

Equifax, the credit-reporting firm that suffered a massive data breach last year, said it will notify an additional 2.4 million U.S. consumers that they were affected by the hack.

March 1 -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

It is unclear whether the Consumer Financial Protection Bureau is abandoning its supervisory oversight of Equifax or just taking a back seat to the Federal Trade Commission as the latter investigates the credit bureau.

February 5