-

Mortgage companies should model cybersecurity protocols after their compliance strategies to avoid being underprepared in the event of a data breach.

April 19 -

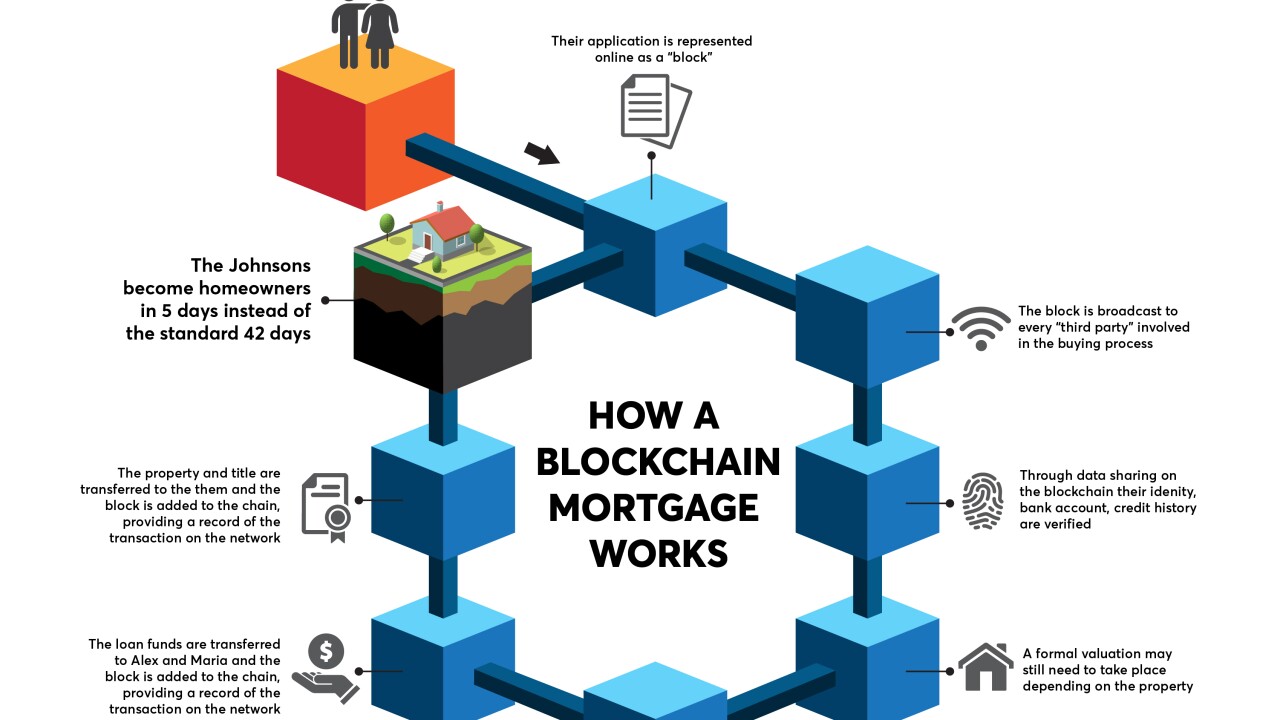

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

The Consumer Financial Protection Bureau is among several agencies that "continue to investigate events related to" last year's Equifax brief, the credit reporting firm said in a securities filing.

March 2 -

Equifax, the credit-reporting firm that suffered a massive data breach last year, said it will notify an additional 2.4 million U.S. consumers that they were affected by the hack.

March 1 -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

It is unclear whether the Consumer Financial Protection Bureau is abandoning its supervisory oversight of Equifax or just taking a back seat to the Federal Trade Commission as the latter investigates the credit bureau.

February 5 -

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

Credit score damage is a chief regret among consumers, but among financial goals it impedes, buying a home lies further down the food chain than other priorities.

January 29 -

While the majority of lenders feel mortgage industry data initiatives have been valuable, their cost is clouding some originators' viewpoint, a Fannie Mae survey found.

January 24 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney has cited hundreds of confirmed and suspected data breaches as justification for his halting the bureau's data collection activities last month.

January 19 -

The CFPB's recent freeze on collecting any personally identifiable information from companies it supervises is slowing investigations and could ultimately cripple the agency's enforcement function — and that may be the point.

January 10 -

The two senators are set to introduce a bill that would force such firms to pay $100 per customer whose personal information was compromised.

January 10 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

A breach at Alteryx that exposed sensitive information from more than 100 million U.S. households could add to fraud risks in housing finance

December 22 -

Block One Capital has signed a binding term sheet to acquire 40% of the equity of Finzat, a private entity aiming to develop a blockchain system to create a safer, more compliant digital mortgage process.

December 6 -

The trade group wants Equifax to reimburse community banks for costs tied to the massive data breach at the credit bureau this year. The ICBA also wants a court to order Equifax to improve its security measures.

November 28