-

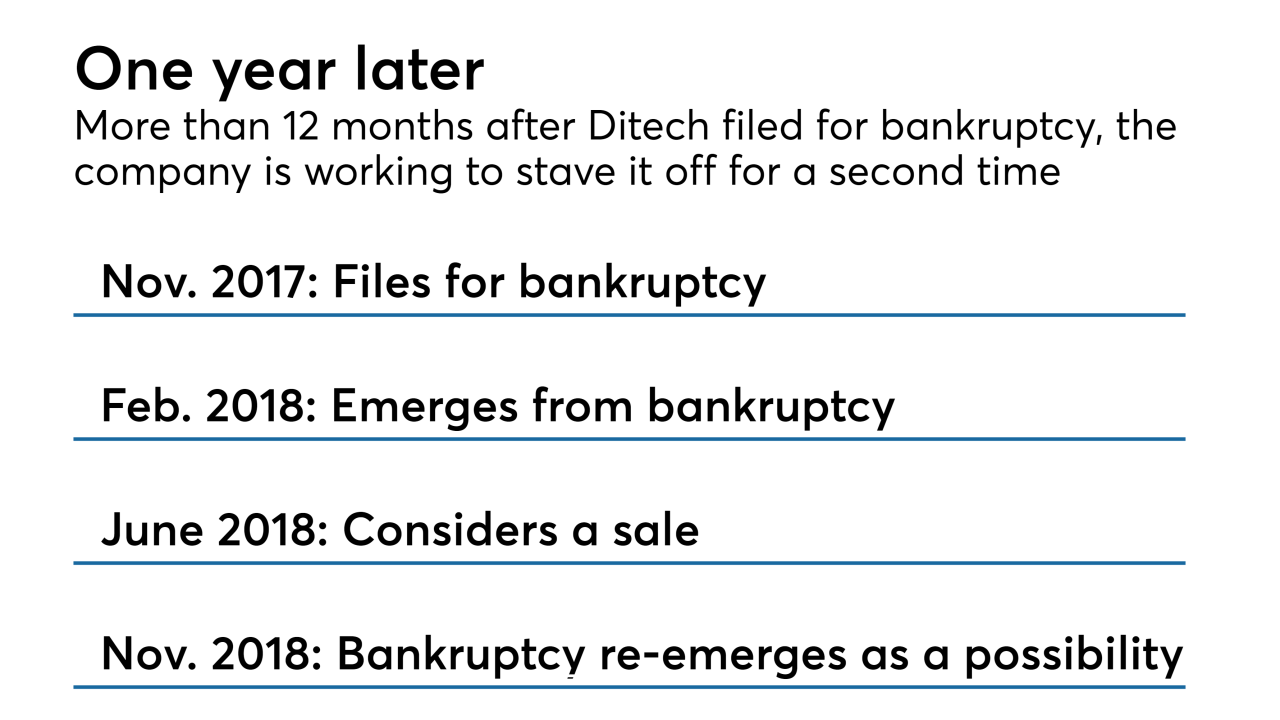

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

While consumer debt is growing overall, borrowers are exhibiting more caution when it comes to mortgage loans, according to LendingTree.

May 11 -

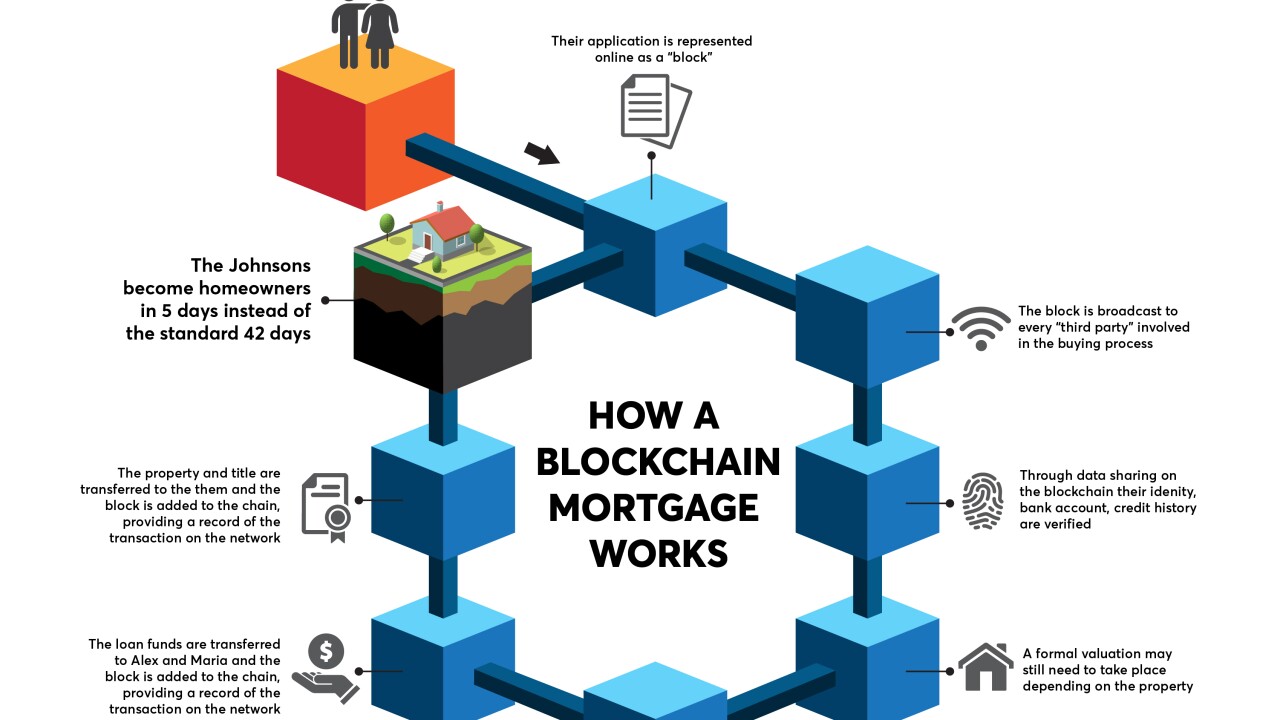

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

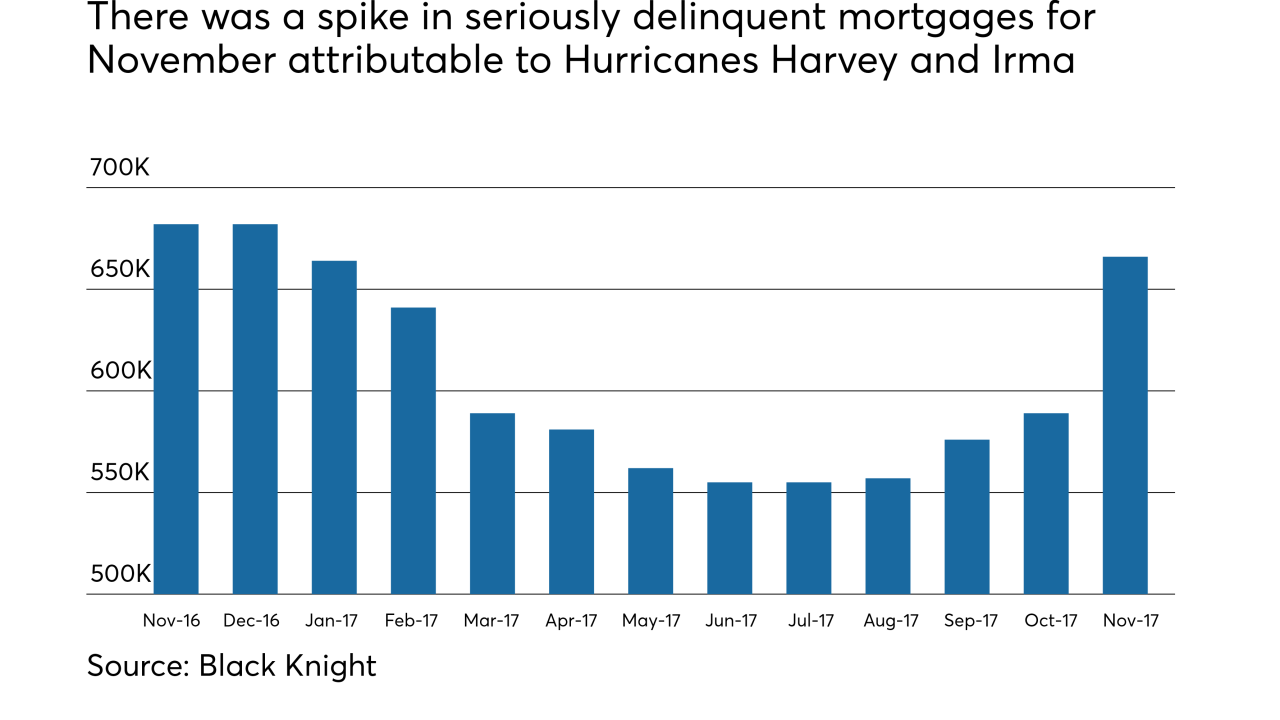

Serious delinquency rates were up sharply in November in both Texas and Florida compared to a year ago, while lower in all other states but Alaska, according to CoreLogic.

February 13 -

Default rates in second mortgages and bank cards rose notably in December, suggesting consumers are having trouble managing increased spending.

January 17 -

PHH Corp. agreed to a $45 million settlement to resolve allegations from 49 states and the District of Columbia that it engaged in "foreclosure process abuses" involving "inconsistent signatures" in its servicing business from 2009 to 2012. The settlement comes as the nonbank mortgage company continues its legal challenge to a separate regulatory action by the CFPB.

January 3 -

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

PHH Mortgage was the first mortgage servicer to be fined by the New York Department of Financial Services for failing to maintain a "zombie" property.

December 14 -

Late payments from borrowers living in areas hardest hit by Hurricanes Harvey and Irma were responsible for October's increase in loan delinquencies.

November 21 -

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

Nationstar Mortgage Holdings posted net income of $7 million for the third quarter, its first under the new Mr. Cooper consumer-facing brand.

November 2 -

Ocwen Financial Corp. will move its servicing portfolio to Black Knight's LoanSphere MSP system of record, following years of regulatory scrutiny of its existing technology provided by Altisource Portfolio Solutions.

November 1 -

Damage from Hurricane Irma could potentially put billions of dollars in commercial mortgage-backed securities at risk, according to Morningstar Credit Ratings.

September 14 -

If Fannie Mae's clear-boarding requirements prove effective, New York may follow Ohio's lead and move forward with a bill requiring it to be used more broadly on zombie properties.

September 8 -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

Defaults on second-lien mortgages have crept up on a year-to-year and a consecutive-month basis; and first-lien defaults are above where they were the previous month, but still below year-ago levels.

August 15