-

Nationstar is preparing its third securitization this year, and sixth overall, of nonperforming and inactive reverse mortgages under a Federal Housing Administration reverse mortgage program.

August 10 -

Morgan Stanley has completed $10.5 million in consumer relief, according to the independent monitor of the company's mortgage-backed securities settlement with New York State.

August 10 -

The foreclosure inventory at the end of June was at its lowest level since August 2007, according to data released Tuesday by CoreLogic.

August 9 -

The Inspector General of the Department of Housing and Urban Development has found a new ally in his fight to reform the down payment assistance programs run by HUD and state and local housing finance agencies.

August 8 -

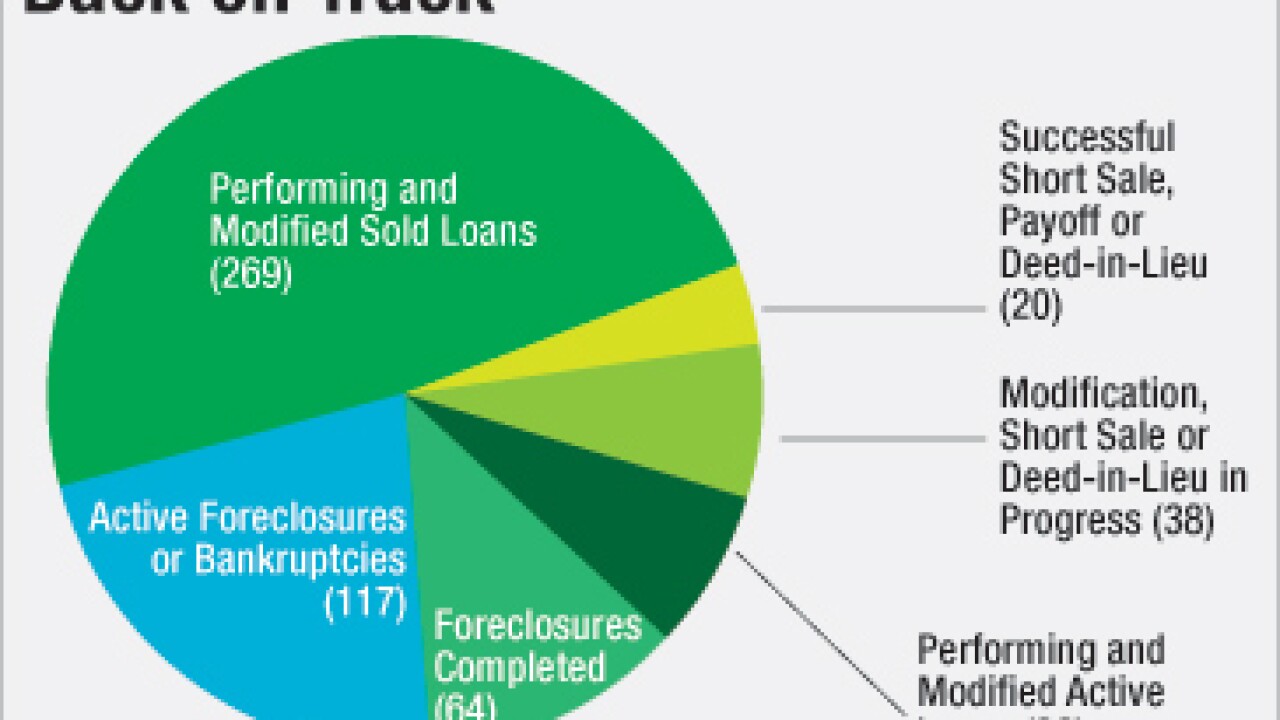

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

Incenter Mortgage Advisors is brokering the sale of an $8.9 billion Ginnie Mae bulk residential mortgage servicing rights portfolio.

August 4 -

The Consumer Financial Protection Bureau on Thursday finalized new requirements for mortgage servicers that provide more help to struggling borrowers and add consumer protections when loans are transferred.

August 4 -

Nationstar Mortgage Holdings is still in the red in the second quarter, as mark-to-market adjustments due to interest rate drops more than offset an increase in servicing revenue.

August 3 -

Ocwen Financial Corp. is marketing $500 million of notes backed by reimbursement rights to funds it has advanced on residential mortgages that it services.

August 3 -

Late payments on securitized commercial mortgages ticked higher again in July, for the same reason they did in June: a number of large loans fail to pay off at maturity.

August 3