-

Rising defaults, fraud risks, and collapsing rents are converging in urban multifamily, threatening lenders and taxpayers, according to the Chairman of Whalen Global Advisors.

February 5 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

VA- and FHA-backed mortgages helped drive the increase in property volume, but sales did not maintain the same pace, according to Auction.com.

January 29 -

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

January 29 -

Prepayment speeds approached recent highs last month, but distressed borrower data paints a mixed picture about the current housing market, according to ICE.

January 26 -

Foreclosure filings were reported on more than 360,000 properties in the United States last year, up 14% from 2025 and 3% from 2023, according to Attom.

January 15 -

The Department of Housing and Urban Development is selling more due-and-payable HECMs on homes that are occupied while reviewing the loan program.

January 7 -

Wells Fargo, JPMorgan Chase, U.S. Bancorp and Citigroup will streamline borrower requests for an additional 90-day forbearance, allowing verbal applications.

January 6 -

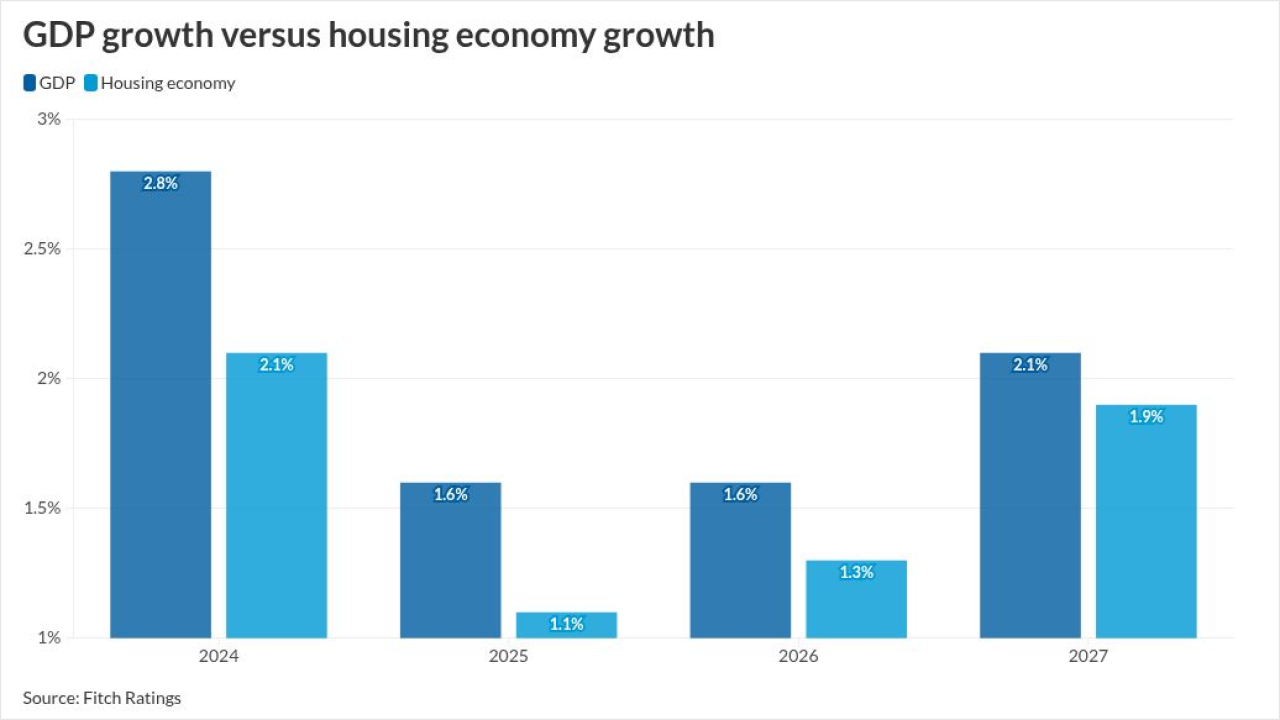

Fitch Ratings' outlooks for mortgage and title insurers this year are neutral, as housing deals with affordability challenges and a likely economic downturn.

January 2 -

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

December 26 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

Higher unemployment has driven these indications of distress higher but most loans that financial institutions hold in their portfolios are still performing.

December 16 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12 -

Planet Home Lending, helped by growing recapture and distributed retail volume, did 64% more originations in the third quarter than one year prior.

December 1 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

Uncooperative neighbors, vicious pets and threats of violence are some of the dangers mortgage field employees run into when on assignments.

November 24 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

Besides adding 60 days to the partial claim deadline in some cases, the bill also has provisions for buyer agent payments for Veterans Affairs borrowers.

November 12