-

The head of the National Treasury Employees Union said the appointment of Eric Blankenstein to a senior role “reflects poorly on CFPB management.”

October 2 -

Eric Blankenstein, a political appointee overseeing fair-lending policy at the agency, said in an email to staff that his blog posts from 14 years ago that used a racial epithet “reflected poor judgment.”

October 1 -

What started as a single senior official at the CFPB voicing concerns about blog posts written 14 years ago by Eric Blankenstein, a top agency political appointee, is rapidly becoming a rising chorus of discontent.

September 30 -

The head of the agency’s fair-lending office cast doubt on a proposed reorganization of her office and raised concerns about blog posts written years ago by the political appointee overseeing the project.

September 28 -

The Fed's order targets affidavits prepared by employees of CitiFinancial in connection with the company's exiting the mortgage servicing business.

August 10 -

Kraninger, a senior official at the Office of Management and Budget, has been heavily criticized by Democrats on the panel over her ties to the administration's family-separation policy at the border.

July 31 -

A ruling involving a Cleveland law firm casts doubt on CFPB claims that attorneys misrepresent their role to consumers.

July 27 -

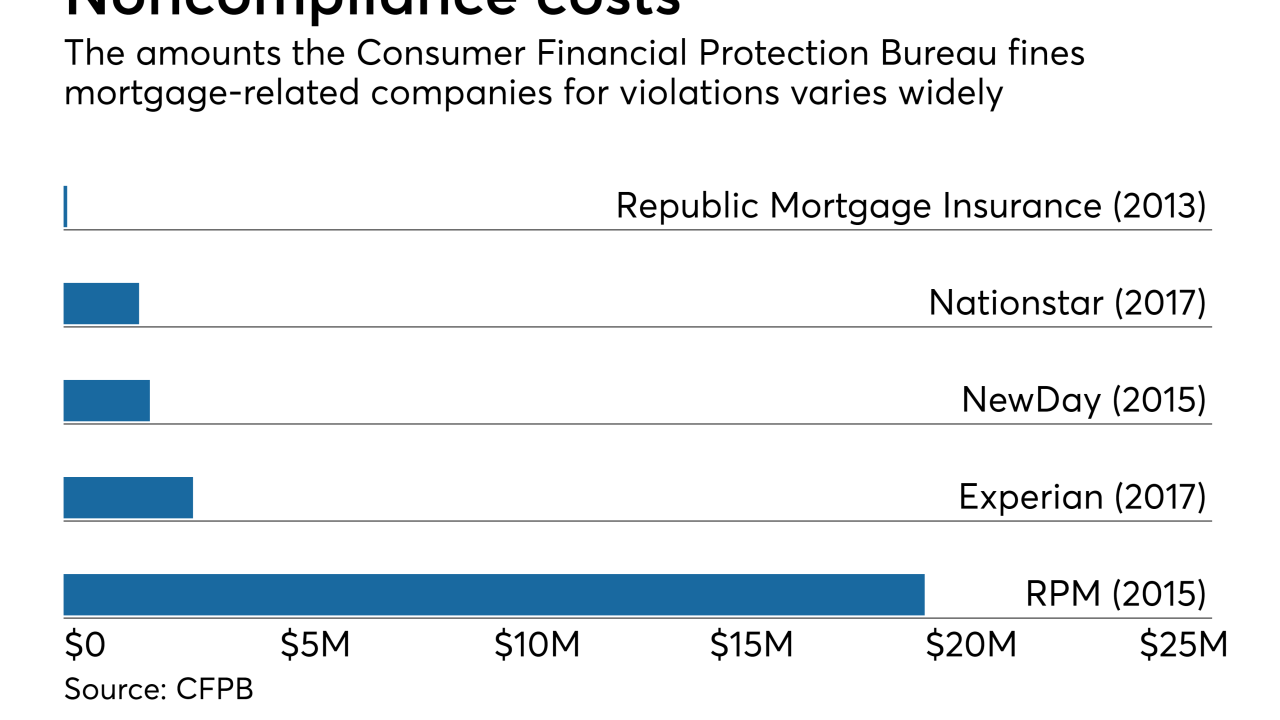

An uptick in fines and a new tactic to counter claims about the CFPB’s authority contrast sharply with the agency’s rhetoric.

July 25 -

The agency will advise lenders on how to obtain partial exemptions from Home Mortgage Disclosure Act requirements that Congress adopted this spring.

July 5 -

The Consumer Financial Protection Bureau's structure is an infringement on the authority of the executive branch, a New York federal judge said Thursday.

June 21 -

Marc Dann, a former Ohio attorney general, has a plan to publicly maintain the CFPB's consumer complaint database if acting Director Mick Mulvaney shuts it down.

June 14 -

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

Banking and mortgage groups are asking the Federal Communications Commission to issue new Telephone Consumer Protection Act rules that would make consumer lawsuits over robocalls harder to win.

May 10 -

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

The Consumer Financial Protection Bureau has dropped an investigation into Altisource, a mortgage servicing technology firm with close ties to Ocwen Financial.

April 30 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

Months after President Trump vowed that Wells Fargo would pay a severe penalty, the CFPB and OCC hit the bank with a $1 billion fine to settle claims it overcharged customers for auto insurance and home loans.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

The New York Department of Financial Services is fining Nationstar Mortgage $5 million for failing to comply with servicing and origination regulations as it grew between 2012 and 2014.

April 11