-

M&T Bank has agreed to pay $485,000 and change its lending policies to settle a lawsuit that accused the Buffalo, N.Y., company of racial discrimination in making mortgage loans.

September 1 -

Bank of America has settled a national class-action lawsuit brought by former employees who claimed they weren't paid for overtime work.

August 28 -

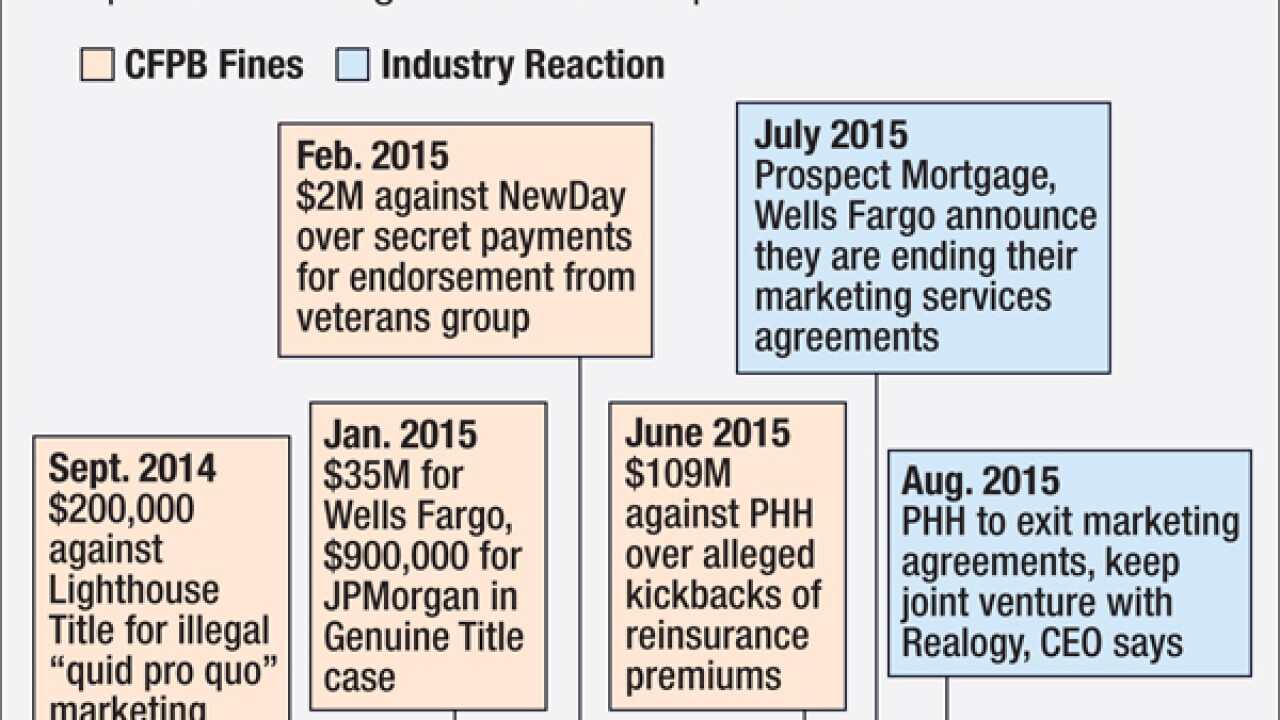

As marketing services agreements increasingly fall out of favor, a more level playing field may emerge where loan officers must aggressively compete on their skill and service to win referral business.

August 28 -

Two Florida men have been sentenced for their roles in a mortgage fraud scheme that resulted in about $24 million of losses for several financial institutions, including M&T Bank in Buffalo, N.Y.

August 25 -

A Virginia woman has pleaded guilty to leading a mortgage-fraud ring that victimized hundreds of Hispanic residents in the northern part of the state and caused millions of dollars in losses for lenders.

August 21 -

Nothing touches off an argument more than questions about whether the CFPB will allow any marketing services agreements to continue. Some mortgage lenders say no and are winding down their agreements, others insist regulators can be satisfied, and still others are just plain confused.

August 21 -

The only thing more ominous than a CFPB investigation is when the FDIC and OCC join in on the action.

August 20 Offit | Kurman

Offit | Kurman -

Banks that sold faulty mortgage-backed securities right before the crisis have suffered a string of legal defeats over the timing of government lawsuits, but some experts believe the industry may still have a shot in the Supreme Court.

August 14 -

Real estate brokers deserve a slice of mortgage revenue, but marketing services agreements are not the way to give it to them.

August 12 National Association of Hispanic Real Estate Professionals

National Association of Hispanic Real Estate Professionals -

There are many concerning aspects of the Consumer Financial Protection Bureau's methods, not the least of which include its proclivity to regulate via enforcement and its reliance on overly broad and ambiguous language to support its activities.

August 11 Offit | Kurman

Offit | Kurman -

Ocwen Financial's internal review group is "independent," and the Atlanta servicer is in compliance with the national mortgage settlement, settlement monitor Joseph A. Smith said Tuesday.

August 11 -

A New York law that was invalidated by a federal judge was one of many efforts by big cities to pressure banks into making more investments in local communities after the crisis. Some municipal laws could be more vulnerable to bankers' legal challenges than others.

August 10 -

A federal judge has overturned a New York City law that would have required banks to make new disclosures regarding their investments in local communities.

August 10 -

M&T Bank's disclosure that it is in settlement talks with the Justice Department for not complying with underwriting guidelines on FHA loans has renewed fears that more lenders will be targeted.

August 7 -

Former Wilmington Trust President Robert V.A. Harra was indicted on U.S. charges that he lied to regulators as part of a scheme to hide bad real estate loans

August 6 -

M&T Bank Corp. said it's in discussions with U.S. officials to settle an investigation into the lender's origination and sale of federally insured home loans.

August 5 -

Lenders said the delay in implementing the combined loan and closing disclosures is giving them valuable added time to train their staff, according to a DocuTech survey.

August 3 -

Goldman Sachs Group Inc. increased its estimate for reasonably possible legal costs in excess of reserves by 55% to $5.9 billion.

August 3 -

Bank of America has received approval for additional credit during the first quarter of 2015 from the independent monitor overseeing its compliance with the requirements of its mortgage settlement agreement.

July 31 -

Home Affordable Modification Program denial rates are still high, but the Treasury Department and top mortgage servicers contend that the numbers have improved.

July 30