-

"These changes reflect adjustments we're making to ensure our staffing levels, locations and expertise align with current business needs; efficiencies we have gained through technology; and progress against our transformation work," the company said in a statement.

January 13 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Two days after the megabank was hit with $136 million of fines, Citi executives said they aren't changing the company's full-year expense guidance. Citi has 30 days to submit a plan to regulators showing that the bank has allocated enough resources to achieve compliance in a timely and sustainable manner.

July 12 -

Larger banks are responsible for a special assessment to cover the costs of the failures of Silicon Valley Bank and Signature Bank. The price tag has ballooned by $4.1 billion, and trade groups are criticizing the FDIC's process, arguing that it lacks transparency.

March 13 -

After the Rhode Island-based company eliminated 650 positions, severance-related costs contributed to a 71% decline in quarterly net income.

January 17 -

Across the industry, the pace of branch shutdowns slowed this year. Still, large financial institutions continued to trim their physical footprints, with two super-regional banks taking the most aggressive actions.

December 15 -

The Pittsburgh-based regional bank expects to save $325 million next year as it reduces its staff by 4%. Executives said the cuts are necessary because revenue has fallen amid a surge in interest rates and a decline in loan volumes.

October 13 -

Headcount at the nation's second-largest bank has fallen by around 1,000 since the end of last month. More job reductions are in the works after noninterest expenses rose by 6% during the first quarter.

April 18 -

The San Francisco bank tallied $2.2 billion in net operating losses, higher than in any quarter since late 2017. The charges offset what otherwise would have been a strong third-quarter performance.

October 14 -

The nation's largest bank indicated Monday that it may again offer home equity lines of credit to a wide audience. Rising mortgage rates have made the product more attractive after a long drought when low rates suppressed demand.

May 23 -

The bank's noninterest expenses fell by 8% in the second quarter — a sign that CEO Charlie Scharf is making progress in reining in spending that had been soaring in recent years amid heightened regulatory scrutiny. He ultimately hopes to reduce gross expenditures by $8 billion annually.

July 14 -

CEO Charlie Scharf disappointed investors by failing to provide either a detailed road map for long-term expense reductions or say when he might release such a plan.

October 14 -

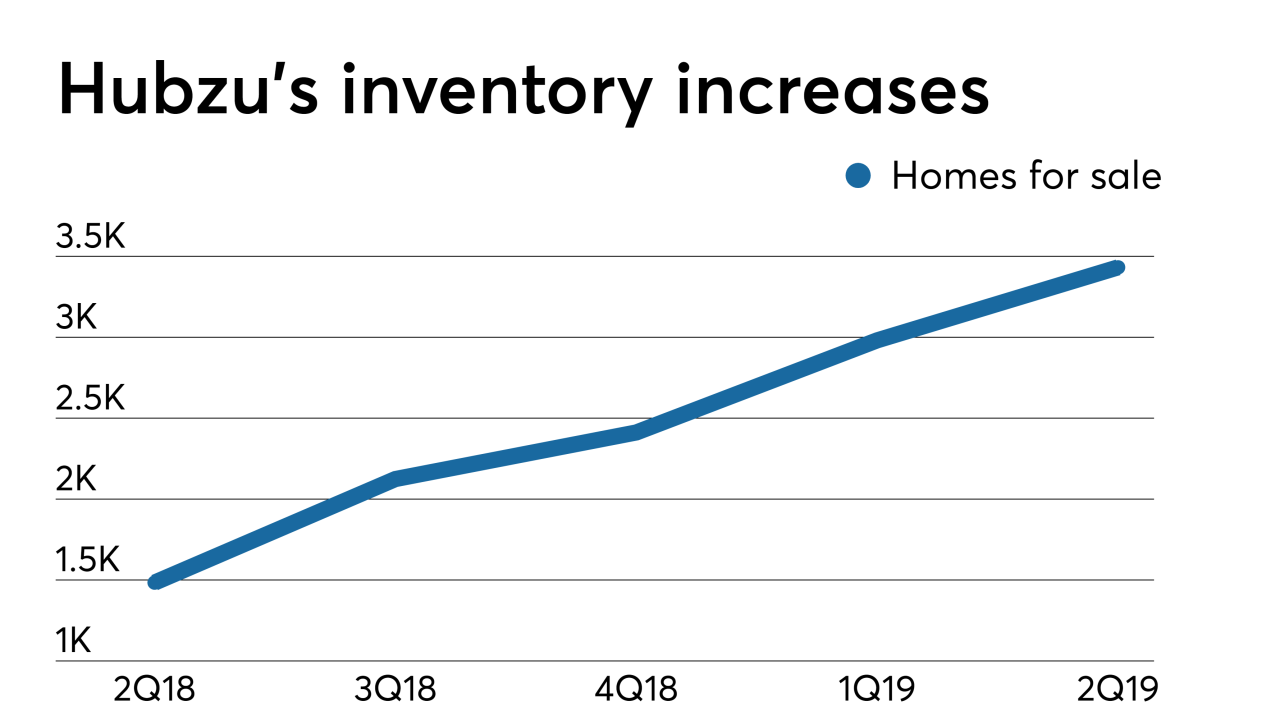

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

Borrowers were more than twice as likely to use a lender they found online in 2018 as they were in 2017, making search engines the mortgage industry's top source of referrals.

March 12 -

The company will shutter the offices it inherited when it bought EverBank in 2017 and focus on lending to existing customers through digital channels. U.S. Bank will assume the leases on about 25 properties.

February 21 -

Altisource Portfolio Solutions plans to discontinue its buy-renovate-lease-sell business for single-family homes and sell its short-term inventory in order to cut costs and repay debt.

November 26 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

The cuts are part of a broader effort to trim expenses by roughly $3 billion a year by 2020.

September 20 -

Banks could shed as much as 20 million square feet of office space over the next five years as they shift many functions to high-tech operations centers in markets with cheaper rents.

July 6 -

The Seattle company is firing 127 people, or a tenth of its mortgage staff, after enduring months of slow activity.

June 14