-

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

February 4 -

President Trump said he would prohibit large institutional investors from buying single-family homes. While the executive couldn't bar such investments on its own, a legislative ban could gain bipartisan support.

January 7 -

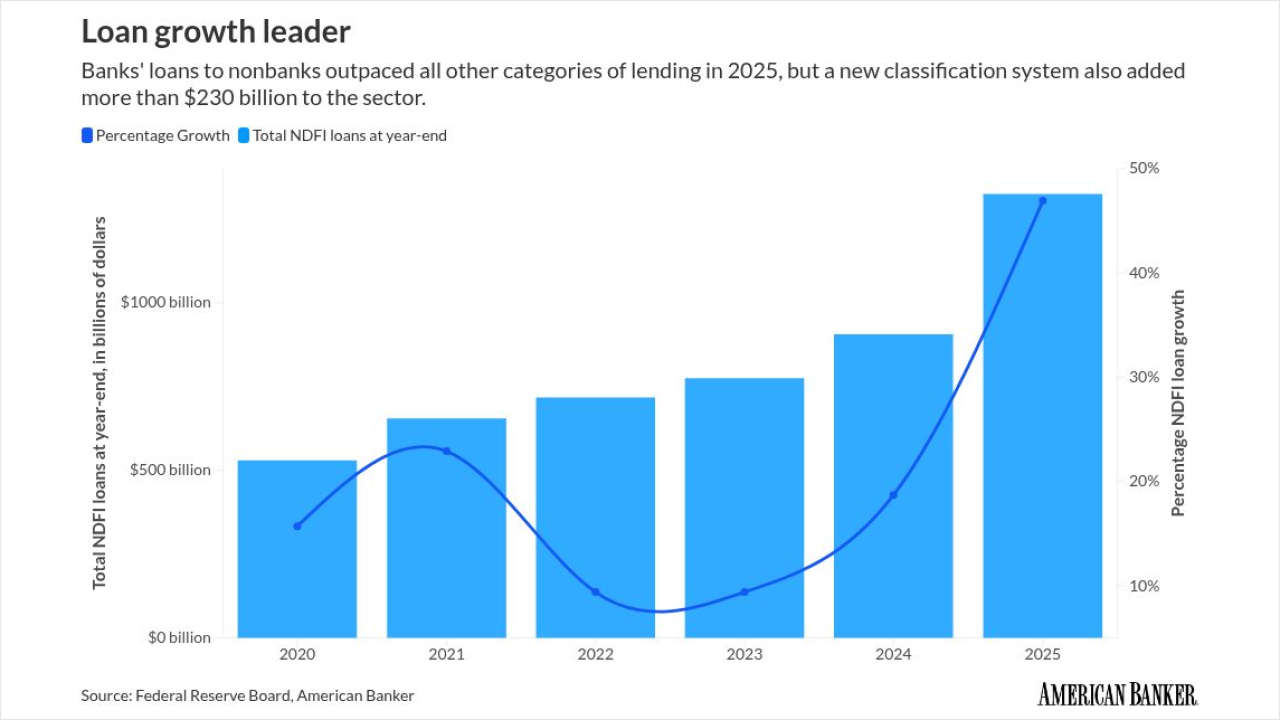

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

A bipartisan housing provision has emerged as a critical negotiating point for passage of an uncommonly bank-relevant defense authorization bill.

December 4 -

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20 -

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

November 6 -

Comptroller of the Currency Jonathan Gould said Tuesday that chartering compliant fintechs is "the only way" to level the playing field between banks and nonbanks. His comments come as the Office of the Comptroller of the Currency weighs new trust charters and stablecoin rules.

November 4 -

Financial literacy advocate John Hope Bryant has joined with a Los Angeles-based developer in an effort to raise up to $300 million from banks to preserve and construct low-income housing around the country.

November 3 -

The Consumer Financial Protection Bureau is rescinding two rules issued under former CFPB Director Rohit Chopra that required nonbanks to register court orders, plus terms and conditions of contracts.

October 28 -

The Arkansas-based company spent nearly four years on the M&A sidelines, grappling with asset quality issues and litigation tied to its 2022 acquisition of Texas-based Happy State Bank. Now it's signed a letter of intent to buy an unnamed bank.

October 24 -

A cohort of more than 100 Republican members of Congress sent a letter to Treasury Secretary Scott Bessent urging the administration to protect and fund a community lending program that has been gutted despite its legal mandate and Bessent's backing.

October 23 -

Six trade groups warned the administration layoffs and funding freezes could dampen lending, threatening the administration's goal of economic growth.

October 20 -

The Office of Management and Budget issued reduction in force notices to Treasury staff working in the Community Development Financial Institution office Friday, saying that the layoffs are necessary to "implement the abolishment" of the fund.

October 10 -

The CDFI Fund is updating definitions of eligible activity to be considered for the funds, including removing climate-focused financing and references to race and ethnicity.

September 25 -

A proposed rule published Tuesday in the Federal Register would limit the Consumer Financial Protection Bureau's ability to designate nonbank entities for supervision.

August 26 -

The Office of Management and Budget under President Donald Trump has not apportioned any discretionary awards to financial institutions in the fiscal year of 2025, according to new documents released by the agency.

August 18 -

The CDFI Fund has yet to announce and disburse awards for five programs, even though applications closed months ago, the lawmakers said in a letter to Office of Management and Budget Director Russell Vought.

July 29 -

Calls for applications for a bank-specific program within the Community Development Financial Institution Fund have been delayed, raising the possibility that those funds are unspent before the appropriated money expires.

July 14 -

The group expressed concern with the White House proposal to reduce the program's funding, and urged Appropriators to fund the bipartisan-backed Community Development Financial Institutions Fund.

July 9 -

A non-bank lender won't ever compete with a bank on price, but can offer flexible underwriting and faster origination times, according to a veteran originator.

June 12