-

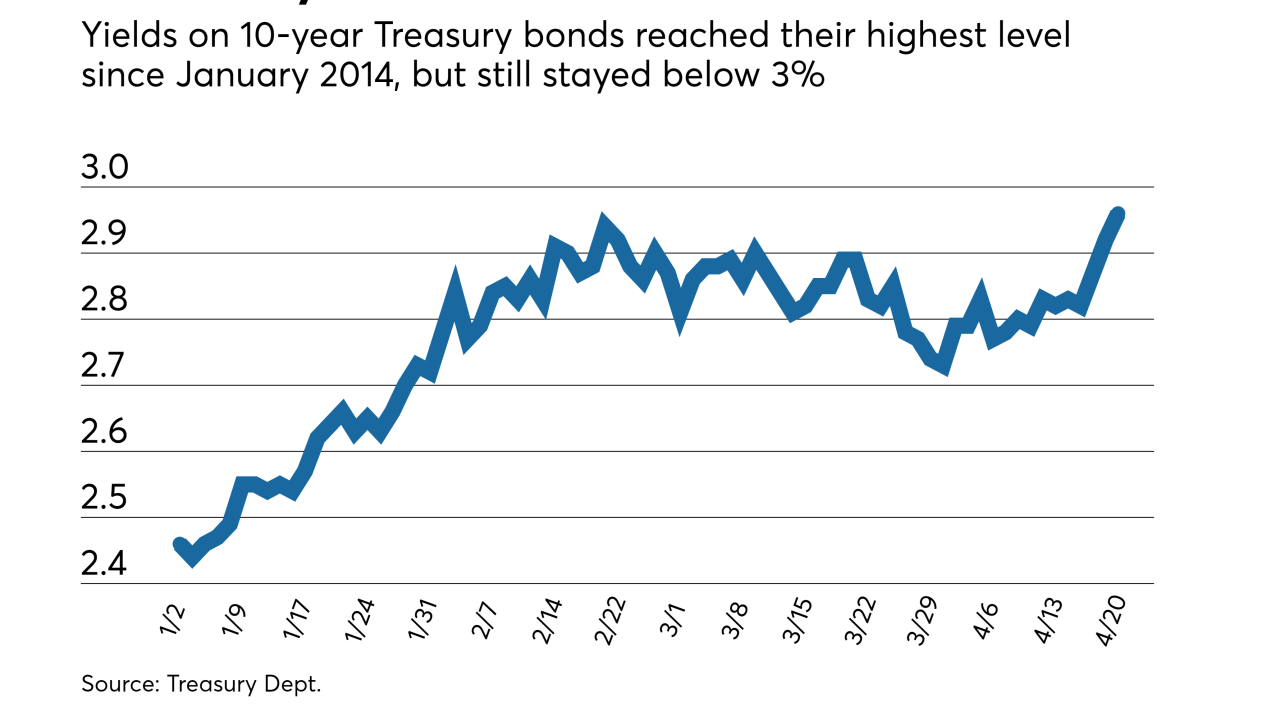

The 10-year U.S. Treasury yield rose to its highest level since 2011, extending a selloff in the world’s biggest bond market and raising fresh questions about how high America's borrowing costs will climb.

May 15 -

PHH Corp. took a net loss in the first quarter but was able to surpass minimums for net worth and available cash necessary for Ocwen Financial to acquire the company.

May 9 -

Capital One Financial Corp. plans to repurchase shares following the sale of $17 billion in mortgages to a Credit Suisse subsidiary.

May 8 -

An increase in title orders opened helped Fidelity National Financial improve its first-quarter net income by 59% over the same period last year.

May 4 -

Arch Capital Group's mortgage insurance subsidiary slipped to No. 2 in market share just five quarters after completing the acquisition of former No. 1 United Guaranty Corp.

May 2 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Ellie Mae's first-quarter net income of a little over $2 million was lower than last year's due to some one-time expenses, but continuing operations numbers exceeded analysts' expectations.

April 27 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

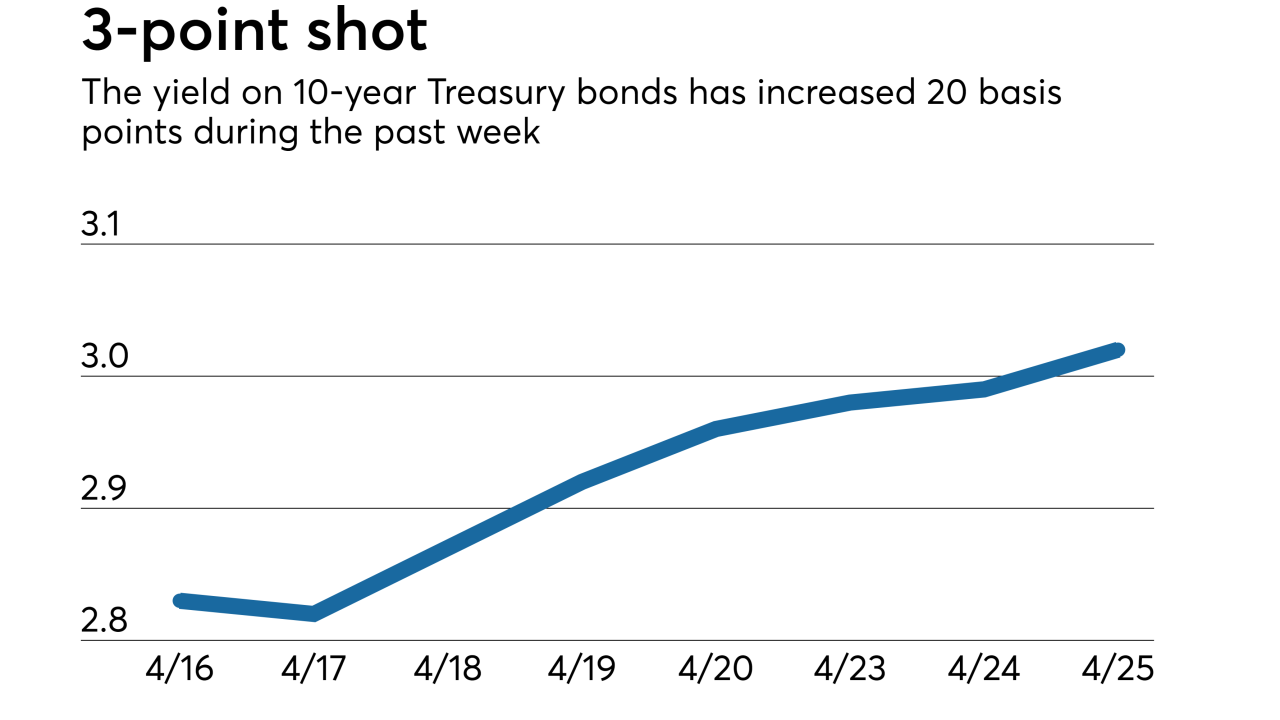

If 10-year Treasury yields remain at or above 3%, the average 30-year fixed-rate mortgage could hit 5% sooner than previously expected.

April 25 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24 -

Yields on the 10-year Treasury hit their highest level since the start of 2014 and got very close to cracking the 3% mark, signaling a potential spike in mortgage rates.

April 20 -

MGIC Investment Corp.'s first-quarter net income beat analysts' estimates due to favorable loss development and that should be seen with the other private mortgage insurers.

April 18 -

Ditech Holding Corp. lost $426.9 million in 2017, with almost half of that recorded during the fourth quarter, when the company filed for bankruptcy.

April 17 -

One measure of how much things have changed in the last decade at Bank of America: The firm has stopped reporting fees from its mortgage business.

April 16 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase were weaker than Keefe, Bruyette & Woods forecast due to lower-than-expected gain-on-sale margins.

April 13 -

Fidelity National Financial's proposed purchase of Stewart Information Services could solidify FNF's leading market share among title insurers if regulators don't balk at its scope.

March 19 -

Crossroads Systems Inc. has relaunched with the acquisition of a community development financial institution focused on the Hispanic mortgage market.

March 9 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1 -

Ocwen Financial Corp.'s acquisition of PHH Corp. will help the nonbank servicer rebuild scale that's been diminished by years of regulatory restrictions and the decline in distressed mortgage volume brought about by improvements in the overall housing market.

February 28 -

NMI Holdings' common stock sale puts the company in a stronger position for future fundraising efforts, such as a now-delayed debt offering.

February 28