Fraud

Fraud

-

PricewaterhouseCoopers was ordered to pay the Federal Deposit Insurance Corp. more than $625 million for negligence in the audit of Colonial BancGroup Inc., an Alabama bank holding company that failed during the financial crisis.

July 3 -

The son of a Lake Worth, Fla., man arrested this month in an alleged rent-fraud scam is wanted for acting as an accomplice in the crime, the Palm Beach County Sheriff's Office said.

June 29 -

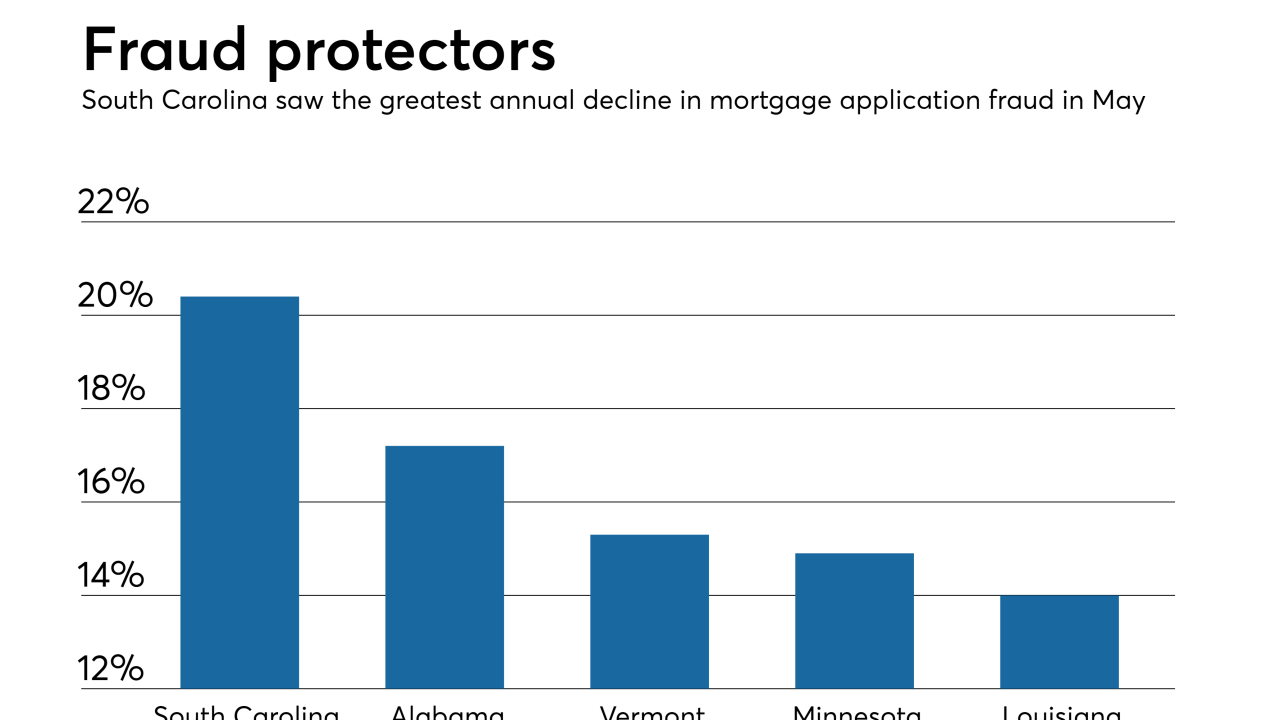

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22 -

One-time Modesto City Council candidate Robert Farrace, an attorney and real estate broker, was sentenced to two years in federal prison for defrauding real estate lenders.

June 19 -

The man authorities called the mastermind behind a complex mortgage fraud scheme targeting distressed properties was arrested June 7 in South Carolina and charged with being a fugitive in violation of probation.

June 18 -

Federal law enforcement authorities have arrested 74 people in this country and abroad, accusing them of participating in a wire fraud scam whose victims included real estate attorneys and settlement service providers.

June 12 -

Federal authorities charged a third real estate investor with bribery-related offenses in a long-running corruption probe of the process through which the Philadelphia Sheriff's Office sells seized and foreclosed properties.

June 8 -

Two Orange County, Calif., men were to federal prison for their part in a mortgage scheme that led to the fraudulent purchase of more then 100 condominium units and $10 million in losses.

June 7 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30 -

The ability-to-repay standard is responsible for the reduction in loan application defects over the past four-plus years, according to First American Financial.

May 30 -

A mortgage loan officer from Methuen, Mass., faces six months behind bars for her role in a conspiracy to defraud banks and mortgage companies.

May 25 -

Gary Klopp of Nottingham, Md., was ordered to pay more than $525,000 and temporarily barred from working in the mortgage industry by a U.S. District Court judge for violating a previous court order, according to Maryland Attorney General Brian Frosh.

May 24 -

A ring of thieves illegally took ownership of more than 40 homes across South Florida in a multimillion-dollar plan — even stealing properties that belonged to the dead, authorities say.

May 11 -

A Texas lawyer pleaded guilty to his role in an elaborate $5 million mortgage fraud scheme involving pricey beach homes, according to the U.S. Attorney's Office in Houston.

May 1 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

While mortgage application defect risk declined overall in March, at the local level it varied considerably, according to First American Financial Corp.'s Loan Application Defect Index.

April 27 -

The bank holding the mortgage on a home owned by a Wichita, Kans. woman accused of embezzling millions from two physician-owned medical businesses and her estranged husband has stated foreclosure proceedings.

April 25 -

WEI Mortgage discovered a data breach from an email phishing scam last fall that may have exposed loan package information and identifying data such as Social Security numbers.

April 24 -

A special agent who used to work for an investigative arm of Immigration and Customs Enforcement pleaded guilty to defrauding Freddie Mac and SunTrust Mortgage through a short sale.

April 23